Not only is our Treasurer unquestionably The World’s Stupidest Treasurer (“Wayne: OOPS! I Did It Again”).

The Assistant Treasurer wants his title.

From ABC Insiders (note carefully the emphasis added):

BARRIE CASSIDY: Now what’s happened to the budget bottom line? This promise to reach a surplus by 2012-13, will that now happen?

BILL SHORTEN: Well as our Prime Minister said, getting to a budget surplus is our objective.

And just referring to your earlier questions about the stock market and Australia and how we’re going, when you look at our public sector finance position in Australia compared to the Americans, the Europeans, we are doing very well.

Our net public sector debt at the moment is 7.2 per cent. Or to put it in plain English, if you as the Australian economy were bringing in $100,000 our net public sector debt is $7,000. Our interest payments are 0.4 per cent or $400 off a base of $100,000.

Oh dear.

This is not only the Assistant Treasurer.

This is also the Minister for Financial Services and Superannuation ( “Stealing Our Super – I DARE You To Ignore This Now” ).

As we saw with the RBA Governor, Shorten is either a liar, or a blithering idiot.

Or more likely both.

His “plain english” analogy is manifestly false and stupid.

And whether by accident or intent, it is inexcusably deceptive.

He is of course, obliquely referring to the preferred “standard” measure of government debt – “as a percentage of GDP”.

Regular readers (and Twitter followers in particular) will know my strongly-held views on the politically-convenient falsity of this measure. I maintain that it is a completely invalid (and deliberately deceptive) measure by which to assess government debt levels.

“GDP” stands for “Gross Domestic Product“, and is supposed to be a measure of the market value of all real “production” of the economy.

The reality is far different.

Rather than actually measuring the actual market value of what is actually produced and actually sold (that is, real products/services that are of real value), the methodologies used for measuring GDP are, to be blunt, fudges. Invented by ivory-towered #JAFA‘s, disconnected from reality, in high-minded belief that they are “approximating” the real world. In the end, what we find is that the “GDP” (and thus, the economic “growth”) figures that we are given, are really nothing more than the grand sum total value of transactions (ie, buying and selling) in the economy.

So, to use a simplistic example – Person A pays Person B $5 for something, and Person B uses that $5 to pay Person C for something; the “GDP” measure considers that to be $10 worth of “GDP”. Note well: nothing new has necessarily been “produced” here. The same $5 has simply churned from one person, to another, to another, in exchange for goods or services. But for the purposes of the false GDP measuring stick, that series of transactions is considered $10 worth of “GDP”.

[Importantly, if the bankstering system creates 5% more new money (credit, ie, debt) out of thin air this year, thus devaluing the buying power of the money already in the system, and as a result, next year the same transaction costs $5.25 from Person A to Person B, and $5.25 from Person B to Person C, then the total ($10.50, versus $10 last year) would be deemed notional “economic growth” of 5%. When in reality, there may still be no new real wealth “produced” in that example … just a churn of more (devalued) money.]

Now most of us would think it quite stupid for a household or a business to measure its debt against the grand sum total of all its buying + selling (or spending + earning). Instead, for budget purposes we measure our debt versus our income (or for Household Balance Sheet purposes, against our liquid, convertible-to-cash assets)

Likewise, when it comes to the national Budget, the Government should not be permitted to blur over and hide the truth of the issue by talking about the debts it accrues (for the taxpayer to pay back) as a percentage of all the buying and selling in the economy. Instead, it should be required to discuss the debts it accrues, as a measure of government debt versus government income.

Let’s consider a real world example.

In the 2009-10 Final Budget Outcome, we see the following:

2009-10 Final Budget Outcome, Part 1, Table 1

As you can see, the government’s income (Revenue) was $292.8 Billion.

It claims this was 22.5% of GDP. Meaning that the GDP calculation for 2009-10 must have been 292.8 / 0.225 = $1.3 Trillion.

Now, to use Shorten’s false, misleading and deceptive analogy, he would have us all think that the government was “bringing in” $1.3 Trillion.

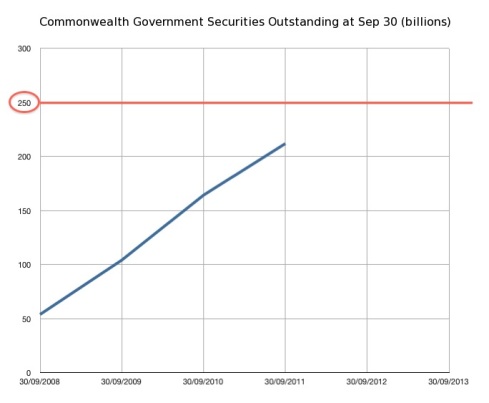

And so, he would have you focus on the totally irrelevant fact that the government’s net public debt was “only” 7.2% of that $1.3 Trillion churned in the economy (or approx. $94 Billion @ June 2010).

Convenient bit of perception management.

Because it doesn’t sound like very much, when stated that way.

But … what if you instead compare the actual public debt number, not to the $1.3 Trillion in transactions churned in the economy, but to actual government income?

Using the same 2009-10 example, $94 billion in net debt, versus $292.8 billion in total income (ie, 32%) sounds a lot worse, doesn’t it.

And most importantly of all, it is an honest way of expressing debt that is far easier for average voters to understand.

When you look at it this way, what you see is a very different picture of government debt.

Presented in these terms, it is like a householder who earns only $29,280 in income, with a net* debt of $9,400.

Once you pay for all your costs of living out of your $29,280 in income, that $9,400 debt is not such a “low” figure after all. Servicing the interest and paying off the debt principal is not so easy, as the deceitful politician would have you imagine.

Finally, did you notice the last sentence that Shorten uttered?

Our interest payments are 0.4 per cent or $400 off a base of $100,000.

By now I hope that you can see how false, misleading and deceptive that statement is.

You now know that his analogy is completely false – that the government is not “bringing in” $100,000 with which to pay interest on the debt. And neither is the economy – because that “$100,000” is simply the grand sum total of all the buying and selling in the economy. It is NOT a measure of income, or of available cash!

If Mr Shorten were honest – or, had a clue what he was talking about – then what he should have said is this –

“Our interest payments are 3.74 per cent or $13,095 off a base of (an estimated) $349,961 in Income for 2011-12 alone”.

Source: 2011-12 Budget, Paper No. 1, Statement 9, Table 1

Swanning around with false, misleading, and deceptive statements about our economy typifies the gross dishonesty of our political “class”.

It’s not good enough.

I suggest that it is high time for fundamental changes to our system of governance.

A good starting point would be for us all to fully wake up to the reality of the kind of self-serving, short-sighted, dishonest and immature scumbags who populate our Parliament, and demand a change to the rules concerning eligibility for running for public office.

I vote for a Parliament of amateurs – regular people – with no one under retirement age allowed to stand for election –

No More Mañana Or Bananas In A Parliament Of Nanna’s

* “Net” debt” is another misleading and deceptive way in which all our politicians (except Barnaby Joyce) prefer to describe debt.

Referring to public debt in “net” terms (rather than “gross”) is another example of politicians wilfully ignoring reality, in order to gild the lily and make their own piss-poor performance seem better than it is.

“Net” debt is (simply stated) the total of debt actually owed by the government (ie, Gross debt), minus the value of “financial assets” held by the government. Australia uses the OECD definition (emphasis added):

Government net debt comprise all financial liabilities minus all financial assets of general government. Financial assets of the general government sector have a corresponding liability existing outside that sector. The exceptions are monetary gold and Special Drawing Rights, financial assets for which there is no counterpart liability.

Monetary gold and Special Drawing Rights may be included as assets of the general government sector or they may be classified as assets of the central bank, at the discretion of the government.

Source Publication:

The OECD Economic Outlook: Sources and Methods.

It’s important to note the bolded phrase in that definition.

Because in choosing to use “Net” debt as the preferred figure to talk about in public, the government (no matter the Party) is wilfully deceiving themselves, and the community.

Gross debt is what the government owes.

Net debt is gross debt, minus the government’s financial assets. And with the exception of gold and SDR’s, those “assets” are someone else’s liability.

To use the politically-convenient “net” debt figure (because it is lower thus sounds better than Gross debt), a politician must count their chickens before they’ve hatched. That is, by implication they are assuming that the counterparty who is liable for the “assets” they are counting on, can and will actually make good on their liability.

The GFC which never went away is a perfect example of why you can never bank on counterparties.

The only honest way to look at debt, is the simplest way.

What you owe to others, is what you owe. You cannot bank on what others owe to you before you get it, as a false justification for claiming that your own debt burden is less than it actually is.

End of story.

Tags: bill shorten, insiders, net debt, public debt, wayne swan

Comments