From Business Spectator:

This week is the one-year anniversary of the historic stock market rally which has seen US shares climb by almost 70 per cent – and we’re getting set to celebrate in style…

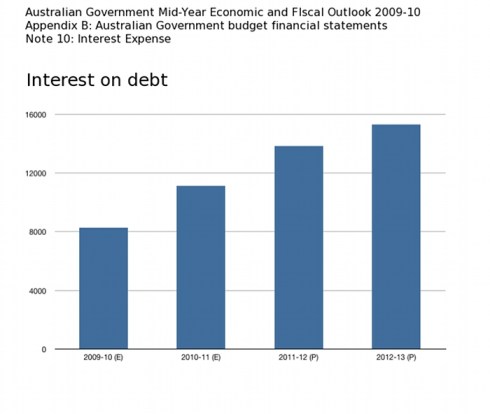

After all, what’s to worry about? Governments across the world are continuing to run massive budget deficits and interest rates are close to zero. The markets aren’t worried about the massive explosion in government debt, because they figure it’ll just mean that governments will have to keep interest rates at historic lows while they continue to pour liquidity into the system.

But while the markets continue to party, one dark thought presents itself. What happens if someone looks outside and sees that the real US economy is still in deep trouble? It is plagued by high unemployment, continuing weakness in the housing market, and faces mounting problems in commercial real estate that threaten to further destabilise the banking system.

What happens when the penny drops that massive government spending packages, combined with unprecedented money printing by central banks, have not produced a sustainable economic recovery?

As RBS strategist Bob Janjuah points out in his latest newsletter, the “gap between the fantasy in markets…versus the reality of the real economy/private sector, is already worryingly large, but risks becoming dangerously large.”

Janjuah says that there hasn’t been any sustainable recovery in private sector demand, and there won’t be for some years to come. Furthermore, there is nothing that can be done about it. Major economies can not generate growth by devaluing their currencies and trying to export their way out of trouble, because this is a strategy that everyone is using. All the big economies are trying to devalue and every country is looking to export. The problem is that there’s no obvious candidate to buy all these exports.

Janjuah also takes aim at those who believe that the massive build-up in government debt isn’t a problem because governments can simply erode the value of the debt through higher inflation. This strategy, he says, only works when inflation is unanticipated. When the market is expecting higher inflation, it pre-emptively prices in this risk of inflation in the form of higher interest rates. And already half the market is expecting to see governments try to inflate away their debts.

The other massive delusion that is buoying markets is that governments can keep pumping/printing/borrowing for long enough to compensate for the slump in demand from the private sector as it cuts back spending and tries to pay back debt. According to Janjuah, the time limits on this strategy are drawing nigh. “Those limits are pretty much already with us (Greece), or are soon to be with us, give or take a few months (in the United Kingdom), or at best, give or take a few quarters (in the case of the United States).”

The conclusion is inevitable; the bubble must burst. And Janjuah fervently hopes that that this happens sooner, rather than later. “The longer we are forced to wait, the bigger the bubble will be and the more horribly damaging the bursting process will be. And if we are forced to wait and the bubble gets anywhere like the one that went pop in late 2007 I have zero idea who will credibly be able to bail us all out the next time round. Certainly not our governments.”

Comments