FSB – G-SIFI, Nov 4, 2011 (click to enlarge)

November 11-12, 2010.

Armistice Day.

That is when all the major governments of the G20 first agreed to implement the new, Cyprus-style “bail-in” regime, at the direction of the internationalist Financial Stability Board under its new, GFC-enabled “broadened mandate” –

Click to enlarge

The pretext?

Financial stability, of course.

“Addressing the ‘too-big-to-fail’ problem”.

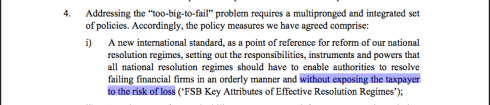

With a “new international standard”.

Specifically, “to enable authorities to resolve failing financial firms in an orderly manner without exposing the taxpayer to the risk of loss.” –

Click to enlarge

One cannot help but laugh at the Orwellian doublespeak slogans used by the architects of this new regime.

To address the problem of “systemically important” banks, “without exposing the taxpayer to the risk of loss,” our puppet politicians have agreed to confiscate … the savings of taxpayers.

Yes, today is All Fools’ Day. And no, you can’t make this $h!t up.

You may be thinking that this excerpt from an FSB press release does not prove that the G20 have specifically agreed to confiscation of bank deposits. And you would be correct.

As with all such schemes, it is not intended that the public will easily discover what has been planned. You have to wade carefully through all the verbose (and deliberately obtuse) technocrat-ese, and cross-reference the supporting documents (and their annexes), in order to discover just what our G20 attendee politicians – geniuses like “World’s Greatest Treasurer” Wayne Swan – have actually signed up to.

And to find the smoking gun.

One with the word B A I L – I N stamped clearly on its barrel.

First, in the FSB press release of 4 Nov 2011 we are told that the G20 allegedly “asked the FSB to develop a policy framework to address the systemic and moral hazard risks associated with systemically important financial institutions (SIFIs).”

Next, in Seoul 2010, “G20 leaders endorsed this framework and the timelines and processes for its implementation.”

That framework is set out in the FSB’s “Key Attributes of Effective Resolution Regimes for Financial Institutions” (pdf).

In the preamble of that document, we learn that one of the objectives is to make it possible for “unsecured and uninsured creditors to absorb losses.” Meaning, if your savings are not covered by some form of government guarantee or federal insurance (for all that is worth) – or if, as in Australia, the government bank deposits guarantee is limited to an amount significantly less than (ie, 1/10th) the total of actual bank deposits held by the public – then your bank account can be made to “absorb losses”. And as we will see shortly, this can be done entirely without your consent –

Click to enlarge

In the sub-points of the preamble, we see that G20 governments are expected to “have in place a recovery and resolution plan (“RRP”) … containing all elements set out in Annex III.” –

Click to enlarge

Each jurisdiction is required to set up a “Resolution authority”, which is to be “responsible for exercising the resolution powers over firms…” –

Click to enlarge

The Resolution authority’s powers are most interesting. For example, we can all applaud the idea that such an authority could (not that they actually would) “claw-back” bankers’ bonuses –

Click to enlarge

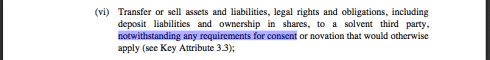

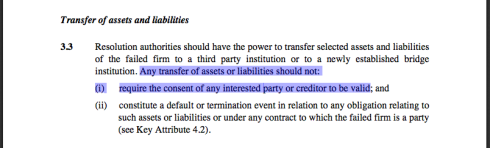

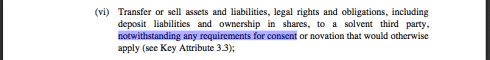

What is of serious concern though, is its power to “transfer or sell assets and liabilities, legal rights and obligations, including deposit liabilities and ownership in shares, to a solvent third party,” … without consent –

Click to enlarge

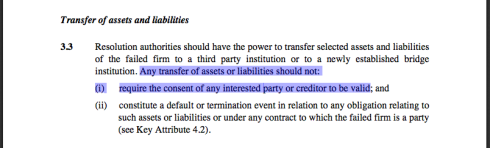

This is confirmed in Key Attribute 3.3, where it is clearly stated that any transfer of a bank’s assets or liabilities (ie, deposits) by the authority “should not require the consent of any interested party or creditor to be valid”, and, that any such action will not be deemed a “default” of the bank’s legal obligations –

Click to enlarge

Now if you are still sceptical that all this means the G20 have specifically agreed to a new regime that might include provisions for a Cyprus-style “bail-in” using depositors’ savings, then perhaps it is because you – like me – would be looking for this exact phrase in order to be fully convinced.

Yes, it is there.

Lucky number (ix) in the “powers” (page 7-8) of the Resolution authority that each of the G20 governments agreed to establish, back in 2010 –

Click to enlarge

Note that not only can the Resolution authority use a “bail-in” to support “continuity of essential functions” of a failing bank; it can also do so in order to finance the setting up of a new third party or “bridge” institution, into which the failed (“non-viable”) bank’s assets or liabilities (ie, your savings) can be transferred. Not so you can get your money back, but for the purpose of “capitalising” the new institution.

At that other elite lucky number (xi), we see another power; to shut banks, suspend payments to customers (except for payments to “central counterparties”, ie, to central banks, quelle surprise), and impose a “stay” on actions by creditors (eg, deposit holders) to “collect money” –

Click to enlarge

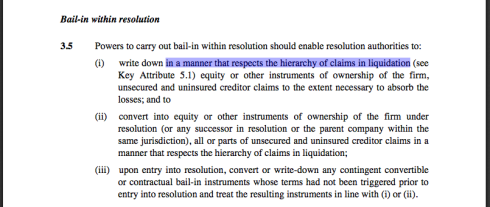

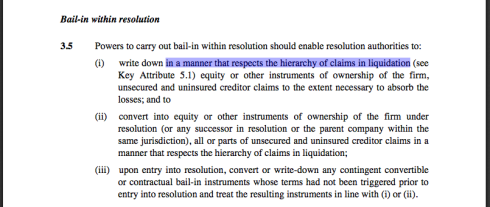

You may have noticed that the “bail-in” power at (ix) referenced Key Attribute 3.5. There, we see that the power to carry out a bail-in “should” (how comforting) be performed “in a manner that respects the hierarchy of claims in liquidation.” This no doubt will reassure the more gullible reader that there is nothing nefarious in this plan; that it is clearly intended that the traditional hierarchy of claims in a bank insolvency would be respected –

Click to enlarge

So, what exactly is the “hierarchy of claims” under this new FSB-dictated regime? Again we have to refer to another section (Key Attribute 5.1) to find the answer. Which does indeed appear to support the traditional hierarchy of claims. Except for this stunning caveat –

Click to enlarge

It is worth repeating –

“Resolution powers should be exercised in a way that respects the hierarchy of claims while providing flexibility to depart from the general principle of equal (pari passu) treatment of creditors of the same class…”

Moral relativism at its finest.

This is what has happened in Cyprus. While the final details are still evolving as to exactly how much Cypriot depositors holding more, or less, than €100k will have stolen from them, what is clear is that this FSB template for bail-ins in G20 nations or “jurisdictions” (EU), is the one being followed.

What is also clear, especially in light of recent revelations that Canada has expressly identified “bail-in” procedures in their 2013 Budget, is that all Western governments have, unbeknown to their citizens and without their consent, agreed to the imposition of the same new regime for managing insolvent banks.

A regime devised, and dictated by, an unelected central body.

Feel free to check these documents for yourself, here (pdf) and here (pdf).

Are you wondering who and what is the Financial Stability Board?

According to their website:

The FSB has been established to coordinate at the international level the work of national financial authorities and international standard setting bodies and to develop and promote the implementation of effective regulatory, supervisory and other financial sector policies. It brings together national authorities responsible for financial stability in significant international financial centres, international financial institutions, sector-specific international groupings of regulators and supervisors, and committees of central bank experts.

A list of institutions represented on the FSB can be found here .

The FSB is chaired by Mark Carney, Governor of the Bank of Canada. Its Secretariat is located in Basel, Switzerland, and hosted by the Bank for International Settlements.

Got that?

A kind of “super regulator”. Chaired currently by a Goldman Sachs man. With membership comprising the central bankers, treasury department heads, and prudential regulators of 24 nations, along with the IMF, World Bank, and a cavalcade of others.

Including – and “hosted by” – the central bank of central banks.

The Bank for International Settlements (BIS).

According to its Articles of Association, the FSB is also funded by the BIS –

Click to enlarge

According to its updated Charter (pdf), the FSB received its original mandate from the central bankers and Finance Ministers of the G7 nations in 1999.

It then received a “broadened mandate” from the “Heads of State and Government of the Group of Twenty” at a meeting in London on April 2, 2009 –

Click to enlarge

At the same meeting, another now-infamous Goldman Sachs alumnus and current President of the European Central Bank, Mario Draghi, was appointed Chairman of the FSB –

FSB – History (click to enlarge)

So… the hapless G20 heads of government, panicking in the midst of the GFC, gave the fonts of central banking wisdom at the FSB a “broadened mandate”, and “asked” them “to develop a policy framework to address the systemic and and moral hazard risks associated with systemically important financial institutions”, did they?

And under the consecutive chairmanships of Goldman Sachs men, these unelected bankers and bureaucrats – not one of whom warned of the approaching GFC – devised this “bail-in” policy for the whole of the G20, to solve the problem of Too-Big-To-Fail banks?

As the Machiavellian-minded so often say:

“Never let a good crisis go to waste”

See also:

Imagine A World With No Banks

The People’s NWO: Every Man His Own Central Banker

Tags: bail-in, Bank of International Settlements, BIS, cyprus, Financial Stability Board, FSB, G-SIFI, G20, Goldman Sachs, IMF, systemically important financial institutions, TBTF, too big to fail, world bank

Comments