On 11 January 2013, the Australian Financial Markets Association (AFMA) responded to the Australian Treasury regarding the government’s Consultation Paper (September 2012) Strengthening APRA’s Crisis Management Powers.

There is much of interest in AFMA’s letter.

But this (page 5) is arguably the “money quote” that should be of most interest to Aussies with savings in a bank:

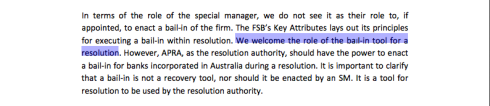

“The FSB’s Key Attributes lays out its principles for executing a bail-in within resolution. We welcome the role of the bail-in tool for a resolution.”

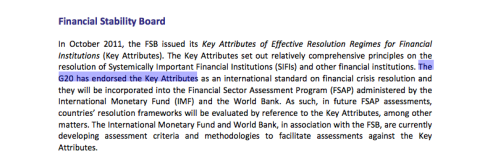

The Australian Treasury’s consultation paper further evidences that the internationalist, Goldman-Sachs chaired, FSB-directed new regime for Cyprus-style bail-in of banks using depositors savings was endorsed by the G20:

Australian Treasury, Strengthening APRA’s Crisis Management Powers, September 2012, page 4 (click to enlarge)

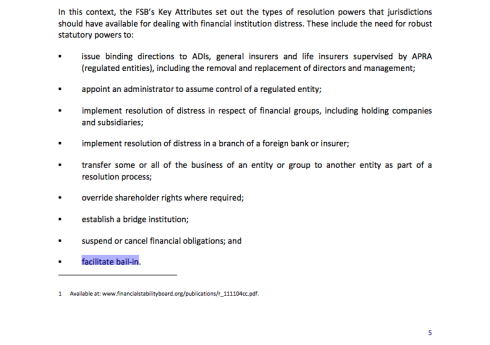

… and that bail-in of Australian banks is an FSB requirement, one that will be enforced by APRA as Australia’s “resolution authority”, under new “robust statutory powers”:

Australian Treasury, Strengthening APRA’s Crisis Management Powers, September 2012, page 5 (click to enlarge)

More to come.

See also:

Australia Plans Cyprus-Style “Bail-In” Of Banks In 2013-14 Budget

Timeline For “Bail-In” Of G20 Banking System

G20 Governments All Agreed To Cyprus-Style Theft Of Bank Deposits … In 2010

So where do we put our savings Barnaby?

Alas, there are laws against giving financial advice without holding a licence to do so. I imagine other commenters will have suggestions for you.

Sadly Australians have not had the intestinal fortitude to stand up and take back control of their money, return creation of credit, money, to the elected government, so we, the voters, determine what is happening to us economically.

There are alternative economic principles to work with, yet no one wants to know.

Debit banking is irreversible self destructive, as the interest to be paid is never created, so we must continue to deduct interest from the capital created, until all is owned by the bankers. It is called the A+B=A

A=capital

B= interest to be paid on capital

Nothing new, it’s called credit banking, and it works, but no politicians or any others seem in the slightest bit interested in fixing the economic problems, which are caused by the banks.

Check it out Barnaby, it works and is easily applicable.

‘Debit banking is irreversible self destructive, as the interest to be paid is never created, so we must continue to deduct interest from the capital created, until all is owned by the bankers. It is called the A+B=A’

thanks for this

Buy a safe, take out all but what is needed in your account/s, and put it in your safe. No interest, but hey, you don’t get much anyway, after all, it’s all about them. I mean how dare we get upset when they have illegally claimed ownership of our money simply by depositing in the bank, they say thank you very much it is now ours.

Right with you on that one. Being an old age pensioner I wonder how long before they stop paying us, but why aren’t Australians willing to stand up and take responsibility for what we are allowing banks, and their lapdogs, the politicians, do to us?

I’ve got a safe, just no money!

Sad that I spend my time talking to myself, but let me ask readers a question. Why are our community, and those we call politicians, so scared of Social Credit?

How many have any idea what it means?

It has been proven to work incredibly well, historically, and the only opposition to it has been from bankers, at it prevents them ripping the community, you and I, off at the rate they are at present.

Note current profit margins, and they want to take our cash for a bail out?

Something stinks, and I think it is the economic/banking system.