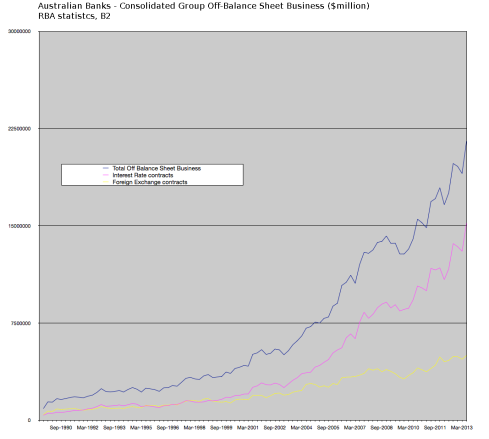

How did it happen?

How did we come to a place where an unknown, unelected body of bankers and bureaucrats — chaired since its inception by former Goldman Sachs men — has duped the G20 heads of government into endorsing a scheme to “bail-in” the insolvent private sector banking system by stealing the savings of taxpayers?

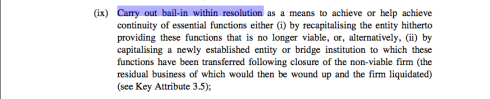

Financial Stability Board: Key Attributes of Effective Resolution Regimes for Financial Institutions, October 2011 (click to enlarge)

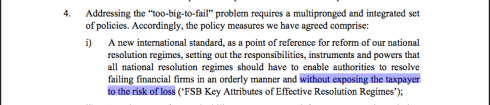

How did we come to a place where the European Union, the UK, the USA, Canada, and now Australia and New Zealand, have all begun implementing a new regime for “addressing the problem” of “moral hazard” associated with government bail outs for “too-big-to-fail” financial firms — supposedly “without exposing the taxpayer to the risk of loss” — by stealing the savings of taxpayers?

FSB – G-SIFI, Nov 4, 2011 (click to enlarge)

Here is the timeline to date (click the links to verify original sources):

FEBRUARY, 1999 – Following recommendations by then President of the Deutsche Bundesbank (German central bank) and later the Vice-Chairman (2003-present) of the Board of Directors of the Bank for International Settlements (BIS), Hans Tietmeyer, G7 Finance Ministers and Central Bank Governors endorse the creation of a new body, the Financial Stability Forum (FSF). It is funded by the BIS, and based in Basel, Switzerland.

Former Goldman Sachs vice chairman and managing director, and now President of the European Central Bank (ECB), Mario Draghi, is appointed the first chairman of the FSF. Its stated purpose is “to promote stability in the international financial system“:

Click to enlarge

…

30 MAY, 2006 – Chairman and CEO of Goldman Sachs from 1999-2006, Henry “Hank” Paulson, appointed Secretary of the Treasury by George W. Bush. During his tenure at Goldman, it became a major player in the creation and sale of collateralised debt obligations (CDO’s), including subprime mortgage-backed securities ($135 billion from 2001-2007). A tax loophole introduced under former President George HW Bush enables Paulson to meet the conflict of interest preconditions for assuming a government position, by “divesting” most of his $700 million fortune in Goldman Sachs’ stock, tax-free.

During Paulson’s first 15 months as Secretary of the Treasury, Goldman Sachs sells $30 billion in toxic mortgage products to pension funds, foreign banks and other investors (including a 59% increase in 2006), and makes billions betting against its own products. In 2006 and 2007, as the housing bubble bursts, Goldman distributes $22.3 billion in year-end profit-sharing rewards to its 31,000 employees and $112 million in bonuses to Paulson’s successor, Lloyd Blankfein.

15 SEPTEMBER, 2008 – Lehman Brothers files for bankruptcy; credit crunch; stockmarket panic; Global Financial Crisis:

…

21 SEPTEMBER, 2008 – On a Sunday, Goldman Sachs is authorised to change its investment bank status, and becomes a traditional bank holding company, thus making it eligible for bailout funds.

26 SEPTEMBER, 2008 – French President Nicholas Sarkozy says “we must rethink the financial system from scratch”.

29 SEPTEMBER, 2008 – USA’s House of Representatives rejects the $700 billion Wall Street bank bailout bill promoted by Secretary of the Treasury, Henry Paulson. Dow Jones Industrial Average (DJIA) index plummets 777 points:

…

1 OCTOBER, 2008 – US House of Representatives agrees to “bail out” Wall Street’s too-big-to-fail (TBTF) banks, passing amended Emergency Economic Stabilization Act, including the Troubled Assets Relief Program (TARP) enabling the government to purchase up to $700 billion in “toxic assets” such as mortgage-backed securities (derivatives) from private sector banks. Despite being a prime cause of the subprime meltdown, Goldman Sachs is the largest individual recipient of public funds ($12.9 billion) from the bailout of insurance giant, AIG, makes $2.9 billion from “proprietary trades” on its own AIG account, and receives a further $10 billion directly from the US Treasury as an “investment” in preferred stock:

…

7 OCTOBER, 2008 – World Bank President Robert Zoellick calls for “a new multilateral network for a new global economy”, says that “We will not create a new world simply by remaking the old”.

13 OCTOBER, 2008 – British Prime Minister Gordon Brown says “We must create a new international financial architecture for the global age”, and that “We are proposing a world leaders’ meeting in which we must agree the principles and policies for restructuring the financial system across the globe”.

15 NOVEMBER, 2008 – First ever summit meeting for heads of government of the Group of Twenty (previously, a G20 summit of Finance Ministers and Central Bank Governors held since 1999). Titled the “Leaders Summit on Financial Markets and the World Economy”, the Washington Summit agrees on an “Action Plan” for financial market reform. It includes an expansion of the Financial Stability Forum to include emerging countries such as China:

…

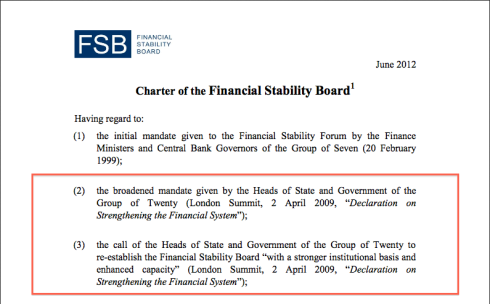

2 APRIL, 2009 – G20 London Summit Declaration on Strengthening the Financial System gives the freshly renamed Financial Stability Board (FSB) a “broadened mandate” and “enhanced capacity”:

…

8 NOVEMBER, 2010 – FSB report to the G20 Progress since the Washington Summit on the Implementation of the G20 Recommendations for Strengthening Financial Stability states that “Good progress has been made in defining a policy framework to address the moral hazard risks posed by systemically important financial institutions (SIFIs)”, and that “The FSB is submitting to the G20 Seoul Summit a set of recommendations and timelines for implementation of this framework”:

Within the “recommendations”, for the first time the spectre of “bail-in” of banks is formally (though blink-and-you-miss-it briefly) mentioned —

“…higher loss absorbency could be drawn from a menu of viable alternatives and could be achieved by a combination of capital surcharges, contingent capital and bail-in debt“:

…

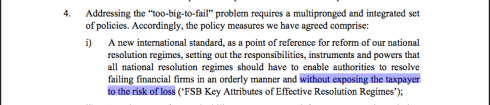

11-12 NOVEMBER, 2010 – G20 Seoul Summit endorses “the policy framework, work processes and timelines proposed by the FSB to reduce the moral hazard risks posed by systemically important financial institutions (SIFIs) and address the too-big-to-fail problem”, “without… exposing the taxpayers to the risk of loss”:

Click to enlarge

Click to enlarge

…

4 NOVEMBER, 2011 – Former Goldman Sachs co-head of sovereign risk and managing director of investment banking, chairman of the Bank for International Settlements’ Committee on the Global Financial System, and Governor of the central Bank of Canada, Mark Carney, is appointed the new chairman of the Financial Stability Board. He replaces fellow Goldman Sachs alumnus and current European Central Bank President, Mario Draghi.

4 NOVEMBER, 2011 – FSB states that “the development of the critical policy measures that form the parts of this framework has now been completed. Implementation of these measures will begin from 2012“:

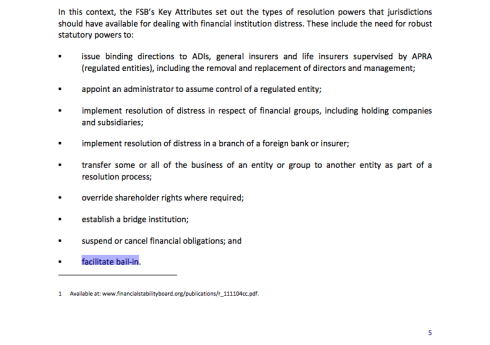

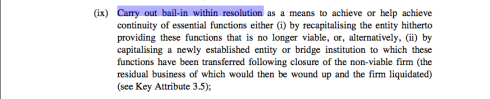

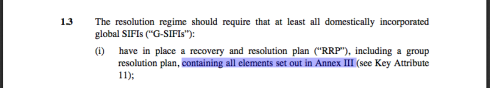

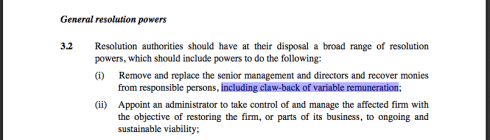

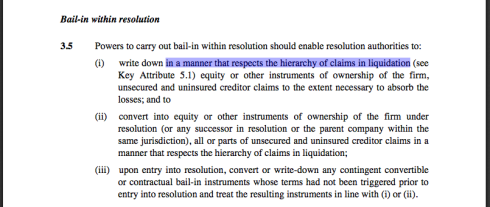

The FSB’s Key Attributes of Effective Resolution Regimes for Financial Institutions expressly identifies “bail-in” of banks as one of the “powers” that must be given to a single “Resolution authority” for each nation (G20) or jurisdiction (EU):

Financial Stability Board: Key Attributes of Effective Resolution Regimes for Financial Institutions, October 2011 (click to enlarge)

In the preamble, it is stated that one of the objectives is to make it possible for “unsecured and uninsured creditors to absorb losses”:

Click to enlarge

Each nation or jurisdiction is required to set up a “Resolution authority”, which is to be “responsible for exercising the resolution powers over firms…”:

Click to enlarge

The Resolution authority is to be given power to “transfer or sell assets and liabilities, legal rights and obligations, including deposit liabilities and ownership in shares, to a solvent third party,” … without consent:

Click to enlarge

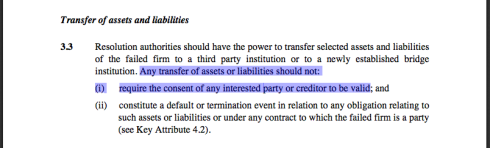

Key Attribute 3.3 clearly states that any transfer of a bank’s assets or liabilities (ie, deposits) by the Resolution authority “should not require the consent of any interested party or creditor to be valid”, and, that any such action will not be deemed a “default” of the bank’s legal obligations –

Click to enlarge

…

25 JUNE, 2012 – Government of Cyprus requests bailout from the EU, due to losses in its banking system associated with the Greek debt crisis.

10 DECEMBER, 2012 – A joint paper by the Federal Deposit Insurance Corporation (USA) and the Bank of England (UK) titled Resolving Globally Active, Systemically Important, Financial Institutions states that “the authorities in the United States (U.S.) and the United Kingdom (U.K.) have been working together to develop resolution strategies that could be applied to their largest financial institutions”:

FDIC and BoE: Resolving Globally Active, Systemically Important,

Financial Institutions, December 2012 (click to enlarge)

It further identifies that “This work has taken place in connection with the implementation of the G20 Financial Stability Board’s Key Attributes of Effective Resolution Regimes for Financial Institutions”:

FDIC and BoE: Resolving Globally Active, Systemically Important,

Financial Institutions, December 2012 (click to enlarge)

The paper explains that its focus is “the application of ‘top-down’ resolution strategies that involve a single resolution authority applying its powers to the top of a financial group”, and how such a strategy could be implemented “for a U.S. or a U.K. financial group in a cross-border context”:

FDIC and BoE: Resolving Globally Active, Systemically Important,

Financial Institutions, December 2012 (click to enlarge)

With regard to the USA, it explains that “the strategy has been developed in the context of the powers provided by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010“, and that such a strategy would “assign losses to shareholders and unsecured creditors“ (meaning, bank depositors):

Click to enlarge

Click to enlarge

With regard to the UK, it explains that “the strategy has been developed on the basis of the powers provided by the U.K. Banking Act 2009 and in anticipation of the further powers that will be provided by the European Union Recovery and Resolution Directive“, and that the strategy would “involve the bail-in (write-down or conversion) of creditors at the top of the group in order to restore the whole group to solvency”:

FDIC and BoE: Resolving Globally Active, Systemically Important,

Financial Institutions, December 2012 (click to enlarge)

Click to enlarge

The paper expressly identifies the origin of the “framework” for the bail-in strategy as being the FSB —

“It should be stressed that the application of such a strategy can be achieved only within a legislative framework that provides authorities with key resolution powers. The FSB Key Attributes have established a crucial framework for the implementation of an effective set of resolution powers and practices into national regimes”:

Click to enlarge

…

14 MARCH, 2013 – Reserve Bank of New Zealand releases draft Open Bank Resolution policy, which includes “bail-in” for failing banks using depositors’ money.

16 MARCH, 2013 – Cypriot Government agrees to EU-imposed conditions for receiving bail out funds, terms which include “bail-in” of Cypriot banks using depositors’ savings.

Cyprus is widely seen as a template for similar actions throughout the EU and the world. Forbes magazine states that “A new strategy has been unveiled around the world, with the first test run in Cyprus. Despite early denials, the ‘bail-in’ strategy for insolvent banks has already become official policy throughout Europe and internationally as well.”

21 MARCH, 2013 – Canadian Government’s Economic Action Plan 2013 states that “The Government proposes to implement a ‘bail-in’ regime for systemically important banks”, aimed at recapitalising failing banks by “the very rapid conversion of certain bank liabilities into regulatory capital”. It further states that “This will reduce risks for taxpayers”:

Canada Budget 2013 Economic Action Plan, March 21, 2013, page 145 (click to enlarge)

…

14 MAY, 2013 – Australian Government Budget 2013-14 Portfolio Budget Statement for the Australian Prudential Regulation Authority identifies implementation of the FSB-directed bank bail-in regime as a key strategic objective for 2013-14 —

“consolidate the prudential framework by enhancing prudential standards where appropriate, in line with the global reform initiatives endorsed by the G20 and overseen by the Financial Stability Board“:

page 134, Portfolio Budget Statements, Australian Prudential Regulation Authority, Australian Government Budget 2013-14, 14 May 2013 (click to enlarge)

…

20 MAY, 2013 – The European Parliament’s Economic and Monetary Affairs committee issues a press release stating that “The case in Cyprus showed how important it is to have clear procedures for making shareholders, bondholders and ultimately depositors foot the bill”.

Bank of England deputy governor Paul Tucker says that draft EU bank rescue laws would be a milestone towards “a global system”.

JUNE, 2013 – Reserve Bank of New Zealand releases its Open Bank Resolution (OBR) Pre-positioning Requirements Policy, stating that the OBR “provides the flexibility to assign losses to creditors“ (meaning, bank depositors):

Reserve Bank of New Zealand, Open Bank Resolution (OBR) Pre-positioning Requirements Policy, June 2013 (click to enlarge)

In Definitions, the OBR states that “‘Customer account’, ‘customer liabilities’, or ‘customer liability accounts’ are unsecured liabilities of the bank represented by a range of products such as cheques, savings and other transactional accounts and including term deposits“, and that these are considered “in-scope for pre-positioning”:

Click to enlarge

The OBR further states that “The Implementation Plan is a key part of the documented evidence that pre-positioned arrangements to quickly close the bank, freeze a portion of customers’ claims to meet potential losses, and reopen the next business day and continue banking services, are in place”:

Click to enlarge

The first requirement for “Pre-positioning” is stated as being “That the bank can be closed promptly at any time of the day and on any day of the week, freezing in full all liabilities and preventing access by customers and counterparties to their accounts”:

Click to enlarge

…

27 JUNE, 2013 – The European Union agrees on “bail-in” rules as part of the Bank Resolution and Recovery Directive.

1 JULY, 2013 – Mark Carney appointed to a second term as chairman of the FSB; also becomes Governor of the Bank of England.

3 JULY 2013 – The Financial Times warns that the EU’s newly agreed ‘Bank Resolution and Recovery Directive’ “swings Europe from one extreme – a system laden with implicit government guarantees that protected bank creditors from bearing losses – to the other”, and “risks old-style bank runs”.

************

To be continued…

Observant readers will note that the G20 heads of government endorsed the FSB’s “recommendations” (Seoul, Nov 2010) a full year before the FSB actually completed their “framework”, and finally documented that the power to bail-in the banks using depositors’ savings would be a requirement (“Key Attributes…”, Nov 2011). Prior to this, the only reference to the possibility of bail-in (with no mention of depositors) was one obscure, and very brief, reference in the FSB’s 2010 “Progress…” report to the G20 Seoul Summit; the report on which the G20 leaders based their decision to formally endorse, and implement, the yet-to-be-completed FSB framework —

“…higher loss absorbency could be drawn from a menu of viable alternatives and could be achieved by a combination of capital surcharges, contingent capital and bail-in debt.”

Amidst all the celebrity shoulder-rubbing, champagne, caviar, and photo ops, I wonder how many of the G20 leaders actually read the document, much less noticed that tiny part.

Or — if any of them did — if any had the first clue what it meant.

See also:

G20 Governments All Agreed To Cyprus-Style Theft Of Bank Deposits … In 2010

Australia Plans Cyprus-Style “Bail-In” Of Banks In 2013-14 Budget

But The Sheep Don’t Scatter: Banks Say “Sophisticated” Customers Have “Less Stable” Deposits

The Bank Deposits Guarantee Is No Guarantee At All

Think You’ve Got Cash In The Bank? Think Again

Tags: bail-in, cyprus, Economic Action Plan, Financial Stability Board, FSB, Goldman Sachs, Key Attributes of Effective Resolution Regimes for Financial Institutions, mario draghi, mark carney, TBTF, too big to fail

Comments