Media Release – Senator Barnaby Joyce, 25 Feb 2010

Finance Minister Lindsay Tanner today on Fairfax Media, shows yet again he is a person who doesn’t “dot the i’s and cross the t’s”.

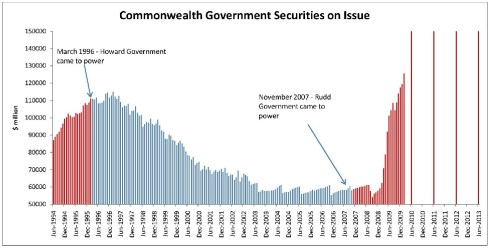

Asked what Australia‘s government gross debt was, he said and I quote, “The most recent actual number is about $120 billion, that’s the gross, I don’t check day on day, week on week”.

Australia‘s gross debt is actually $126.083 billion. It cracked $120 billion back before the 28thJanuary. So is the best we can hope for month on month? But don’t worry, Mr Tanner, it’s only somebody else’s money and I suppose somebody else has to repay it.

Mr Tanner you should be checking day on day, week on week. You should be dotting the” i’s and crossing the t’s”. You should be doing everything in your power to stop the trajectory that this debt is on.

When you are out by $6 billion and you are the Finance Minister, you do not leave a sense of confidence that you are managing the problem. It appears you are not even closely watching the problem. Mr Tanner you would have got closer to the number if instead of waving my media releases around in the chamber, you actually read them.

So Mr Tanner, if you are not watching our debt, who in the government is?

For more information –

Jenny Swan

Office of Senator Barnaby Joyce,

Leader of the Nationals in the Senate

02 6277 3697

0438 578 402

jenny.swan@aph.gov.au

Note: Unlike Lindsay Tanner – the responsible Finance minister – Barnaby Joyce is right up-to-the-minute with his knowledge of the debt numbers. Even the Australian Office of Financial Management (AOFM) has not yet updated their home page to reflect the additional $600 million in Commonwealth Treasury Notes that were auctioned off today.

Finance Minister Lindsay Tanner today on Fairfax Media, shows yet again he is a person who doesn’t “dot the i’s and cross the t’s”.

Asked what Australia‘s government gross debt was, he said and I quote, “The most recent actual number is about $120 billion, that’s the gross, I don’t check day on day, week on week”.

Australia‘s gross debt is actually $126.083 billion. It cracked $120 billion back before the 28th January. So is the best we can hope for month on month? But don’t worry, Mr Tanner, it’s only somebody else’s money and I suppose somebody else has to repay it.

Mr Tanner you should be checking day on day, week on week. You should be dotting the” i’s and crossing the t’s”. You should be doing everything in your power to stop the trajectory that this debt is on.

When you are out by $6 billion and you are the Finance Minister, you do not leave a sense of confidence that you are managing the problem. It appears you are not even closely watching the problem. Mr Tanner you would have got closer to the number if instead of waving my media releases around in the chamber, you actually read them.

So Mr Tanner, if you are not watching our debt, who in the government is?

For more information, Jenny Swan

Office of Senator Barnaby Joyce,

Leader of the Nationals in the Senate

02 6277 3697

0438 578 402

jenny.swan@aph.gov.au

Comments