It has been well-documented by others that the Cyprus-style bank “bail-in” scheme that is presently being prepared right across the G20, is really all about derivatives — those “financial weapons of mass destruction” that were at the heart of the GFC in 2008 (see Derivatives Managed By Mega-Banks Threaten Your Bank Account).

To briefly summarise, a critical aspect of what the bail-in scheme is intended to do, is to prioritise the payment of banks’ derivatives obligations to each other, ahead of depositors. In other words, it is about stealing the public’s bank deposits, to pay out at least some of the big banks’ Death Star-massive — and toxic — derivatives positions.

Yves Smith of Naked Capitalism explains:

In the US, depositors have actually been put in a worse position than Cyprus deposit-holders, at least if they are at the big banks that play in the derivatives casino. The regulators have turned a blind eye as banks use their depositories to fund derivatives exposures. And as bad as that is, the depositors, unlike their Cypriot confreres, aren’t even senior creditors. Remember Lehman? When the investment bank failed, unsecured creditors (and remember, depositors are unsecured creditors) got eight cents on the dollar. One big reason was that derivatives counterparties require collateral for any exposures, meaning they are secured creditors. The 2005 bankruptcy reforms made derivatives counterparties senior to unsecured lenders.

Note carefully that last point about the “collateral” for derivatives exposures, which means that derivatives counterparties are deemed “secured” creditors, making them “senior” to unsecured “lenders”.

In layman’s terms, what all that means is that when banks take out a derivatives bet, the bank on the other side of that bet (the “counterparty”) requires some collateral to be put up. Thanks to deregulation of the financial system over the past couple of decades, banks have — unbeknown to the public — been putting up their customers deposits as collateral for their derivatives bets.

Now, because collateral (or “security”) has been put up for those derivatives bets (or “positions”), this means that those bets are considered “secured”. And in a bank “resolution” (ie, a “bail-in”), the secured creditor has seniority (ie, priority) over “unsecured” creditors (ie, depositors).

Got that?

The big banks are all counterparties to each other on their derivatives bets. They have pledged “collateral” — often, your deposits — as “security” on those derivatives bets. When a bank fails, and is “resolved” under the new, FSB-directed bail-in regime, payouts on those “secured” derivatives bets get priority over paying you back your deposit.

Here at barnabyisright.com, we have recently been looking at the documents going back and forth between the Australian Treasury and the Australian banks. And it is here that we find confirmation of what has been reported by Yves Smith and others.

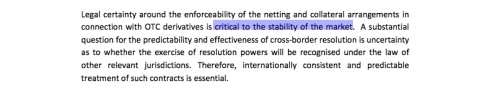

In the Australian Financial Markets Association (AFMA) 11 January 2013 letter in reply to the Australian Treasury’s September 2012 consultation paper, “Strengthening APRA’s Crisis Management Powers,” we see clearly that our banks consider the issue of how derivatives would be handled in a bank bail-in to be “critical”:

Legal certainty around the enforceability of the netting and collateral arrangements in connection with OTC derivatives is critical to the stability of the market.

In particular, what the banks are concerned with — so much so, they call it a “guiding principle” in their response to Treasury — is ensuring that the implementation of bail-ins in Australia will “include appropriate respect for…collateral rights”, with safeguards to protect their derivatives positions against “destruction of value”:

Governing our response to the Consultation Paper are three guiding principles:

…

Ensuring consistent treatment of transactional claims relating to derivatives and other financial instrument, including appropriate respect for netting and collateral rights, subject to safeguards to avoid destruction of value.

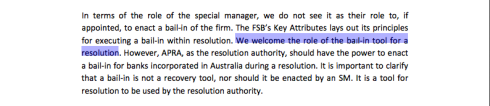

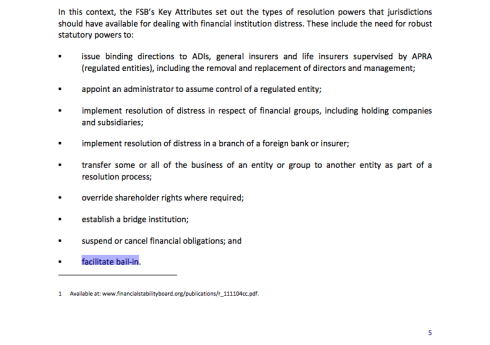

The international bankers (the Financial Stability Board) who are behind the G20-wide bank bail-in scheme, have sought to portray it as being designed to “resolve” failing banks, while at the same time, “protecting” bank depositors.

However, the truth is that the FSB bail-in scheme is really designed to ensure that the mega-banks — “systemically important financial institutions (SIFI)” — will receive priority for payout on their derivatives positions, in any “resolution” of a failing bank.

Because for the bankers, propping themselves and their compadres up is all that matters. What we call “theft”, they call “ensuring financial system stability”.

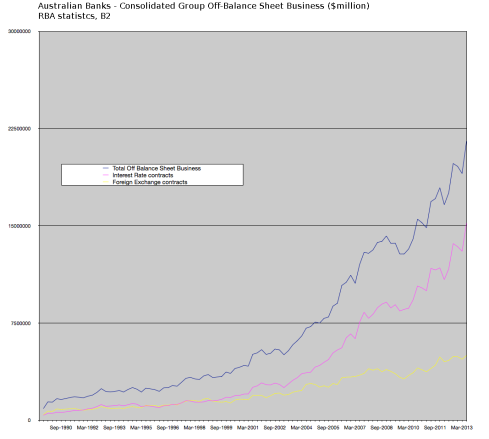

According to the RBA, our banking system holds $21.5 Trillion in “Off-Balance Sheet” derivatives exposures:

Over $15 Trillion of that is the “value” of derivatives betting on interest rates.

In the “bail-in” of an Australian bank, do you really think there would be anything left to pay you back your deposit, after the banks get “seniority” for payout on their “secured” derivative positions?

See also:

Australian Banks “Welcome” Cyprus-Style Bail-In Plan

Australia Plans Cyprus-Style “Bail-In” Of Banks In 2013-14 Budget

Comments