This Little Goose Went To Market

With the Budget coming up, let’s take a look at how well the government has been managing our >$189 billion gross national debt “investment” portfolio.

The Australian Office of Financial Management’s (AOFM) official Overview of the Portfolio document makes for interesting reading (click images to enlarge) –

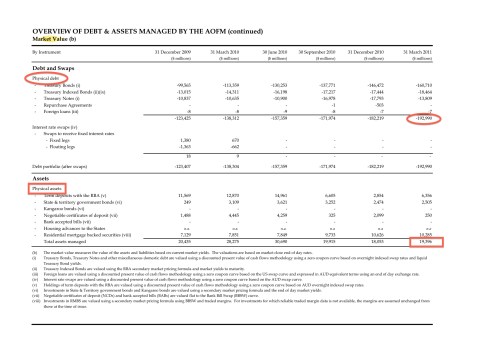

AOFM Portfolio Overview - Face Value

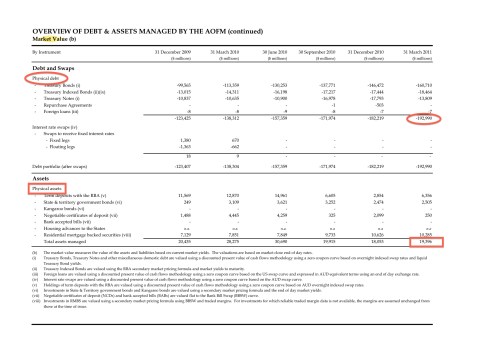

AOFM Portfolio Overview - Market Value

Note the difference at 31 March 2011 between the Face Value, and the Market Value, of the “Physical debt” and the “Physical assets“, respectively.

The Market Value of the debt in “our” national portfolio is now greater than the Face Value, to the tune of $7.9 billion. And the Market Value of the assets in our portfolio is now $3 billion less than the Face Value.

Notice also the standout feature – that our portfolio is being taken ever deeper into the red. To the tune of $15 billion (15,000,000,000) every 3 months, through end September last year. And by a further $23 billion (23,000,000,000), in just the last 6 months.

Seems someone forgot to tell Wayne Swan that the GFC peaked 31 months ago, in September 2008. And, that there is an ongoing and worsening European debt crisis, the US has been placed on negative credit outlook for the first time in history, and the World Bank President has warned the global economy is “one shock away from a full-blown crisis”.

Wayne must be oblivious to all this. Because this month he authorised the AOFM to “invest” up to $4 billion more in Residential Mortgage Backed Securities (RMBS) – yes, those things that blew up America’s financial system. Read the detail at the AOFM website, and you’ll see our Swanny is even happy to “invest” more borrowed billions in RMBS’ that hold Low Doc loans exceeding 10% of the initial principal value of the security pool. Seems he’s never heard of “sub-prime”.

Oh yes, and to pay for these – and the ongoing mega-billion NBN disaster – he’s all set to borrow even more hundreds of millions at the end of next week.

Would you want this Goose managing your investment portfolio?

Bring on an election!

Roast Goose

Tags: AOFM, debt and deficit, GFC, government bonds, stimulus spending, wayne swan

Comments