From China Daily:

China’s real estate industry is in an “undisputable” bubble with its skyrocketing property price fermenting an imminent structural inflation that might hijack the country’s booming economy into violent fluctuations, a high-ranking official said on Wednesday’s Beijing News.

“The over-speedy price hike is evident of an undisputable bubble in the property market, which is a major propeller behind the current inflation,” said Yin Zhongqin, deputy chairman of the Financial and Economic Affairs Committee of the National People’s Congress.

Famous international financier George Soros has said that he is “very cautious” on China.

Last week, former IMF chief economist Professor Ken Rogoff predicted that the China bubble will bust “within ten years”, sparking a regional recession and hammering commodity exporters.

Despite measures being taken by the Chinese central authorities, leading authorities on Asian economics say that the China real estate bubble cannot be cooled, as it is being driven by trillions of dollars borrowed for speculative, leveraged investments by local municipal governments.

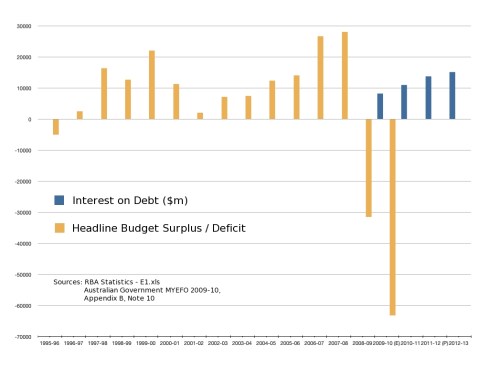

In Australia, our economic authorities are again asleep at the wheel, having confidently predicted a “Golden Age” of “unprecedented prosperity” from a multi-decade mining boom.

Barnaby is right.

Comments