From the Australian Office of Financial Management (AOFM) Public Register:

Australia’s Public Debt Now 61% Worse Than Ireland Before It Crashed

7 AugThere are many who want you to believe that Australia’s public debt level is “low”, and nothing to be concerned about.

The truth is, there are a lot of lies told about our public debt. Usually, they are lies of omission. A deliberate choice to not give you the truth, the whole truth, and nothing but the truth.

Recently the Australian Financial Review published an article that — unlike politicians’ claims — would hold up in court:

You’ve been grossly misled about Australia’s finances – again.

Getting insight into the true state of the government’s finances is as important as understanding your own. The government’s liabilities are ultimately our debts, and will be paid back by taxing our earnings.

Last time I sunk my teeth into these issues I explained how the ostensibly very low “net debt” figures bandied around by many, including the PBO [Parliamentary Budget Office] are a complete fiction: they assume the debts of wholly owned government companies and state governments simply do not exist.

The net debt numbers are also artificially reduced by taking cash from the Future Fund, which was set up to meet unfunded superannuation liabilities, which are not – surprise, surprise – included in the debt estimates.

It’s the same as ignoring money you owe to someone but recognising the cash you have saved to repay them.

Once you add back in state and wholly owned government entity liabilities, Australia’s net debt almost doubles from 10.6 per cent to over 20 per cent of gross domestic product. Since net debt is open to so much fudging, real analysts focus on true debt. Since 2007 federal and state government debt has exploded from $150 billion to $500 billion, with the actual debt-to-GDP ratio approaching… 40 per cent…

This is precisely what Barnaby Joyce has been saying, since late 2009.

In recent days here at Barnaby Is Right, we have seen how our Treasury department boffins have completely failed to recognise the true reason for Australia’s structural budget deficit.

It is exactly the same reason that Ireland crashed in 2008.

A banking system — and a government — that had become dependent on profits (and taxes) flowing from “an unsustainable boom in the housing sector”:

So our supposedly “low” and ever-rising public debt level does matter.

Because at 40% of GDP (Federal and state debt combined), our true public debt level is now 61% worse than Ireland before it crashed … and bailed out its banks:

You may notice that the chart for Australia shows an apparent small decline in (Federal) government debt in 2013, to 20.7% of GDP (circled in red).

That is the Federal government’s forecast.

We all know what their forecasts are worth.

See also:

Australia Plans Cyprus-Style Bail-In Of Banks In 2013-14 Budget

Australian Banks “Welcome” Cyprus-Style Bail-In Plan

UPDATE:

Labor spending simplified –

The Clinching Argument In The “Private vs Public Debt” Debate

5 Jul“He’s pretending that he’s elected by the people, and he’s actually elected by the banks”

In the following interview, Professor Steve Keen discusses how government “stimulus” or “help” programs that hand out borrowed (by the government) money to entice prospective house buyers, are actually Ponzi schemes.

But the most important truth of all is revealed from 10:14sec onwards:

INTERVIEWER: The Chancellor of the Exchequer, George Osborne, says he wants to reduce debt in Britain, while simultaneously launching the “Help To Buy” scheme which is an increase in debt. So my simple question is, Is the Chancellor lying?

KEEN: I think the Chancellor, like most politicians, is focussing on the level of government debt, not on the level of household and private debt, and they think that’s the real problem. The cause of this crisis was an out of control private banking sector lending to the private sector to encourage it to speculate on assets….

INTERVIEWER: (interrupts) Let me, let me, let me jump in for a second, because what we have found out in 2008 and going forward is that there really is no such thing as private debt, because when these private debts become unsustainable the private sector simply gives them to the government. So ultimately taxpayers always end up footing the bill for this debt, all the combined debt of household debt, bank debt, government debt, it’s all the same debt, that’s all underwritten by the same abused taxpayers, and the Chancellor — by ignoring this — is pretending that the UK people are brain dead!

KEEN: Well, what he’s pretending is that he is elected by the English people and he’s actually elected by the English banks. All this happens because the banks have got the politicians by the intellectual balls. They believe that the economy has to have a growing banking sector to be healthy, and that’s just like believing that you have to have a growing cancer to be a healthy human being. Past a certain stage the financial sector becomes a parasite. But it becomes such a strong and powerful parasite that the politicians think that if they let it die the economy will die. That’s precisely the opposite of the case — you’ve got to get the financial sector to shrink, you’ve got to cut it down, say in England, by a factor of at least 2 — and then in terms of abolishing debt, writing it off, not honouring the stuff, and standing up for the debtors, rather than standing up and voting for the creditors which, unfortunately, is what the politicians around the world have been doing this time around…

Unfortunately, Steve sidestepped the critical observation made by the interviewer — that because banksters simply palm off their out-of-control debt problems to the government, aided and abetted by compliant politicians, what this means is that, in the end, private debt and public debt must be considered in sum, not separately.

This is why Barnaby is right.

Although relatively “low” compared to that of “other advanced economies”, nevertheless Australia’s ever-rising public debt trajectory does matter a helluva lot.

Why?

Because — even though (sadly) Barnaby never points this out — Australia’s private debt levels are the highest in the world.

Our Household Debt sits around 150% of household disposable income.

Our government-guaranteed banking sector is massively leveraged to Australia’s world-leading house price Ponzi.

So, simply stated, because of our massive private debt problem, our nation absolutely cannot afford the added risk of an ever-rising public debt level too.

$5.2 Billion Budget Blowout

15 MayLet’s hear a caustic cheer for all the “experts” who insist that Australia’s public debt is “small”, and does not matter.

Interest on debt forecast, Budget 2012-13:

Interest on debt forecast, Budget 2013-14:

That’s a blowout of $699 million in 2012-13. $937 million in 2013-14. $1.594 billion in 2014-15. And $1.982 billion in 2015-16.

For a grand total blowout — just the blowout, not the total — of $5.2 billion “over the forward estimates.”

Now remember — all this is based on the forecast assumption of 5% per annum nominal GDP growth in the next two years. Even if that were to happen, the forecast is for another deficit (ie, more borrowing, at interest) of $18 billion in 2013-14, and $10.9 billion in 2014-15.

So, what do you think is going to happen to the forecast budget deficits — and the forecast interest on debt — if when that GDP forecast turns out to be highly optimistic … again?

Dear reader, I invite you to ponder, if you will, just how much productive investment could be made, if the economy were not loaded down with the ever-increasing burden of repaying a forecast $14 billion every year to (mostly foreign) bondholders, just for Interest on the Federal government’s debt?

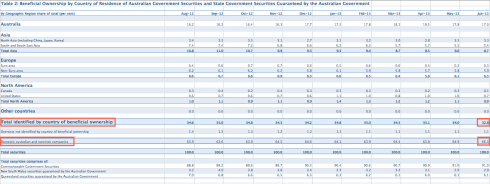

84% Of Australia’s Debt Owed To “Non-Residents”

19 MarLet us return to a topic covered previously ( Who Owns 73% Of Our Debt? ; Our Government *Officially* Does Not Know Who Owns More Than 60% Of Australia’s Debt ).

According to the RBA’s most recent statistics, 84% of the “public” debts being accrued by Green-Labor are owed to “Non-residents”.

$187.6 billion, out of a total $223.3 billion, at end December 2011.

A new all-time record level of indebtedness to foreigners:

Source: RBA Statistics, E3 Commonwealth Government Securities Classified By Holder | Click to enlarge

Australia, you are being sold out.

As Mark McGovern of QUT’s Business School observed in the must-read Australia’s Debt Dreamtime:

The net external wealth of Australia has deteriorated across the generation (McGovern 2010b, from which Figure 1 is drawn). Calculation of external wealth is based upon cumulative financial surpluses from an essentially zero basis in 1960. As is evident, Australia has been increasingly building external liabilities. A particularly marked decline has occurred over the last decade resulting in a total external exposure of $820b as at June 2010 with an annual deterioration of over $50b.

…

The central conclusion is stark: all the efforts of a generation of Australian men and women have only made them more obligated to the rest of the world. All that reform, all those industry and government initiatives, all those strategies, all that talk of productivity, all the promises of a previous boom in mining – all have come to naught. Today, we stride the world stage with external debts and other net liabilities above seventy percent of GDP, and increasing. Unaddressed, this is a precursor for crisis…

And as Delusional Economics recently observed (emphasis added):

So where is it all going ? Well if we breakdown primary income into its component parts we get the result below. This tells us that the major components of our primary income deficit are from direct investment income and portfolio interest payments to the rest of the world:

Which basically means that in aggregate Australia sends massive amounts of dividends and interest payments to the rest of the world. In fact it is so large that it is dwarves our trade in goods and services, resulting in a net loss to the external sector even during the historically high terms of trade. The most important thing to note is that these are payments stemming from previous foreign investments meaning Australia is continuously making payments to rest of the world somewhat independently of the balance of trade.

Finally, the financial account tells us that in order to maintain this current account deficit, Australia continually relies on foreign direct investment capital flows along with sales of equities:

…

So in other words we sold lots of new financial assets to foreigners so we could pay them the interest we owed them stemming from their previous purchases. Sounds a little ponzi-ish doesn’t it?

And as reader Craig so eloquently and insightfully observed in comments to Saturday’s post about the Foreign Investment Review Board being – in the words of Barnaby Joyce – “full of merchant bankers“:

In Australia, everything is up for sale to foreigners and always has been. The FIRB is absolutely useless; a bunch of doctrinaire econocrats spouting the Treasury Line. These are people, just like the rest of the governing class actually, who have no sense at all of the national interest. Patriotism is a dirty word for them. I’m not surprised the Liberals couldn’t give a toss about selling off the farm. When Lenin once observed that if the Bolsheviks starting hanging some of the bourgoisie, the others would compete among themselves to sell them the rope, he had people like the members of the Liberal Party in mind.

What a dreadful choice we Australians are left with; between a bunch of socialist incompetents on the one hand and money-grubbing traitors on the other.

You know what they used to do to traitors?

Wayne Predicts 57% Blowout In Net Debt … This Year

2 DecYour humble blogger will not bore readers with another tirade about the wilful deception of governments (and lapdog economic commentators) always preferring to reference Australia’s “net” government debt position, rather than what is actually owed … the (much bigger) gross figure.

Instead, let us simply take a look at the government’s own preferred measure, in their own budget statements.

Here’s the government’s stated net debt position in the Final Budget Outcome for 2010-11 – that’s only 5 months ago:

Note that the “estimate” for net debt for the year ending June 2011, as given in the mid-May budget ($82.3 billion), was blown out by more than $2 billion just 6 weeks later ($84.5 billion).

Now, let’s look at the May budget, and the original “estimate” for net debt at year ending 2011-12:

Original “estimate”? $106.65 billion in net debt, for the year ending June 2012.

And now, 6 months later, let’s look at the latest 2011-12 MYEFO, and the revised “estimate” for net debt at year ending June 2012:

Ok.

So, net debt was $84.5 billion at end June 2011.

In the May budget, it was “estimated” to reach $106.65 billion by end June 2012.

The reality?

Barely 6 months later, net debt is now “estimated” to be $132.5 billion at end June 2012.

IF the government can keep net debt down to their latest upwardly revised estimate, that would be an actual blowout of 57% in total net debt … in just one year.

And it would be a 24% blowout on the Treasury #JAFA’s original “estimate” made in the May budget just 6 months ago.

The chances of this government keeping net debt down to their latest “estimate”? Based on track record, somewhere between Buckleys and none.

Finally, note that net debt is now “estimated” to not increase by more than $3 billion over the three years following 2011-12.

This prediction from the same ‘experts’ whose “estimate” in mid-May for net debt at end June, was wrong by $2 billion.

Now now dear reader … stop laughing.

Come on.

That’s enough now.

Seriously … this is serious.

Comments