Good for his word. That’s Senator Joyce.

He pledged to never relent in reminding Australians that “if you do not manage debt, debt manages you” (Feb 2010).

Check out his latest and greatest attack on Labor’s melanoma-like growth in debt, in the Canberra Times (my emphasis added):

Forever in debt and Labor still ignores cost cuts

The Labor Party did something remarkable last week: it actually paid back some money after borrowing $11billion over the six weeks before. Our gross debt is now at $215billion. Unfortunately, Labor will probably borrow more again this week.

Recent statements by Penny Wong about cost-cutting and by the secretary of the Treasury, Dr Martin Parkinson, seem to accord with my fears of two years ago that we were taking on too much debt.

On October 21 , 2009, Australia’s gross debt accelerated through $100billion. This was before my unfortunately spectacular and brief tenure as Australia’s shadow finance minister. I was deeply concerned about the trajectory of our debt but it was very hard to find somebody else in government or the fourth estate that held similar concerns.

I remember the date well as I put out a media release at the time which concluded, ‘‘There are lots of ways you can try to pay debt but closing your eyes tightly and crossing your fingers has proven lately to be completely ineffective.’’

Leading the caravan of opprobrium against me was Treasury, acting as an arm of government. Repeatedly, it said Australia had no problems. It avoided that it was not the size that was the concern, it was the rate of growth, a very small active melanoma. We fell into trap of saying we are in a better position than others because our melanoma is tiny compared with theirs.

In a speech last week, Parkinson said ‘‘efforts to reduce government net debt should be the immediate focus’’. I’ll give him a tip, it would have been easier to control back in 2009. It has taken a couple of years, but now Parkinson and I appear to be on the same page.

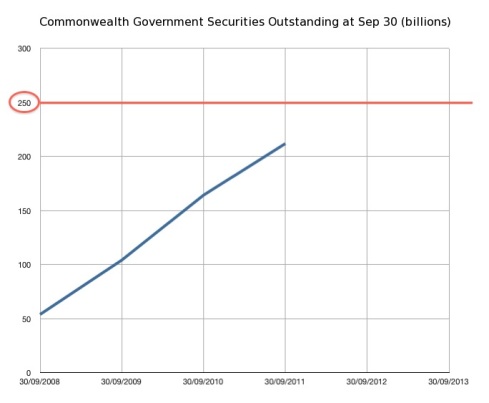

You can see Australia’s gross debt grow almost every week, like a Chia Pet, by visiting the front page of the Australian Office of Financial Management website. I imagine it is there because the people we borrow from want a fully transparent view of exactly how much we have borrowed. If you start hiding it they get very, very suspicious.

Everything is moving into unfortunate focus as we approach at a rapid rate our third debt ceiling under this Government’s watch, and Europe and America come to the realisation that the problem is debt.

To understand debt ceilings you must understand gross debt. On March 10, 2009, Treasurer Wayne Swan increased our debt limit from $75billion to a ‘‘temporary’’ level of $200billion. According to Swan, we needed this increase because China and India were going to ‘‘slow markedly’’ and the mining boom was ‘‘unwinding’’.

The mining boom didn’t, but we not only hit our new debt ceiling but it is now at $215 billion, or over $17,000 for every Australian taxpayer. Our next ceiling is at a quarter of a trillion dollars. This debt does not include state government debt (heading towards $250billion), the debt of fully owned government entities, such as the National Broadband Network, or the debt of local governments.

To make a budget based on blue, sunny days is not only fraught with danger, it is naive. It is the old adage of keeping money aside for a rainy day. School halls and ceiling insulation are not the only reasons we now have so much debt, it is generally just poor day-to-day cost management. Labor talks of budget cuts now but why did they ignore people such as Productivity Commission chairman Gary Banks and former Reserve Bank board member Dr Warwick McKibbin, who both said Labor should have been cutting spending two years ago?

Those with the purse strings either don’t have the strength, or don’t have the competency, to remain within our means. Labor’s cabinet is lacking the real business experience where what you bill or sell is what you earn, and the cheques you write over the long term better be less than that.

What happened to the $11billion that Labor borrowed in six weeks? Are there new aircraft carriers in Sydney Harbour with the Australian ensign fluttering? Is there a big new freeway somewhere that I am not aware of? Are there big new dams in Northern Australia delivering water to vast new agricultural areas to feed the world?

If you were to go searching for this money, the place I would humbly suggest you start looking is Canberra. Not the people of Gungahlin, but generally to the ministers who are in charge of departments that are just not controlling costs.

Barnaby is right:

There exist very few ways to subdue a state.

1. Militarily, but hey, how many times has some nutter tried this method over the centuries. Hitler, Genghis Khan, The Romans. It’s messy and it never lasts very long. People don’t like being pushed around.

2. Politically, as in a coup d’etat, but again, it’s risky for the instigators, and even if they pull it off successfully, sooner or later the people seem to get tired of being dictated to by some unelected bully in a flashy military uniform promisng elections “soon”.

Which brings us to…

3. Economically. Ruin a country (or an EU or a USA or Japan) economically by perverting it’s economy and citizenry with too much debt. (better yet, give it a debt based monetary system right from the get-go) Combine this debt with a gradual corruption of the population with too great a reliance on a Welfare State to be fed, clothed and shelterer by the State, eh voila!!

While the citizens are being brought to their economic knees, continue increasing costs, making outrageous promises, and make sure that all your policies are aimed at reducing national productivity (industrial,agricultural) AND making business/living more costly. (Carbon Taxes, etc).

Set and forget. Once these policies are set in motion, take as many junkets at the taxpayers expense as you can, look imperious as often as possible, receive foreign dignitaries on their way through to set up new military bases, and wait for the inevitable outcome.

And not 1 in a 1000 of us can see how it’s done.

Barnaby can! It’s the debt stupid…… It’s always the debt…..

The only argument in our household is whether it is deliberate or not. The problem I have with deliberacy is, to what end? You ruin the country, then what? What do they do then that they aren’t doing to us already?

Australians are suckers for gradual change, but no revolutionary change will ever get past. As bad as the Carbon Tax is, they could do far worse. What they get now is control. That appears to be the end, unless someone can argue for a greater desire for them than control.

To what end? I do not know, but I suspect that the plan is to promote national debt so that UN and the World Bank can take total control of formerly independent nations.

Something strange is happening in economics:

Where does the World Bank get funds to loan major cities?

http://www.physorg.com/news/2011-06-mayors-climate-world-bank.html

How can the UN promise $100 billion annually for research on climate change?

http://www.physorg.com/news/2011-11-ubc-billion-annual-climate-aid.html

Where is the money coming from while individual nations are going bankrupt?

Oliver K. Manuel

Former NASA Principal

investigator for Apollo

http://www.omatumr.com/

“…suspect the plan is to promote national debt so that UN and the World Bank can take total control of formerly independent nations.”

Correct.

Thanks, Blissful.

But from where does the World Bank get funds?

Like all Central Banks, I would imagine the World Bank too simply “creates” the money out of thin air (a few taps on the keyboard). The vast majority of “money” does not exist .. it is just electronic digits in a computer owned by unimaginably wealthy folks who We-The-Sheeple have foolishly granted the exclusive power to “create” money and loan it to us. At interest.

Or, as per the IMF, it gets its funding from “the international community”. Meaning, from the Central Banks of contributing countries (esp. the USA).

And where do those Central Banks get the money? They create it out of thin air.

Hi do you remember that the World Bank announced in June that if carbon trading didn’t get sufficient infusion of funds, it would crash (Again?) And that the world temps would go up 3 – 4 C in the near future. They must be worried.

We’ll all sink together it seems into the quagmire of human delusion, while the bankers of the world get rich and capitalism takes on a new control of the futures of people.

In someways you can now understand why communism or socialism takes over in places where the division between the rich and others is so great it causes revolution. Really we are just well off serfs. At the moment. Just that we have removed our collars. Now if the banks suddenly call in mortgages, we’d be all on the streets or forced to find new higher interest funds to cover the former ones.

The J curves of debt around the worlds governments are looking much more scarey than the J curve of climate change which just doesn’t seem to want to kick in yet. Generally people in democracies behave like frogs if you just increase the temperature slowly you can boil them alive so we need politicians like Barnaby to keep telling people this.