BREAKING NEWS

UPDATE: Aggregate balance of US Fed loans to Westpac = USD87.52 billion, NAB = USD378 billion (csv file 1e_Fed Dated Estimated Income Ranking Text Only)

From Bloomberg:

Fed’s once-secret data released to the public

Bloomberg News today released spreadsheets showing daily borrowing totals for 407 banks and companies that tapped Federal Reserve emergency programs during the 2007 to 2009 financial crisis. It’s the first time such data have been publicly available in this form.

To download a zip file of the spreadsheets, go to http://bit.ly/Bloomberg-Fed-Data. For an explanation of the files, see the one labeled “1a Fed Data Roadmap.”

The day-by-day, bank-by-bank numbers, culled from about 50,000 transactions the U.S. central bank made through seven facilities, formed the basis of a series of Bloomberg News articles this year about the largest financial bailout in history.

“Scholars can now examine the data and continue the analysis of the Fed’s crisis management,” said Allan H. Meltzer, a professor of political economy at Carnegie Mellon University in Pittsburgh and the author of three books on the history of the U.S. central bank.

The data reflect lending from the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility, the Commercial Paper Funding Facility, the Primary Dealer Credit Facility, the Term Auction Facility, the Term Securities Lending Facility, the discount window and single-tranche open market operations, or ST OMO.

Bloomberg News obtained information about the discount window and ST OMO through the Freedom of Information Act. While the Fed initially rejected a request for discount-window information, Bloomberg LP, the parent company of Bloomberg News, filed a federal lawsuit to force disclosure and won in the lower courts. In March, the U.S. Supreme Court decided not to intervene in the case, and the Fed released more than 29,000 pages of transaction data.

As we saw in “Our Banking System Operates With Zero Reserves”, a previous data release showed that Australian banks … including the Reserve Bank of Australia … secretly borrowed billions from the US Federal Reserve to survive during the GFC. In the case of the RBA, the value of its loans totalled around AUD88 billion given the exchange rate at that time:

National Australia Bank Ltd, Westpac Banking Corp Ltd and the Reserve Bank of Australia (RBA) were all recipients of emergency funds from the US Federal Reserve during the global financial crisis, according to media reports.

Data released by the Fed shows the RBA borrowed $US53 billion in 10 separate transactions during the financial crisis, which compares to the European Central Bank’s 271 transactions, according to a report in The Australian Financial Review.

NAB borrowed $US4.5 billion, and a New York-based entity owned by Westpac borrowed $US1 billion, according to The Age.

This new data release allows us to see more detail about the secret loans to Westpac and NAB.

Two of the four pillars of our allegedly “safe as houses” banking system.

And now we can see that it wasn’t just a “New York-based entity owned by Westpac” that borrowed from the Fed. It was Westpac itself.

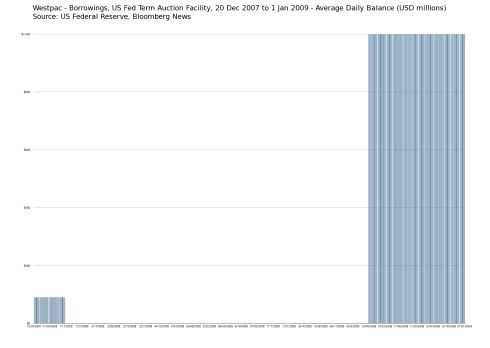

Between 20 Dec 2007 and 16 Jan 2008, Westpac secretly borrowed USD90 million per day from the US Federal Reserve. Between 9 Oct 2008 and 1 Jan 2009, Westpac borrowed USD1 billion per day. For a total of 113 days, Westpac was surviving on daily loans from the US Fed:

For a total 252 days straight, between 6 November 2008 and 15 July 2009, National Australia Bank survived by secretly borrowing USD1.5 billion per day from the US Fed:

[Don’t forget that during the GFC, the AUD plummeted from 98c to the USD, to 60c … where the RBA actively bought AUD’s in order to keep it propped at 60c. So these USD quoted loans were in fact dramatically higher when considered in light of the relative value of the Aussie dollar at the time]

Half of our “Four Pillar” bankstering system survived on USD2.5 billion per day of US Fed-supplied life support during the peak GFC “fear” period … and in NAB’s case, for many months afterwards.

And all on the hush hush.

We’d never know about it, except for Bloomberg News taking the US Fed to court when they refused an FOI request for the information.

How’s your con-fidence in our AAA-rated Ponzi now?

If you’ve not read it yet, and if like most Aussies you are oblivious to the hushed up bank run that was occurring right here in Oz during the GFC, then you should take the time to read my June 24 blog, “Our Banking System Operates With Zero Reserves”:

Ian Harper, one of Australia’s leading financial economists, spent much of the weekend of October 11-12, 2008, reassuring journalists that Australian banks were safe.

But there was something about the calls Harper was getting from reporters over that weekend that worried him.

“There was a whiff of panic,” he recalls. It had been building all week. He had no doubt that the government and the Reserve Bank would be able to manage a run on cash, but it might take days to arrest. Panic has been an unpredictable force in the history of banking. And the instant world of electronic banking had never been tested with a full-scale crisis of confidence.

He talked about media calls with his wife. “Come Monday morning and they tell us one of the banks is in strife and internet banking is down, I can’t look you in the eye and say you can pay this week’s grocery bills.”

The man who had just been reassuring everyone there was nothing to worry about went down the street to the ATM and made a sizeable withdrawal to make sure his wife would have enough cash.

All around the country, banks were facing unusual demands for cash. Small businesses in Queensland and Western Australia were switching their deposits from regional banks to accounts with the big four banks.

An elderly woman turned up in the branch of one bank in Queensland with a suitcase and asked to withdraw her term deposits of $100,000 or more. Once filled, she took the suitcase down to the other end of the counter and asked that it be kept in the bank’s safe.

A story did the rounds of the regulators about a customer who wanted to withdraw his six-figure savings. The branch manager said he did not have that quantity of cash on hand, but offered a bank cheque, which the customer accepted, apparently unaware that the cheque was no safer than the bank writing it.

It was a silent run, unnoticed by the media. Across the country, at least tens and possibly hundreds of thousands of depositors were withdrawing their funds. Left unchecked, there would soon be queues in the street with police managing crowd control, as occurred in London at the Golders Green branch of Northern Rock a year earlier.

“With a bank run, or any rumour of a bank run, you can’t play games with that,” says Treasury Secretary Ken Henry.

“You can’t pussyfoot around that stuff. It’s a long time since Australia has had a serious run on a financial institution, but it’s all about confidence, and you cannot allow an impression to develop generally in the public that there is any risk.”

Now, what was it that I wrote just hours ago … about our AAA-rated Ponzi economy?

Nice work TBI. If you haven’t already, take a look at A1 – Assets & Liabilities at RBA statistics. During the second half of 2007, foreign exchange reserves absolutely plummeted after an extraordinary run up during the previous few years, the supposed ‘surplus’.

This plummet coincided with the mid 2007 increase in credit spreads (fall in financial ‘asset’ prices) across the board. The RBA was caught ‘holding the bag’ as the value of its foreign exchange ‘reserves’, probably Bear Stearns private label USD denominated MBS, went down the toilet.

The extraordinary run up was those ‘geniuses’ in the Liberal Party riding atop an enormous credit bubble that nearly destroyed the credit of the government itself (notwithstanding the fall in interest rates here), as financial speculators rushed to cash in on the enormous USD ‘profit’ given by the Fed as it moved the Fed Funds rate to zero in response to the same shitstorm in the US.

The RBA was left completely illiquid, thus insolvent, unable to redeem its liabilities (the AUD) until bailed out by the Fed. Nothing has changed, except possibly the foreign exchange reserves of the RBA are probably US government ‘guaranteed’.

Thanks JMD, great tip … I knew nothing of this, can’t recall ever looking at A1. More coffee to keep the eyes open, it seems.

EDIT: Maybe you’d like to do another writeup, and explain the significance for readers per this comment?

EDIT2: Sheesh, you’re right!! … Aug 2007 began to plummet through to, surprise surprise, Sep 2008 and the beginning of US Fed bailouts. FX reserves at RBA more than doubled from Sep to mid Nov 2008, then falling away again ever since.

By US government ‘guaranteed’ I mean the biggest credit bubble in history, though I’m not saying it’s about to burst immanently.

I’ll see what I can put together re. another writeup.

Merry Christmas

So where on NAB’s balance sheet is the USD378 billion it owes? Or is that “off-balance sheet” like the NBN?

And why is this not MSM-worthy?

Given the extreme secrecy over these loans .. exacerbated by the recent coverup by the RBA and AOFM over the Wholesale Funding Guarantee … pretty safe bet that these Fed loans don’t appear anywhere on NAB’s ‘official’ books. In any event, supposedly it’s been paid back now, according to the spreadsheets, and was only ever US1b (Westpac) to US1.5b (NAB) loaned at a time. The key point being that the banks were apparently insolvent, and so were accessing rolling daily (secret) loans from the Fed (and RBA, which in turn was borrowing from the Fed too!) just to keep functioning.

When the story was broken some time ago (without the current details), the ‘spin’ put on it by the banks / RBA / APRA was that our banks didn’t actually “need” the money, they were just “testing” the facility. Given NAB was “testing” the facility for 250-something days in a row … I call bullsh!t on their claim.

EDIT: It’s not MSM-newsworthy for the obvious reason. If all Aussies comprehended just how dodgy our Ponzi financial system really is, there’d be a “loss of con-fidence”, mass bank run, thus system implode (ie) extreme threat to the established ‘order’.

From Doug Nolands latest – http://www.prudentbear.com/index.php/creditbubblebulletinview?art_id=10610

“I believe the vast majority of the modern financial apparatus over the years gravitated to speculative spread trading and various leveraged risk arbitrage strategies – especially at the expense of funding sound investment in the U.S. and other advanced economies. The system’s focus turned to financing the securities and asset markets, an extremely lucrative business that so dwarfed opportunities available from financing capital investment. The intense focus on Credit market spread/arbitrage “profits” – as our central banking incentivized leveraged speculation – made real economic returns virtually irrelevant to the broader economy (home mortgages were much preferred over business investment loans as fodder for risk intermediation and financial arbitrage). Never before had the possibilities for Credit creation – and resulting fees and speculative profits – been so unfettered and incentivized. That is, as long as asset prices continue to inflate. Over time, this resulted in “money” and Credit becoming dangerously and increasingly detached from real economic wealth and wealth-producing capacity.”

Note “as long as asset prices continue to inflate.” Thus ‘asset’ prices have to rise – interest rates lowered – by incentivising central banks. Without ‘incentivisation’ (read speculative profit) the system will disintegrate & most people will lose everything, since most people’s ‘money’ is ‘invested’ in ‘assets’ rising in price due to central bank incentivisation! There is no way out.

Also,

“From Mr. Gross: “Conceptually, when the financial system can no longer find outlets for the credit it creates, then it de-levers.” True enough. I would add that a system will find it increasingly challenging to find “outlets for Credit” once premises behind – and confidence in – the mania in Credit instruments begins to break down.”

This could well explain the recent carbon tax fiasco. Despite being completely on the nose, carbon ‘credit’ is an outlet for a dysfunctional financial system that has to create more & more credit or die, since it is now so overleveraged.

Great summation. Entirely agree .. and yes, I (and many) have long argued that carbon “credit” is just the next bubble, hence why the 1,000-odd pages of our so-called carbon “tax” legislation is all just a bureaucratic smokescreen for the one or two key bits – legalising carbon units as a tradable commodity, and most importantly, allowing banks to create derivative products and secondary trading markets from Day 1, even before the scheme begins.

Do the Banks need to declare these loans to the market & shareholders? It would seem to me that CEO Kelly might have some explaining to do? No wonder CEO Kelly of Westpac was so hot for Carbon Trading.

Have any disclosure laws beenbroken?

In theory, “yes”. In practice … they are a law unto themselves.

Good find Col.

Pity the MSM doesn’t run with.

I don’t know when but it will end in tears one day.

So where’s the “safest” place to park any money,assuming one of an advanced age has any spare?

Disclaimer: The following should not be viewed as constituting financial advice –

And then there’s this, from ZeroHedge:

😉

Saw this interesting article in the Fairfax press today.

“APRA’s ‘risk registers’ came after crisis”

They are 12 secret documents judged to be so potentially damaging that releasing their contents would endanger the stability of Australia’s whole economic system.

http://www.canberratimes.com.au/news/national/national/general/apras-risk-registers-came-after-crisis/2404184.aspx?storypage=1

The regulator warns the risks outlined in the registers are so sensitive that releasing the information ”may affect the stability of Australia’s economy”.

Release of the registers could influence investing decisions and harm individual institutions – a reference to behaviour such as a run on a bank.

Yes we wouldn’t want this house of cards coming down because the public , god forbid actually figured out how vulnerable their investment are.

Great link … thank you Richo.

“you cannot allow an impression to develop generally in the public that there is any risk”

And that is a public admission that the person speaking considers lies and deceit to be not only acceptable but absolutely necessary for the greater good. After he has said that, who cares what else he might have to say?