Yesterday, RBA Assistant Governor Guy Debelle indulged in some MOPE.

Management Of Perceptions Economics.

Lies, deceit, and propaganda, in other words.

But for those with an ear to hear, and an inclination to check the “authorities'” claims, what he really did – unintentionally – was to give us a heads up.

That our Too Big To Fail banks (TBTF) are going to get bailed out, sooner rather than later.

Go grab a modest quantity of your favourite beverage, and settle in. You are about to learn – in detail – why we cannot trust a word the banksters say.

Ready?

Now as expected, the mainstream press all lazily parrotted the “everything’s fine, move along, nothing to see here” headline that Mr Debelle wanted. Here’s a good example, from the nations’ “premier” newspaper:

Australian banks safeguarded from Greek debt crisis, says Guy Debelle

Our standards are more rigorous here at Barnaby Is Right.

Let’s critically examine what Mr Debelle actually had to say in his official Address to Conference on Systemic Risk, Basel III, Financial Stability and Regulation (emphasis added):

Today I am going to talk about a few interrelated issues concerning the banking system: collateral, funding and liquidity.

The financial crisis brought into sharp relief the liabilities side of a financial institution’s balance sheet, that is, the funding structure. This had previously been somewhat neglected, but the fates of Northern Rock, Bear and Lehmans were clearly affected by the nature of their funding. While their funding structure played a significant part in the downfall of those institutions, I would argue the ultimate concern was about the quality of their assets. The funding problems were symptomatic of concerns about asset quality.

The solvency of any bank first and foremost is a function of the quality and value of its assets. This is, of course, true of any entity, but it is particularly true for banks because of the implications asset quality has for liquidity and because of the leveraged nature of financial institutions.

The crux of my argument today is this: if I am a creditor of a bank, my due diligence should be spent mostly on assessing the asset side of the bank’s balance sheet in determining whether or not I will get repaid in full.

Exactly.

Now, in the classic British political satire Yes Minister, master of obfuscation and manipulation Sir Humphrey Appleby said that it is always best to “dispose of the difficult bit in the title; it does less harm there than in the text.”

And by beginning his speech with this quite correct and valid talk of asset quality – and then not examining those “assets” in any detail – this is the clever game that Mr Debelle has played here.

No doubt he expected that no one would actually bother to check the banks’ asset quality. They’d just take it on presumption, and Mr Debelle’s inference, that they’re fine. And indeed, none in the mainstream press have bothered to check.

So let us do just that, shall we? Let us assess our Australian banks’ all-important “asset quality”.

Just two days ago ( “Our Banks Racing Towards A ‘Bigger Armageddon'” ), we saw that our banks held a combined $2.68 Trillion in On-Balance Sheet “Assets” at March 2011. So $2.68 Trillion is the claimed “value” of their Assets.

Now, about Mr Debelle’s “ultimate concern”. The all-important “quality” of those Assets.

What exactly are these bank “Assets”?

$1.76 Trillion (65.56%) of these “assets” are actually loans.

That’s right – your loan is considered the bank’s “Asset”. They own you, as their debt slave.

$1.018 Trillion (57.84%) of those loans, are Residential loans.

That’s right – fully 38% of our banks’ Total “Assets” is the notional value of their loans given as mortgages.

Here’s a chart sourced from the RBA’s own data, showing the % breakdown of our banks so-called “Assets”:

Now, in light of the recent housing-triggered banking and debt crises in the USA, UK, Ireland, Spain, and many other nations throughout the Western world; and in light of the fact that our property market is widely considered “the most overvalued in the world”; and in light of the fact that our property market has recently suffered its biggest quarterly fall in 12 years; and in light of the fact that arrears on mortgage payments have spiked to a record high, in the same quarter as house prices had a record fall … do you really think that having over 65% of your “Assets” in the form of loans, with 38% in the form of home loans, could be considered as high “asset quality”?

In light of the fact that business failures have risen 25%, with more than 10,000 going under in 2010; and in light of the fact that a leading Australian businessman has said that Eastern Australia is in “deep recession” and NSW and Victorian manufacturing is “stuffed”; and in light of the fact that the only Australian economist to predict the GFC has recently said that we will “almost certainly” be in recession in the second half of 2011 … do you really think that having 24% of your “Assets” in the form of commercial (business) loans, and 4% in the form of personal loans, could be considered as high “asset quality”?

In other words, do you really think that having over 65% of your Total “Assets” in the form of loans to households and businesses, who are all increasingly vulnerable to (eg) cost-of-living pressures, loss of employment, house price falls, and/or a recession, could be considered as having high “asset quality”?

Don’t answer that yet.

There’s more to consider.

Our banks presently hold a staggering $16.83 Trillion in Off-Balance Sheet “Business”. That’s around 15 times the value of Australia’s entire annual GDP. And most of that Off-Balance Sheet Business, is in derivatives. The exotic financial instruments at the very heart of the GFC. These are the instruments of intergalactic-scale gambling that the world’s most famous investor, Warren Buffet, famously called “a mega-catastrophic risk”, “financial weapons of mass destruction”, and a “time bomb”.

(They are also the reason why it is the banking industry that is pushing so hard for a CO2 trading scheme. Because for banks, it means trading in a juicy new mega-market casino, with a whole new type of “derivative” – carbon permits).

Here’s a chart of our banks’ On-Balance Sheet “Assets” (blue line), compared to their Off-Balance Sheet derivatives “Business” (red line):

But wait, there’s still more!

Just 6 days ago, we saw the global head of HSBC’s foreign exchange division warn of “a bigger Armageddon out there”, in foreign exchange markets.

And just 5 days ago, we saw a warning given by Fitch Ratings that Australia’s banks are the “most vulnerable” to Europe’s debt crisis, due to their heavy reliance on wholesale funding from abroad.

In other words, whether it be Greece, Portugal, Spain, Italy, Belgium, or any of the other massively indebted EU nations embroiled in a debt crisis, when one (or more) of them finally does go under – an inevitability – our “safe as houses” banks will go under with them:

Now, yesterday Mr Debelle contradicted the HSBC and Fitch Ratings’ warnings. While admitting that Australian banks’ reliance on funding from overseas does represent a foreign exchange risk, he argued that there is nothing to worry about.

Why? Because, quoth he, our banks’ foreign currency exposures are “fully hedged” into Australian dollars (emphasis added):

If a liquidity issue were to arise around this funding, it is of critical importance that the foreign-currency denominated funding is fully hedged into Australian dollars, which indeed it is.

Now, that critical claim is one we should all take with a crate of salt.

Here’s why.

In supposed proof of his claim that our banks’ foreign exchange exposure is “fully hedged” into Australian dollars, Mr Debelle referred (in his speech’s footnote #9) to a paper that appeared in the RBA Bulletin, December 2009.

Doubtless no one in attendance bothered to check that old paper. Certainly, not a single journalist who reported on Mr Debelle’s comments in the mainstream press bothered to check first, and then report the truth.

But I did.

In that old paper, we see that the authors did claim that our banks had their foreign exchange exposure fully hedged.

Well … sort of.

Here is what they actually wrote. Note carefully the all-important weasel words (my emphasis added):

Summary

The 2009 survey of foreign currency exposure indicates that Australian institutions remain well hedged against the risk of sharp movements in the exchange rate. Australia’s foreign currency debt liabilities are essentially fully hedged into Australian dollars using derivative instruments…

Hardly a categoric affirmation.

And here’s the really crucial point. Mr Debelle’s referencing this paper in support of his claim is a nonsense – and thus, suspicious – simply because the data in that old paper is (obviously) now completely out-of-date!

Mr Debelle must know this. Because the RBA publishes its own statistical data for our banks’ derivatives exposure – and their most recent data is current to 31 March 2011.

Moreover, the data used in that old paper was sourced via an ABS survey – that is, it relied on the banks honestly reporting their true positions (!?!). And, the data was only current to 31 March 2009 – more than two years ago.

At that time, the banks’ admitted to holding a notional value of foreign exchange derivatives positions, allegedly for “hedging” purposes, totalling gross $2.802 Trillion:

Table 2: Residents’ Gross Outstanding Foreign Exchange Derivative Positions By counterparty, notional value, A$ billion, as at 31 March 2009(a) Counterparty Long foreign currency/short AUD positions Short foreign currency/long AUD positions Net positions (a) Positive values represent derivative positions under which the holder will receive foreign currency in exchange for Australian dollars at a predetermined exchange rate (that is, a long foreign currency/short AUD position). Negative values represent derivative positions under which the holder will receive Australian dollars in exchange for foreign currency at a predetermined exchange rate (that is, a short foreign currency/long AUD position).

Source: ABSResident 554 −554 0 Non-resident 991 −703 288 Total 1,545 −1,257 288

As you can see, the breakdown of our banks’ foreign exchange derivatives “positions” at March 2009, was Long foreign currency $1.545 Trillion, and Short foreign currency $1.257 Trillion. For a net Long position of $288 Billion.

And the counterparty to that $288 Billion Long “position” (ie, gamble) was … “Non-resident”.

Now, a few important points to consider.

Firstly, these 2 year old figures did not represent solid proof of a “fully hedged” foreign exchange position. And it certainly is not proof of that claim being true now, 27 months later, in June 2011! Instead, what it represented was a $288 Billion Long foreign currency position, at 31 March 2009. A net $288 Billion bet that foreign currencies would improve in value, compared to the Aussie Dollar.

Secondly, why do you think Mr Debelle would seek to reassure us that our banks’ foreign exchange risk is “fully hedged”, and back his claim by reference (in the footnotes) to a 2 year old, redundant paper – just 4 days after Fitch Ratings warned of the vulnerability of our banks to foreign exchange volatility, and 5 days after the global head of HSBC foreign exchange warned of “a bigger Armageddon out there” in foreign exchange markets?

[Hint: These days it’s euphemistically – and deceitfully – called “spin”, or a “smokescreen”]

Thirdly – and perhaps most importantly – as we saw just 2 days ago, at 31 March 2011 our banks’ gross foreign exchange derivatives position has grown (blown?) from the claimed $2.80 Trillion … to $3.98 Trillion:

Let us not even bother going into the huge question marks over this.

Including very basic questions. Such as, why did the banks report a $2.80 Trillion FX derivatives exposure to the ABS survey … when the RBA’s own statistics report that they had a $3.58 Trillion exposure at that date (see highlight in chart above). Or, the basic question of why did Mr Debelle fail to reference the current, and much larger, foreign exchange derivatives exposure of our banks.

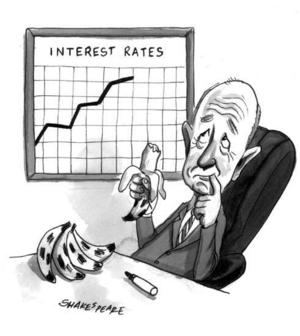

And let us not bother going into the even bigger questions (and dire implications) over our banks’ $11.68 Trillion exposure to Interest Rate derivatives – that’s the going-parabolic blue line on the above chart.

We’ve seen more than enough to know that Mr Debelle’s belated assurances about our banks are a sham.

It is my view that Fitch Ratings’ and HSBC’s warnings are most likely closer to the real truth.

And the reality of our banks’ extreme vulnerability, due to their off-shore funding reliance, their truly staggering derivatives exposure, and perhaps above all, their poor “asset” quality, is the real reason why Mr Debelle gave the speech that he gave yesterday.

Whether he meant to or not, the simple message for the wise and prudent to take away from (the inconsistencies, lies, and deceptions in) his speech is this.

He is essentially saying, “Don’t worry folks … our banks are going to fail … but the RBA can just print money to bail them out”.

Don’t believe that printing money is what Mr Debelle was saying?

Here it is in his own words:

As I discussed earlier, an Australian dollar liquidity issue can be addressed by the Reserve Bank. The Reserve Bank can meet a temporary liquidity shortfall by lending Australian dollars against the stressed bank’s assets denominated in Australian dollars.

Where does the RBA get its dollars from, in order to “lend” support to our soon-to-be-insolvent, imploding banks?

It creates them. Out of thin air.

Click click on the mouse button. Tap tap on the keyboard.

Just like all “independent” central banks.

And then lends those dollars, at interest.

As we have seen previously ( “Our Banking System Operates With Zero Reserves” ), thanks to the way our banking system is designed, printing more money is the only thing that the RBA can do in response to a bank insolvency crisis.

And as we also saw previously, that is exactly what they did do, in the GFC.

Welcome to the Grand Opening of our Zimbabwe Experience, dear reader.

Brought to you by your friendly “independent” RBA banksters, and their Big Four cronies.

A final thought.

It is particularly interesting that Mr Debelle was effectively reassuring everyone that the RBA is able to provide “liquidity support” (ie, money) for our banks in the event of their running into trouble with their wholesale funding from abroad.

What he did not mention, is that our government – that is, we the taxpayers – has provided both explicit and implicit support for the banks through the Government Guarantee Scheme For Large Deposits And Wholesale Funding.

(Indeed, when Moody’s recently downgraded the credit rating of our Big Four banks, they made it quite clear that if these taxpayer guarantees were not there, our banks’ credit ratings would be slashed by at least another two ‘notches’)

So, if Mr Debelle is arguing/reassuring that the RBA is able to provide liquidity support for our banking system, then why is the Australian taxpayer on the hook to backstop the banks?

And why did Mr Debelle not mention this very important fact in his speech?

As with anything involving the “unholy alliance of politicians and bankers versus ordinary people”, everything about this stinks to high heaven.

Comments