Regular readers will know that I am an ardent opponent of the practice of usury.

In the classical meaning of the word.

Indeed, it is my view that the practice of usury is The Key to the power of the money-lenders.

While many others have argued that the key to their power is their exclusive right to create money (debt) whenever they make a loan, I tend to disagree.

In the absence of the legal right to charge interest (usury) on those loans, the money-lenders’ power would be effectively nobbled.

They could be replaced by full public banking. Or by alternate, free currency solutions like my own.

This key issue of the charging of interest on “money” lending, its origins, and its legal history, is awash with myths, theories, distortions, and outright falsehoods.

There are many eloquent and brilliant advocates for the alleged “need” for the charging (and offering) of a rate of usury on money. The theory of the so-called “time-value of money” is commonly cited in justification of what is, in truth, plain and simple parasitism –

Parasitism is a non-mutual relationship between organisms of different species where one organism, the parasite, benefits at the expense of the other, the host.

First used in English 1539, the word parasite comes from the Medieval French parasite, from the Latin parasitus, the latinisation of the Greek παράσιτος (parasitos), “one who eats at the table of another” and that from παρά (para), “beside, by” + σῖτος (sitos), “wheat”. Coined in English in 1611, the word parasitism comes from the Greek παρά (para) + σιτισμός (sitismos) “feeding, fattening.”

What I hope to do in today’s post is dispel some of the banking industry’s most powerful falsehoods. That the charging (and offering) of “interest” on money is normal. That, at worst, it is a “necessary evil”. That it is really something natural, and good, like a law of the universe, and vital to keeping our world turning.

I also hope to encourage readers to STOP using the banksters’ language.

And instead, to “call each thing by its right name.”

The original word used for the charging of interest on money … is USURY.

Usury does not mean charging “excessive” rates of interest.

The etymology of the word “usury” shows that it originally meant the charging of any interest, at all:

usury (n.)

c.1300, from Medieval Latin usuria, from Latin usura “usury, interest,” from usus, from stem of uti (see use (v.)). Originally the practice of lending money at interest, later, at excessive rates of interest.

How very convenient for the modern day money-lenders, that we have changed our language over the centuries.

No doubt with more than a little help from our “friends”.

In researching for more information on the origins of the word “usury”, recently I happened across an article published in the American Bar Association Journal, Volume 51, September 1965. It was written by a J.L. Bernstein, NYU Law School graduate and editor-in-chief of the New York State Bar journal. Following are some extended excerpts. It really is fascinating stuff.

But if you are tempted to leave before finishing, please do me one favour. Skip to the end, and read my closing observations concerning ancient Sumeria, the true origin of debt jubilees and New Year’s Eve celebrations, and the deeper meaning behind the Biblical story of Abraham.

Now, to the history of the legal case against usury (my bold emphasis added):

Background of a Gray Area in Law: The Checkered Career of Usury

Tracing the ancient and medieval history and development of usury, Mr Bernstein shows that at first it was any charge for the use of property, but later became only the charge of excessive interest on money. With the advent of our present consumer society, various procedures and methods of conditional selling have enabled what might otherwise be usury to escape illegality. It is time, the author suggests, to delineate what is fact and what is fiction in this shadowy world.

A CASE MAY BE MADE for usury as one of the oldest professions of man, yet the complexities of modern economic life “make fundamental a review” of the problem, as the late C.S. Lewis, Oxford and Cambridge don, scholar and theologian pointed out. The checkered career of usury cum interest is too long to detail here, but this mixed question of theology and law has always been a gray area for the courts – a veritable hodgepodge of legal decision, as this Journal once put it, with “no clearcut rationale”.

Even an elementary statement in a leading New Jersey case is questionable. The Supreme Court said: “Although the common law did not prohibit usurious exactions, our statutes have done so since 1738.” This view of the common law is challenged in Mark Ord’s authoritative Essay on the Law of Usury (1809), which states: “Usury in its strict and legal sense was always considered unlawful.” Likewise, Robert Buckley Comyn says: “Usury was in England an object of hatred and legal animadversion at least as early as the time of Alfred; and Glanville, Fleta, and Bracton bear ample testimony to the abhorrence in which it was held.”

All Interest Once Was Usury

At common law a usurious contract could not be enforced, and usury appears to have been an indictable offense, the punishment for it being fines and imprisonment. The fact is that from the earliest recorded times until the later Middle Ages even interest was forbidden by both canon and civil law, for interest then was synonymous with usury. Indeed, interest had no significant usage in English law until the statute of 21 Jac. 1, c. 17 (1624), although it had been employed in commerce, having been adapted from the Justinian Code of the Roman Empire.

The Lombard merchants, the principal moneylenders of medieval times, had made it a practice to charge a penalty on default, and the custom spread. Thus interest was not a charge for the use of money, but an exaction to make the creditor “whole”. In time it came to mean permissible usury, but it is noteworthy that neither the Old nor the New Testament recognizes this concept, except for the new Catholic edition of the Holy Bible (1954) which substitutes interest for usury and banker for exchanger.

Comyn describes the gradual transformation: “Usury was an offense which having first become odious from religious prejudices, at length became the object of political consideration, and parliamentary restraint. And as at first the taking of any profit upon money was denominated usury, so afterwards, when such profit was authorized by law, the profit was termed interest, and the illegal excess alone retained the odious name.” Thus usury began as malum in se, but at least from the time of Charlemagne in the ninth century (he considered all profit as “filthy lucre”), the secular arm had sought to reinforce the spiritual, making it also malum prohibitum. Speaking of the earliest English statutes, those of Henry VII (1487-1495), Coke declared that all usury was “damned and prohibited”. According to an ancient book of the Exchequer, entitled Magister et Tiburiensis, usury was ranked with murder as an offense.

But the general detestation was diminished by 37 Hen. 8, c. 9 (1545) which, while entitled “A Bill Against Usury”, tacitly legalized it to a maximum of 10 per cent per annum. This statute inaugurated the serviceable fiction that usury no longer meant any interest, but only excessive interest. As Ord puts it, this was the first English statute to “give any connivance to the practice of lending at interest”.

The statute still called usury “a thing unlawful”; it was an attempt at moderation, following the lead of the church. Earlier attempts to ban all interest had failed ignobly, but so did this new approach, and by 5 & 6 Edward 6, c. 20 (1552), repeal made interest and usury one and the same again. But this didn’t work, as before, and 13 Eliz. 1, c. 8 (1571) repealed the Edwardian edicts and revived the statute of Henry VIII. In order, 21 Jac. 1, c. 17 (1624); 12 Car. 2, c. 13 (1660); and 12 Anne, c. 16 (1713), toyed mainly with the rates, which went from a maximum of 10, to 8, to 6 and finally to 5 per cent in the statue of Anne of 1713. This is the one followed in this country. But the most common maximum rate of 6 per cent is derived from the Justinian Code.

The statute of 12 Anne, which served as a common model here, was abrogated 110 years ago in England by 17 & 18 Vict., c. 90 (1854). Therefore, the mother country has no general usury law today and interest of 48 per cent may be quite legal – even more, if the courts can be convinced. As H. Shields Rose puts it in his book, The Churches and Usury (1908), this was “the final capitulation of the state … as regards the maintenance of a legal maximum rate of interest in England”.

Note: The abrogation of this 183-year-old English law placing limits on the charging of interest, came just ten years after the privately-owned Bank of England was granted exclusive power to issue the nation’s banknotes (Bank Charter Act, 1844). Coincidence? I think not.

The etymology of usury is from the Latin words usa and aera, meaning “the use of money”. But both by ecclesiastical and civil law it was always held that usury could exist in nonpecuniary transactions as well. Many state statutes, following the language of 12 Anne, speak generally of “money, wares, merchandise, goods and chattels”. The Bible is more inclusive: “Thou shalt not lend upon usury to thy brother; usury of money, usury of victuals, usury of any thing that is lent upon usury.”

But courts that maintain that usury was not prohibited by the common law are on firmer ground if they mean thereby the common law as it was interpreted by the colonial judges here. Blackstone says that the common law of England consists of “That ancient collection of unwritten maxims and customs …”. Our early courts seemed to regard English authority on the subject so dubious, indifferent or contradictory that, without legislative enactment, anything by way of usury was legal. This led to such abuses that the colonists petitioned for action, and general usury statutes were adopted everywhere.

It is useless to deny that confusion abounded in the common law, for usury was no less a gray area and a hodgepodge of thinking then. Coke, for example, said that: “All usury is not only against the law of God [but] the laws of the realm, and against the law of nature.” But on another occasion he avers that what was actually forbidden was “biting usury”, i.e., unconscionable charges…

Note: It is your humble blogger’s firm opinion that, in a technological age where 97% of all “money” is no more than electronic binary code, mere digital bookkeeping entries, created at the click of a bankers’ mouse in the form of new debt, there is no question that ALL usury charges are unconscionable.

Genesis of the Problem Is of Ancient Origin

But if the common law is no less a puzzle than our decisional law, the trouble goes far back – to Holy Writ itself. Until the later Middle Ages all interest was interdicted, for it was abhorrent that money – “barren” as Aristotle and the inspired writers of the early Church had taught – should increase unnaturally while lying fallow. That a lender should profit in his own idleness and that a borrower should be charged even though he may have lost money in the transaction, both were intolerable. Indeed, the worst form of usury in medieval times is considered a most respectable practice in our own. This was the custom of paying interest from the day of the loan. Banks today not only pay interest “from the date of deposit”, but even from before, so that money deposited by the fifteenth of a month will draw interest from the first.

Note how the author first refers to “paying interest from the day of the loan”, then immediately switches gears to speak of banks paying interest “from the day of deposit”? This is a classic and oh so subtle mind trick, commonly used in justification of the practice of charging interest on lending. How so? By redirecting the focus of the argument on the fact that banks pay interest as well. It is a clever distraction, because what is overlooked, is that banks never pay more interest than they charge. As a so-called “intermediary” in the payments system of the economy, the banks achieve the easiest of profits. Not just because they charge more interest than they pay, which in itself would be a form of parasitism. But because they are not mere intermediaries – banks are able to create money (debt), and charge interest on it. Contrary to popular belief, banks do not simply lend out money deposited by other customers. See The World’s Most Immoral Institution Tells You How

We have come a long way in our view of the fertility of money. But, oddly, the statute of James I, which gave the word interest its first significance in Anglo-Saxon law, contained the proviso that “… no words in this statute contained shall be construed or expounded to allow a practice [of charging interest] in point of religion or conscience”. But what did morality actually hold? That is the most vexatious of all inquiries.

The Fifteenth Psalm is clear without cavil: “Lord, who shall abide in thy tabernacle? Who shall dwell in thy holy hill … He that putteth not out his money to usury…”. Throughout the Bible the angry prophets denounce what the early theologians called “horrible and damnable sinne”. But there are also loopholes born of contradiction, and the frustrations of the moralists came to be visited upon the jurists.

Although the quoted passage from Deuteronomy forbids all usury, the next verse is most tantalizing: “Unto a stranger thou mayest lend upon usury; but unto thy brother thou shalt not lend upon usury…”. What does this mean?

Indeed. There is much that can be said, and much evidence raised, in answer to that question. But we will leave that particular controversy for another time.

From Biblical times until the later Middle Ages, a moneylender was simply a usurer, and a banker an exchanger. The distinction of moderate usury, called interest, received no recognition in the Church until after the Reformation. In a sense, therefore, the liberalization of religious thought also marked the turn to the “Money Society”, in which the medium of exchange achieved the status of a commodity of intrinsic value and became the lifeblood of commerce. The burgeoning materialism of the age, trading on the discovery of the New World, was in a mood no longer to tolerate philosophical and religious thought treating money as “infertile” and profit from it as “unnatural”, since it was not endowed by God or nature “with genital and procreative faculties” in the words of St. Basil (fourth century). In the end, it was the lawgiver, Justinian, who prevailed, rather than the philosophers and theologians.

And there you have it. What has ultimately prevailed with respect to usury, is the code of man. The Corpus Juris Civilis of the “lawgiver”, Justinian, a ruler of the late Roman Empire (c. 529AD), are the foundational documents of the Western legal tradition. It is ancient Roman law that serves as legal justification for the resurrected, and globally-dominating practice of usury in our day.

Theory of Moderate Usury or Interest Is Approved

This same logic, that there is nothing immoral about usury, was advanced in Parliament in the last century during the debates on the proposed abolition of the general usury statute of 12 Anne. “God did not so hate it, that he utterly forbade it”, contended one member; while another stated: “He could not have desired that the ban against all usury should be of moral and universal application”, for the Bible did not so clearly provide. An economist with the United States Treasury Department even advanced the view that usury could be traced “to the Creator Himself”, who first caused “all things to grow and increase”.

Nevertheless, that the total prohibition of all interest was at the center of canonist doctrine until the later Middle Ages is clear. “Not until sixteen hundred years after Christ did interest find any defenders”, proclaimed Roger Fenton. Then it was the Church which led the way to its acceptance, and the State which followed. Two principal reasons may be advanced for it: (1) the growing power of economic forces which chafed under enforced unselfishness and (2) the equivocations of Scriptures which encouraged the casuistries of “permissible instances”. Ultimately, perhaps, it was a hopeless struggle against human cupidity, or maybe only against “progress” for it is unlikely that, no matter what position it assumed, the Church could have stemmed the tide that was running.

Assailed on either side by those who, like St. Basil, called usury “the last pitch of inhumanity” and those who found it out of harmony with the facts of life, the Church sought to steer a middle course. Since its primary object has always been to protect the weak against the economically strong, it saw justifications for exceptions in commercial transactions between sophisticated parties.

“Sophisticated” parties? Now where have we heard that justification used more recently?

Moreover, on the allegation that, after 16 centuries, the Church succumbed to the pressures of economic greed and “progress”, it behooves one to point out that, in doing so, its ecclesiastical leaders and learned theologians all managed to lose sight of the simplest teachings of their own namesake, The Christ:

“No one can serve two masters: Either he will hate the one and love the other, or he will be devoted to the one and despise the other. You cannot serve God and money.”

It is this blogger’s view that the vast, unfathomable wealth of “the Church” – the sheer obscenity of which induced a sense of nausea on his sole tour of the Vatican – stands as ample testimony to the identity of which “master” it has long chosen to serve.

“Interest”, laconically comments Roger Fenton, “is the brat of commerce.” By what Mark Twain would have called “theological gymnastics” the Church has been charged with acquiescing in contrivances and subterfuges; and its capitulation to usury – limited or otherwise – has been held to constitute a virtual abdication of the precept against avarice, a former “venal” sin.

The Church first approved the idea of interest as it originated in the Justinian Code, which implied a justified penalty on default, although it is likely that this in itself was a subterfuge to avoid the ban against usury. But theological approval of the dammum emergens, for actual loss incurred, was not satisfactory to business or its lawyers, who argued also for the lucrum cessans, certain gain lost. This the Church resisted for at least a century more, for it was not ready to concede that money, the love of which is “the root of all evil” in the Bible, was fertile. But in time it acceded to this, provided that the money was lent for an initial gratis period. Thus, technically, the interest was still not for the use of money, but as compensation for its nonreturn on the due date.

This attempt at charity led to an ingenious evasion. The grace period, accepted with high good humor in the market place, became a mere sham. The lenders merely fixed a due date so close that borrowers could not hope to repay by then, following which huge penalties were added. The evasion and the practice survive to this day, and the courts commonly enforce, after default, a rate of charge in excess of that permitted by general usury laws. It persists in “revolving” or “flexible” charge accounts, in which no charge is made if a bill is paid within ten days or so, after which interest (called a “service charge”) of 18 per cent is added.

But the Church never approved of lending to the poor in order to profit from their poverty, nor of such things as “consumer’s loans”, formerly called “consumptive loans”, a rather more descriptive phrase. Indeed, to lend for any but productive purposes or to engage in commerce except as a service to the community was still immoral. In 1515 the Lateran Council pronounced: “This is the proper interpretation of usury, when gain is sought to be acquired from the use of a thing not in itself fruitful, without labor, expense or risk, on the part of the lender.” The element of risk loomed larger in importance, but the Church having made distinctions, it was not long before the law of England followed suit. Within thirty years, in 1545, came 37 Hen. 8, the first statute to legalize moderate usury.

Today it is commonly argued that the charging of interest on loans simply represents a fair and reasonable “rate of return” to moneylenders, to compensate them for their “risk” in making the loan.

This is self-serving bunkum.

As we have seen previously, there is no labor or “risk” involved in the modern process of “money” creation and lending. It is simply typed into existence, as a new digital bookkeeping entry. And even when the moneylenders take their money debt-creation schemes to stratospheric levels, blowing asset bubbles that lead to the total insolvency not just of millions of common people, but of their own institutions – (eg) the predatory mortgage lending practices in the USA preceding the GFC – the government conspires with the bankers to make them “whole” again. In the modern era, it is perfectly clear and beyond refutation that the lending of money by the banking system is risk-free … for the bankers.

In closing this post on usury, there is one more piece of research I’d like to share.

Biblically-literate readers will be familiar with the story of Abraham. As the man chosen by God to be “the father of many nations”, he is a central figure in the history of three powerful world faiths and their billions of adherents. Indeed, they are named after him – the “Abrahamic” faiths of Christianity, Islam, and Judaism.

In the Genesis 11-12 account of Abraham, we learn that he lived in the region of ancient Sumeria (or Babylonia), in a place called “Ur of the Chaldees”. God told him to get out of Ur, and to go to a land that He would show him.

The Promised Land.

A metaphor for Heaven.

In David Graeber’s masterful work Debt: The First 5,000 Years, we learn a wealth of fascinating, myth-busting information on the true anthropological history of money, exchange, barter, and debt throughout recorded history. It is a “must read” book.

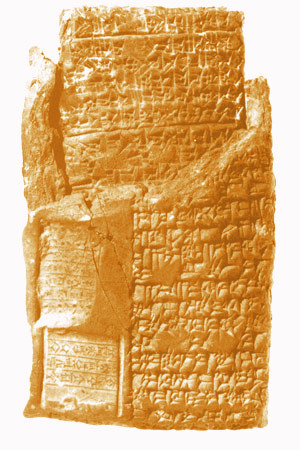

Many of us would be aware that the earliest written records of humankind are the clay tablet (cuneiform) writings from ancient Sumeria. The concept of a debt jubilee now being revived by Professor Steve Keen has its earliest origins in Sumeria/Babylonia, where actual “money” (eg, coins) was very little used; instead, the economy functioned almost entirely on a system of debts and credits, which (like today) were nothing more than bookkeeping entries, written originally on clay balls, later, on clay slates. The phrase “a clean slate”, meaning to have a fresh start or new beginning, has its origins here. New Year’s Eve celebrations also have their origins here – it was not uncommon practice for Sumerian kings to declare all debts annulled, to destroy all the records of debt and so begin with “a clean slate” in the new year; a cause for joyous celebration if ever there was one!

In chapter 7 of Graeber’s book, we also discover the meaning of the word “Ur,” from an early Sumerian dictionary:

ur (HAR): n, liver; spleen; heart; soul; bulk; main body; foundation; loan; obligation; interest; surplus; profit; interest-bearing debt; repayment; slavewoman.

I think there may well be a significance to the story of Abraham and his journey out of Ur to the Land of Promise, that is both far deeper, and far more practical, than most give it credit for.

Comments