page 134, Portfolio Budget Statements, Australian Prudential Regulation Authority, Australian Government Budget 2013-14.

I found it.

As predicted. Apologies it took so long.

Unsurprisingly, the evidence was fairly well buried. Naturally, the government does not want you to know what they are doing.

Just like the Canadian government did in March, and just as Europe, the USA and the UK have now done, the Australian government too is now beginning to make good on its 2010 G20 commitment to implement the Goldman Sachs-chaired, internationalist Financial Stability Board’s new regime for bailing out the banks using depositors’ money.

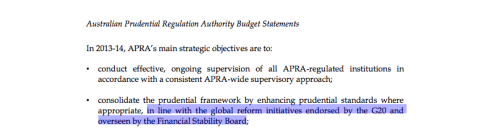

On page 134 of the Australian Government Budget 2013-14 Portfolio Budget Statements, under the section for the Australian Prudential Regulation Authority, we find the first of APRA’s main strategic objectives for 2013-14. It can be effectively summarised as “business as usual”.

Their second strategic objective for 2013-14, is to:

- consolidate the prudential framework by enhancing prudential standards where appropriate, in line with the global reform initiatives endorsed by the G20 and overseen by the Financial Stability Board; [see image at top of this post]

Those “global reform initiatives endorsed by the G20” include the FSB plan to “bail-in” insolvent banks:

FSB: ‘Key Attributes of Effective Resolution Regimes for Financial Institutions’, Annex III (click to enlarge)

In the waffle that follows, we find further that:

APRA will focus on implementing the new global bank liquidity framework in Australia…

page 134, Portfolio Budget Statements, Australian Prudential Regulation Authority, Australian Government Budget 2013-14.

This is likely referring in particular to the Basel III International Framework For Liquidity Risk Measurement, Standards, and Monitoring.

When published in combination with the previously mentioned strategic objective to “consolidate the prudential framework… in line with the global reform initiatives endorsed by the G20 and overseen by the Financial Stability Board”, the implication is crystal clear.

“Global bank liquidity framework” is really just technocrat-ese for “global bankster plan to prop up insolvent banks using other people’s money, and so instantly impoverish everyone who still has any savings left”.

For further proof that what this all means is the Australian government planning to steal your money to “bail-in” so-called “systemically-important financial institutions” (SIFI’s) — under the orders of an unelected international body (of bankers and bureaucrats) you’ve never heard of; a body funded by the Bank for International Settlements (BIS), and chaired consecutively by Goldman Sachs alumni — then please study the detailed primary source evidence in this blog’s original breaking story published on April 1st –

G20 Governments All Agreed to Cyprus-Style Theft Of Bank Deposits … In 2010

That’s something else to thank our recently-deposed PM Julia Gillard for doing, without our knowledge or permission.

Don’t save in currency and you don’t have a problem

Correct.

That could still be a problem.

I have been thinking of solution for similar situations and of course, “Don’t save in currency..” comes up. But, then the question is, “What to save in.”

Now that gets to buy low and sell high. How does one do that? And what assets or liabilities to pick?

You don’t want to save in some asset that will plummet. Yeah they do that some times.

If I had chosen gold six months ago I would have lost about 27% in 6 months. That would be 56% annualized; more than half! That would have been buying high.

Look at the charts for gold and silver from 2008. Gold dropped 30% from $1000 to $700, then took off almost 270% increase. Better for silver. $21 down to $9(down 60%) then it took off to $50.(about a 550 increase)

And don’t make the mistake of equating the paper, manipulated prices with the physical prices. Big mistake.

Good luck.

I’m thinking 1980 Gold priced in US$ and for 2 decades after. Historically that is a possibility in addition to some thing like your 2008 possibility. Which one or other? I haven’t got a clue.

(Gold in US$ looks a little different than AUS$.)

I agree with you in sentiment, but I have lost money investing on mostly sentiment.

In speculating there are many mistakes available for the making.

Gold is still up 5x from a low in 2000. Buying today would not be buying low. That adds more risk to the amount invested.

That does not absolve responsibility for bank honest dealing and return of deposits.

The mistake is to think you have 100% chance of the return of your saving when you lend your money to the bank. Lenders always risk their capital when it is lent. This has been forgotten. It is why you receive interest – it is payment for risk. If you don’t want to lend your money, withdraw cash and put it into a safe deposit box. That would be madness I agree. The point is, you lent your money to the bank in order to gain a return.

Don’t forget, that when you write off the debts to the debtors, it is the savers who have lent that money to the debtors. The banks are just middle men.

Steve Keen’s debt jubilee is disingenuous. It pretends the savers will be treated fairly with the money hand out which is far from true. The debtors pay off their debts with the hand outs, the savers meanwhile when they want to buy goods and services with their hand outs are competing with massively devalued dollars. Yes they got $500k handout but now apples are $10 each. The debtors keep the assets they purchased with preinflated dollars. It isn’t fair but you are only affected if you keep your saved wealth in the monetary plane. Money is not for saving. Save in the physical plane. Art, collectibles, precious metals.

Earning interest in the bank is not risk free even if the banks are solid. The Central Banks target 2-3% inflation to devalue your cash and tax the savers. Currency also fluctuates. The AUD is 91c today and was 101c a few months ago. 10% loss there that will affect oil imports which price everything.

Yes gold is volatile, but if you are saving for long term realise the difference between price and value. Look at the balance sheets of the central banks. The only physical asset that is not an IOU of another country is gold. It is the only thing that can and will explode in value when the wheels fall off the banking system. It must explode to repair balance sheets as debt defaults.

“The point is, you lent your money to the bank in order to gain a return.”

Precisely. Which is why I argue a fundamental point, that usury is The Key tool used by banksters/TPTB for generations to first deceive and ultimately enslave humanity — the offering of usury on deposits appeals to our greed for easy gain, and distorts and confuses our understanding of the fundamental difference between “money” (store of value), and “currency” (medium of exchange). Usury (both offered on deposits, and demanded for loans) is the great evil that must be (again) banned.

“Money is not for saving. Save in the physical plane. Art, collectibles, precious metals.”

Correct. As I also argue.

However, so as not to (inadvertently) mislead, what you should instead be very careful to say is that “currency is not for saving. Save in the physical plane. Art, collectibles, precious metals.”

There still some thing wrong about stealing deposits. Theory shouldn’t be used to justify.

You make very good points. I’m not sure Keen has savers in mind at all. Most economists do not speak as if they do.

The money dropping on the public is a myth. It rarely happens of ever any magnitude. More often, in actuality, more money goes the other way.

I just saw this on the same topic.

How often do you hear an economist in the media say this?

Title:Market Guru- “India Needs To Tighten Monetary Conditions” (part of an interview)

Interviewee: Marc Faber

note:India has horrid inflation.

http://www.youtube.com/embed/BcfsWPWAAWY?rel=0

“Bail-ins” coming to the US next, yet another violation of our rights. The gov’t constantly violates our rights.

They violate the 1st Amendment by caging protesters and banning books like “America Deceived II”.

They violate the 4th and 5th Amendment by allowing TSA to grope you.

They violate the entire Constitution by starting undeclared wars.

Impeach Obama.

Last link of “America Deceived II” before it is completely banned:

For a debt jubilee to be good for society it should negate the usury of the subjects of usury. The bail in is just the opposite.

Jubilee is meant for the benefit of the borrowers subject to usury not the lenders and usurers.

Correct.

From Protocol No.6, “We shall soon begin to establish huge monopolies, resevoirs of colossal riches, upon which even large fortunes of the goyim will depend to such an extent that they will go to the bottom together with the credit of the States on the day after the political smash…….”

.

Problem – Reaction – Solution

.

Vampire Squids –

.

http://andrewgavinmarshall.com/2013/07/10/global-power-project-part-5-banking-on-influence-with-goldman-sachs/

.

“…………In late 2007, as the mortgage crisis was accelerating, executives at Goldman Sachs sent each other emails explaining that they would make “some serious money” betting against the housing market. Like a self-fulfilling prophecy, the bank helped the market crash harder and faster.

.

A U.S. Senate investigation into Goldman Sachs concluded that the bank “profited from the financial crisis [which it helped cause] by betting billions against the subprime mortgage market, then deceived investors and Congress about the firm’s conduct,” and referred the Securities and Exchange Commission (SEC) and the U.S. Justice Department to investigate the bank for criminal or civil action.

.

As Goldman’s CEO Lloyd Blankfein himself stated: “We focused a lot of ourselves on trying to benefit from the crisis that happened… we were going to use that opportunity to make ourselves a better firm.”

.

In 2012, however, President Obama’s Justice Department announced that it would not pursue criminal charges against the bank. This, after the bank received over $12 billion in bailouts from the U.S. government to save the bank from the crisis that it created and profited from.

.

This, after Goldman Sachs helped create the Greek debt crisis for which entire populations of European countries are being punished into poverty while allowing the bank (among other banks) to continue to profit from the deepening depression and crisis in Europe.

.

This, after Goldman Sachs (along with other investment banks) helped create a global food crisis by speculating on food prices, sending the prices sky-high, then making immense profits while tens of millions of people around the world were pushed into hunger and starvation.

.

Obama’s decision not to prosecute the bank, of course, had nothing to do with the fact that Goldman Sachs was one of the top contributors to the Obama campaign in 2008 and again to his re-election campaign in 2012.

.

CEO Blankfein turned more heads when he told CBS News in November of 2012: “You’re going to have to undoubtedly do something to lower people’s expectations – the entitlements and what people think that they’re going to get, because it’s not going to – they’re not going to get it.” Suggesting that benefits like social security, Medicare and Medicaid were providing too much “support” to everyday people, Blankfein explained that “entitlements have to be slowed down and contained… because we can’t afford them.”

.

Apparently, the fact that Goldman Sachs received more than $10 billion in government welfare in exchange for its role helping to create a national and global financial crisis did not strike Blankfein as hypocrisy. The lesson he imparted: there is plenty of money to support the bank but not old-age pensioners. Because as Blankfein lectured the public about its need to “lower expectations” and lose its social benefits, bonuses for Wall Street executives were going up, with Goldman Sachs’s bonuses and salaries for 2012 topping $13 billion………”

Hey BI,

Thought you might like to know, “Cyprus style Bail Ins” just picked by a US website.

http://americannationalmilitia.com/contagion-who-is-next/

Thanks TS … it’s being picked up by a number of other websites now. Excellent — the word spreads.

Hi Rob, please don’t take my silence to date as a mark of inconsequence to this announcemnt.

So far i have been on one talk back radio show, had it published at WRH website and personally talked to loads of people.

The implications are huge.

Not just for the whole trust issue in the banking sector, but the global coordination of this netharious plot to embezzle the hard earned wealth of the 99%.

Thanks for the heads up.

G.

________________________________

The way the banking system works is a nefarious “plot to embezzle the hard earned wealth of the 99%!” Just read the synopsis of the book published earlier this year in the UK, called “Modernising Money”, on the website http://www.positivemoney.org

Basically, 98% of the money in circulation — electronic money in bank accounts — is created out of nothing by banks when they make loans. When any portion of a loan principal is repaid, the money disappears back into the nothing from whence it came. Banks always lend out, i.e. create out of nothing, money at a much faster rate than the economy is growing, and much of the surplus money is always used to buy assets, which bids up their prices. This explains why house prices and commercial property prices rise much faster than people’s incomes. When the inevitable asset bubble bust occurs, bankers call in loans, become very tardy at granting new loans, and people repay existing loans faster than they otherwise would. This causes a rapid reduction in the amount of money in circulation — the “money supply” — and voila, we have a recession, or worse, a depression.

The Positive Money solution to the loony money system under which we the 99% suffer, is to change the law so that banks no longer create any money, but merely function as the intermediaries that they have always held themselves out to be, and which most people mistakenly believe is all they do. New (electronic) money would be created only by the Reserve Bank of Australia, under the instructions of a new statutory body, transparently independent of politicians (who can never be trusted to manage the money supply – witness Zimbabwe and numerous other countries) and also independent of banks (who also have proven time and time again that they cannot be trusted to manage the money supply – witness inflation since 1913 by a total of around 10,000%, depending on country). This body would be called the Money Creation Committee (MCC). The MCC would by law have to create new money at a rate to cause whatever inflation rate the government chose, most likely around 1% to 2%. Personally, I believe a zero rate of inflation would be more equitable.

The new money so created would be handed as a gift to the government for spending into circulation according to its democratic mandate, and the government would be able to reduce taxation by the amount of the new money creation (the seigniorage accruing to the government). In Australia this would be several thousand dollars per taxpayer, depending on the rate of economic growth.

A Positive Money banking system would greatly curtail the economic power of the handful of families that control the bulk of the world’s financial system. Booms and busts would become relics of the past and we would all enjoy steady economic growth, limited only by our collective ingenuity and entrepreneurial ability, together with our collective capacity for hard, and smart, work. There would be no bank bailouts, no state-sanctioned bank deposit haircuts, and no bank would ever be too big to fail. The new wealthy would be the people who produce goods and services that other people want to buy, which is as it should be.

Pope lives in hotel – safety fears after Bank investigation.

http://deanhenderson.wordpress.com/2013/07/11/press-tv-inside-the-vaults-of-the-vatican-bank/

http://deanhenderson.wordpress.com/2013/07/09/the-house-of-rothschild/#comment-8923

http://www.storyleak.com/greece-goldman-sachs-rothschild-help-economy/

.

GREECE HIRES GOLDMAN SACHS, ROTHSCHILD TO HELP ECONOMY

.

“Who better to help Greece escape financial turmoil than Wall Street mafia head Goldman Sachs and the international banking elite family known as the Rothschilds?

.

Greece’s bank rescue fund has turned to the banking mafia duo in order to sell off two Greek banks (Proton and Hellenic Postbank) that were all but decimated by the economic turmoil in the nation. And

who better to help sell these banks and help Greece to get back to a stable economic than Goldman Sachs, who actually was very helpful in helping to wage financial warfare on the Greek people through hiding Greece’s slimy debt

.

But that, of course, is just seasoning on top of the ironic yet horrific dish cooked up by this rescue fund in choosing the very origin of the modern banking mafia through turning to the notorious Rothschild

family. From funding mega wars to originally making their massive wealth through outright deception following the Battle of Waterloo, electing any Rothschild to act as a Greek adviser is a choice that goes against the interests of the Greek people.

.

But then again, that is the way of the international banking cartel.

.

As we saw with the Cyprus incident, the wealthy bankers and connected corporate moguls pulled their voluminous amounts of cash from their accounts within the nation before the government went in and took

finances from the savings of the people in order to pay for the country’s mega bailout. Even Cyprus President Nikos Anastasiadis was found to be on the list of individuals who

withdrew their finances before the government-backed theft began………………………………..”

Read more: http://www.storyleak.com/greece-goldman-sachs-rothschild-help-economy/#ixzz2YuAMr0Xc

.

http://www.storyleak.com/greece-goldman-sachs-rothschild-help-economy/#ixzz2YuAMr0Xc

.

http://revisionisthistorystore.blogspot.com.au/2010/03/michael-hoffmans-online-revisionist.html

.

http://www.reuters.com/article/2013/06/28/greece-banks-idUSL5N0F428M20130628

.

http://www.storyleak.com/wealthy-insiders-pulled-cash-cyprus-confiscation/

.

http://www.oxforddnb.com/index/24/101024162/

.

http://www.washingtonsblog.com/2012/02/how-goldman-sachs-helped-corrupt-politicians-to-screw-the-greek-people.html

.

http://www.redicecreations.com/article.php?id=25975

Question. If one thinks it COULD POSSIBLY plummet and sky rocket what is one to do? OR, it might do some thing else.

Buying your gold high could be a poor decision. Buying some now and later. Or spreading the purchase.

You were probably smart enough to get yours at a lower price that is being offere

Great! Common plans make for larger systemic issues. Iceland followed in the beginning but couldn’t or wouldn’t at the end, so they did some thing different.

Why would folks in the southern hemisphere do what the north is “talking about” doing?

Doesn’t it look like the sun goes the other way when facing the equator? Don’t you turn your maps (your) side up?

Should have seen this coming as soon as Cyprus did it.

some good info here

http://larouchepac.com/

http://www.cecaust.com.au/