“As a percentage of GDP”.

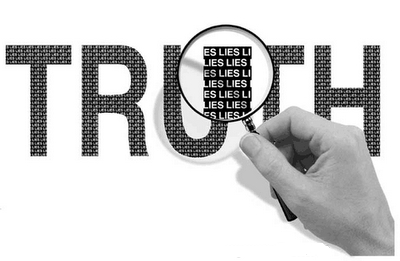

Possibly the most common phrase of deception in the average Treasurer’s armoury.

In the case of the average economist, the most common phrase of self-deception.

Let us take a look at how The World’s Greatest Treasurer Wayne Swan the Treasury department’s economists have used the “as a percentage of GDP” lie as the foundation of steaming bovine faeces for an entire speech delivered to the Australian Business Economists’ Breakfast on 29 March 2012 by the Treasury’s muppet.

Here’s Wayne:

The GFC hit all our revenue heads, as production, consumption, profits and employment all tumbled. The tax-to-GDP ratio fell 4.2 percentage points to 20.0 per cent. Compare this with the Howard Government’s peak of 24.2 per cent, and we’re looking at a massive write-down in tax receipts across the board.

Wayne Treasury had prepared some charts showing GDP and Tax Receipt estimates for the period 2007-08, through 2011-12 (MYEFO). Expressed “as a percentage of GDP”.

But let us set aside the “per cent of GDP” measure, and dig deeper.

What about the raw figures?

2007-08 Final Budget Outcome Taxation Revenue (actual) – $286.22 billion

2010-11 Final Budget Outcome Taxation Revenue (actual) – $309.89 billion

2011-12 Mid-Year Economic and Fiscal Outlook Taxation Revenue (estimate) – $323.63 billion

An increase in Taxation Revenue from 2007-08 (actual) to 2011-12 (estimated) of $37.41 billion.

Back to Wayne:

Collections, particularly relating to company profits, have been lower than expected. In part, our lower tax take reflects reduced tax receipts following the GFC…

We have already seen that the second part of this statement is a lie. Actual tax receipts are higher now, than they were in the 2007-08 (pre-GFC) Final Budget Outcome.

It is only when one uses the misleading and deceptive “as a percentage of GDP” measure, that black can become white. Or in the case of a government budget, black can become red. Or red can become black, depending on the political lie of the moment.

For the sake of thoroughness, let us break down “Tax Receipts” to just look at “Company Tax”. Perhaps Wayne Treasury is right, and Company Tax receipts have fallen since the GFC?

2007-08 Final Budget Outcome Company Tax revenue (actual) – $66.48 billion

2010-11 Final Budget Outcome Company Tax revenue (actual) – $57.31 billion

2011-12 Mid-Year Economic and Fiscal Outlook Company Tax revenue (estimate) – $71.80 billion

Yes, there was a decrease of $9.17 billion in actual Company Tax revenue between 2007-08 and 2010-11.

But as at MYEFO Nov 2011, there is an “estimated” increase in Company Tax revenue (versus 2007-08) of $5.32 billion.

So, what is the problem, dear reader?

Quite clearly, the government IS pulling in more actual Total Revenue now, than they were in 2007-08.

Last year (2010-11) the government raked in $23.67 billion more in Total Revenue, than in 2007-08.

Their November MYEFO estimated that the government would rake in $37.41 billion more than in 2007-08.

With all that extra income, why is it that this government cannot seem to achieve a balanced (much less a surplus) budget for a year?

Indeed, their annual budget deficits just keep getting bigger.

Could this government’s spending have anything to do with it?

Wayne Treasury barely even mentioned the government’s actual record of expenditure in the speech to the Australian Business Economists’ Breakfast. A long, tiresome rant, complaining about lower revenue “than expected” … “as a percentage of GDP”. And a mere handful of paragraphs about “Savings” at the end of the speech. Saying absolutely nothing.

Well, except for this doozy:

The savings we find in this Budget will be consistent with the discipline that has been the hallmark of the Budgets we’ve delivered. Remember that in the four Budgets since 2008-09, we have identified over $100 billion of savings.

Really?

2007-08 Final Budget Outcome Total Expenses (actual) – $280.1 billion

2010-11 Final Budget Outcome Total Expenses (actual) – $356.1 billion

2011-12 Mid-Year Economic and Fiscal Outlook Total Expenses (estimate) – $371.74 billion

An actual increase in Total Expenses of $76 billion in 2010-11, versus 2007-08.

An “estimated” increase in Total Expenses of $91.64 billion in 2011-12, versus 2007-08

But that’s ok.

All is forgiven … because they “identified over $100 billion in savings” over those four years too.

And all is forgiven with respect to our economic commentariat, who faithfully repeat Wayne’s Treasury’s misleading and deceptive statements without scrutiny. As illustrated by Alan Kohler in Business Spectator:

In fact, as Wayne Swan pointed on Thursday, Labor has already cut $100 billion from spending and this year’s budget will cut even more…

No, Alan. That is not “in fact” at all. It is what he wanted you to hear, and report. But it is not what he actually said. “We have identified over $100 billion in savings” is not the same thing as “we have already cut $100 billion from spending”.

Let us recap.

According to Wayne’s Treasury’s most recent published figures, in 2011-12 this government will rake in $37.41 billion more revenue than in 2007-08, pre-GFC.

But they will spend $91.64 billion more than in 2007-08, pre-GFC.

All the “as a percentage of GDP” nonsense, is a smokescreen.

The simple reality is, this government is getting tens of billions more annual revenue than the Howard Government did in its last year.

But they are spending a SHIPLOAD of borrowed-from-foreigners money more every year, than they are receiving in increased annual revenues.

Back to Wayne one last time:

It was Stephen Koukoulas who reminded us that … we never exceeded the tax-to-GDP ratio that we inherited…

Hmmmm.

How is that possible?

We have already seen clearly, that this government is getting more total tax revenues than in 2007-08.

So given that their tax take is up, then the only way this claim is possible is if there has also been a truly remarkable increase in the GDP figure.

Oh look!

There has!

How very, very convenient that the new System of National Accounts introduced in the GFC year of 2008-09, just happened to result in a “substantial increase” in the GDP figure. One that you would not be aware of unless you had carefully read all the fine print in the 2009-10 MYEFO. Or if you’d carefully read the Treasurer’s press release sent out on … the opening day of the Copenhagen Climate Change Conference. One month after the MYEFO.

Now that’s creative accounting (see “Hide The Recession: Labor’s Grand Deceit On GDP Figures Exposed” )

Even when you apply Wayne’s (Treasury’s) philosophy on Tax to GDP ratio, a lower number is not necessarily a good thing. The tax to GDP ratio declines because tax receipts are more volatile than GDP. As you pointed out projected tax receipts are lower, but GDP is still growing.

But this doesn’t stop muppets like Koukoulkas crowing about Labor is supposedly a low taxing government.

If you look at Tax to GDP ratios over the last 20 budgets, the lowest ratios have occurred under Labor Governments. however the unemployment is also higher in these years. Therefore the ratio will be lower because there are less people paying tax.

So yes you can claim you are a low taxing government based on fudged figures, just ignore the fact more people are out of job.

Let’s cut to the bloody chase..

“they are spending a SHIPLOAD of borrowed-from-foreigners money more every year, than they are receiving in increased annual revenues.”

WTF are they spending all this fiat on????

No dams, trains, ports,

WHAT????!!!??????