Finance Minister Lindsay Tanner has demonstrated yet again that he is a liar and a fraud:

Lindsay Tanner today accused the Opposition of punching a $2 billion hole in the budget after it helped defeat a means test on the private health insurance rebate last night.

“Tony Abbott and the Liberal Party are blocking almost all the government’s major initiatives in the Senate these days,” Mr Tanner told ABC radio.

“We faced a huge budget problem as a result of the global financial crisis. We have to repair the damage to the budget and we have to get the budget back into surplus as quickly as possible.”

“Yet he’s punched a huge hole in our savings initiatives that are designed to get the budget back into surplus quickly.”

In a recent column for the Sydney Morning Herald, ironically and hypocritically titled “Dishonesty in the debt debate”, Lindsay Tanner wrote:

Why are we going into debt? Because the global financial crisis punched a huge hole in our projected revenues, and forced us to act to support the economy and to sustain jobs. Had we just sat back and watched, as our opponents seem to suggest, we would have seen unemployment rise dramatically. That would have reduced tax revenues even further, and thus pushed us into deficit anyway… The Rudd government had no choice but to intervene to protect Australian working people from the ravages of the crisis. The dishonest campaign about debt being prosecuted by our opponents should be seen for the fraud it is.

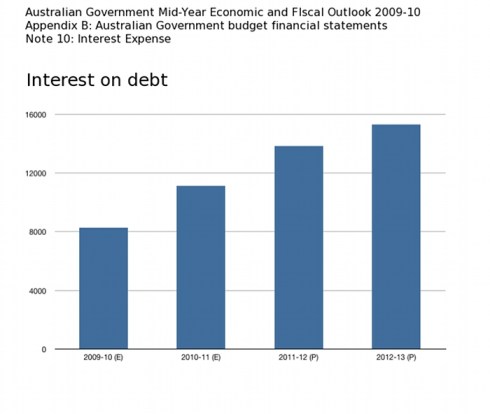

Tanner’s claim that the GFC “punched a huge hole” in the government’s projected revenues, is an outright lie. And I will prove it to you, from the government’s own Budget documents.

The real reason that Rudd Labor faces a “huge budget problem” is not a result of the global financial crisis. Instead, it is entirely a result of their panicked, monumentally incompetent response to the idea of a GFC.

The simple fact is this: Contrary to Tanner’s recent claim, and Labor’s shrill proclamations throughout 2009, the GFC barely affected Australian government revenues at all. The “huge budget problem” is entirely of the Rudd Government’s own making. Because their team of uneducated economic illiterates panicked, and went on a massive, unnecessary spending binge. And now they are lying to cover up that fact.

Want proof?

Take a look at the Government’s 2009-10 Budget, Statement 10, released in May 2009. It shows that Government income (“Receipts”) was estimated to be down by just $7.8bn (2.7%) on the previous year –

Continue reading ‘Tanner Lies About Budget, GFC’

Tags: barnaby joyce, budget, Commonwealth securities, debt and deficit, FHBG, FHOB, foil insulation, lindsay tanner, sovereign debt, stimulus spending

Comments