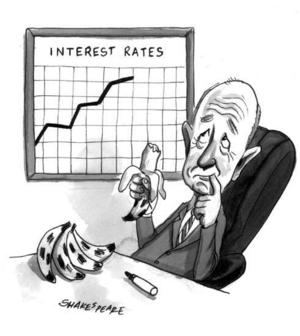

Could the USA default on its debts? Barnaby thinks so… and said as much in October and December last year:

The Nationals Senate leader Barnaby Joyce is openly canvassing an economic upheaval that would dwarf the current global financial crisis, triggered by the US defaulting on its sovereign debt within the next few years.

In unusually pessimistic comments for a senior political figure, Senator Joyce said the US Government was running such large deficits and building up so much debt that it was in a similar position to Iceland or Germany before World War II.

Is Barnaby alone in expressing this concern? Rudd Labor would have you think so. Others agree with Barnaby:

It is not literally impossible that the Federal Reserve could unleash the Zimbabwe option and repudiate the national debt indirectly through hyperinflation, rather than have the Treasury repudiate it directly. But my guess is that, faced with the alternatives of seeing both the dollar and the debt become worthless or defaulting on the debt while saving the dollar, the U.S. government will choose the latter.

And this:

The economic landscape still looks pretty gloomy despite (because of?) massive increases in federal government spending by Congress. Want something else to worry about? What if your government suddenly went “belly up” on some or all of its public debt IOU’s?

Impossible you say? Not really.

And this:

The specter of a wave of sovereign debt defaults is becoming more of a possibility daily. Historically, waves of sovereign debt defaults follow periods of relative calm in credit markets. In short, sovereign defaults are contagious.

And this:

Mr Ip believes the government will sooner try and inflate down the debt than default, which is probably true. But he reckons that in the unlikely event America must choose between hyperinflation and default, the unthinkable could occur.

And this:

The list of countries at risk of bankruptcy is increasing by the day. The acronym used to be PIGS (Portugal, Ireland, Greece and Spain). It is now PIIGSJUKUS and growing. The main contenders are currently: USA, UK, Japan, Spain, Italy, Greece, Ireland, France, Portugal, Baltic States, Eastern Europe and many more. On a proper accounting basis all of these countries are already bankrupt, but since many nations can either print money, like the US and the UK, or increase their already high borrowings, like Greece and the Baltic States, they have technically avoided bankruptcy.

And this:

But the ultimate financial question – until recently, unthinkable – is now being asked. Yes siree, the mighty US government could default. That’s how much the world has changed.

So why do Kevin Rudd, Wayne Swan, Lindsay Tanner, Ken Henry, and Glenn Stevens, not wish to discuss concerns about US debt, and the implications of a possible sovereign default on the Australian economy? According to Treasury secretary Ken Henry, to do so could “alarm” the community:

”I don’t mind discussing hypotheticals in general … [but] one has to be careful not to discuss publicly hypotheticals that are that extreme,” Dr Henry said.

Right. This is the same Ken Henry who never saw the GFC coming. No doubt he would have considered it just another “extreme” hypothetical back in 2007.

Tags: barnaby joyce, cdo, GFC, ken henry, PIIGS, sovereign debt, sovereign default, usa

Comments