46 out of 50 US state governments are now technically bankrupt. To understand how bad that is for the global economy – including Australia – consider the fact that California alone has an economy that is larger than that of Russia.

From Bloomberg:

California, tied with Illinois for the lowest credit rating of any state, is diverting a rising portion of tax revenue to service debt, Bloomberg Markets magazine reports in its August issue.

Far from rebounding, the Golden State, with a $1.8 trillion economy that’s larger than Russia’s, is sinking deeper into its financial funk. And it’s not alone.

Even as the U.S. appears to be on the mend — gross domestic product has climbed three straight quarters — finances in Arizona, Illinois, New Jersey, New York and other states show few signs of improvement. Forty-six states face budget shortfalls that add up to $112 billion for the fiscal year ending next June, according to the Center on Budget and Policy Priorities, a Washington research institution.

State budget woes are a worsening drag on growth as the federal government tries to wean the economy from two years of extraordinary support. By Jan. 1, funds from the $787 billion federal stimulus bill will dry up. That money from Washington has helped cushion state budgets as tax revenue has plunged.

State leaders won’t be able to ride out this cycle the way they have in the past. The budget holes are too large.

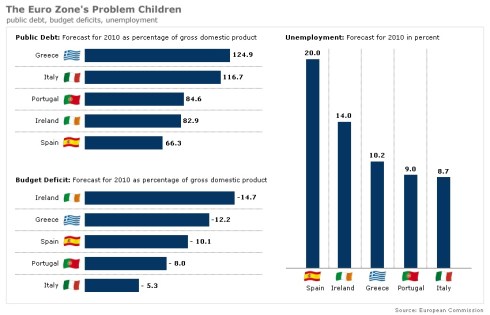

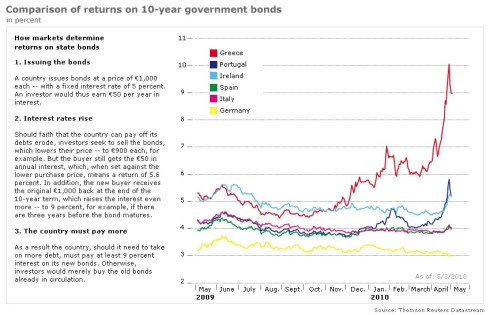

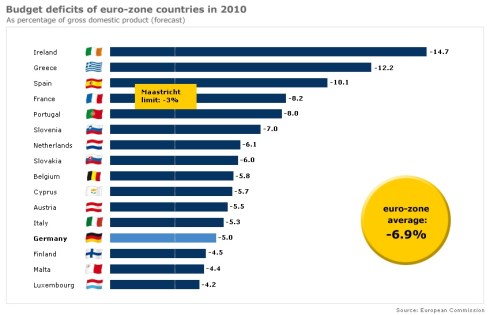

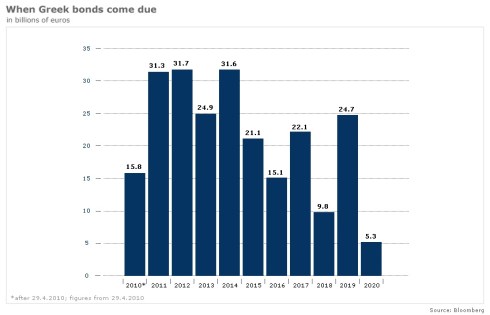

What will the US do when nearly every state government is facing Greek-style deficits?

According to an RBS note to its clients, prepare for unprecedented money printing.

From the UK’s Telegraph:

As recovery starts to stall in the US and Europe with echoes of mid-1931, bond experts are once again dusting off a speech by Ben Bernanke given eight years ago as a freshman governor at the Federal Reserve.

Andrew Roberts, credit chief at RBS, is advising clients to read the Bernanke text very closely because the Fed is soon going to have to the pull the lever on “monster” quantitative easing (QE)”.

“We cannot stress enough how strongly we believe that a cliff-edge may be around the corner, for the global banking system (particularly in Europe) and for the global economy. Think the unthinkable,” he said in a note to investors.

Societe Generale’s uber-bear Albert Edwards said the Fed and other central banks will be forced to print more money whatever they now say, given the “stinking fiscal mess” across the developed world. “The response to the coming deflationary maelstrom will be additional money printing that will make the recent QE seem insignificant,” he said.

Barnaby Joyce began warning about a bigger GFC in October last year. No one wanted to listen.

He was roundly ridiculed by the “experts” – such as the genius academic who designed the controversial RSPT, Treasury secretary Ken Henry – for suggesting the possibility that the USA could default on its massive debts.

The simple fact is this. The USA is defaulting on its debts.

Printing money (euphemistically called “Quantitative Easing”) is technically a form of sovereign default. When you cannot pay your debts, printing money devalues your currency, and makes it easier to pay back your debts.

It also means high inflation. Possibly hyperinflation. Think Weimar Germany in the 1920’s. Or Zimbabwe today.

Barnaby is right.

Tags: ambrose pritchard-evans, barnaby joyce, Bloomberg, debt and deficit, debt bubble, GFC, hyperinflation, ken henry, resources super-profits tax, RSPT, sovereign default

Comments