A few days ago I wrote an article titled “The Real Reason Why Gillard’s A Spinster“. It ruffled feathers. Not for the intended reason, unfortunately.

Humourless critics were so rankled by my [insert self-righteous PC perjorative] that they did not see the point.

So here’s a follow up. Without the creative literary device/s for decoration.

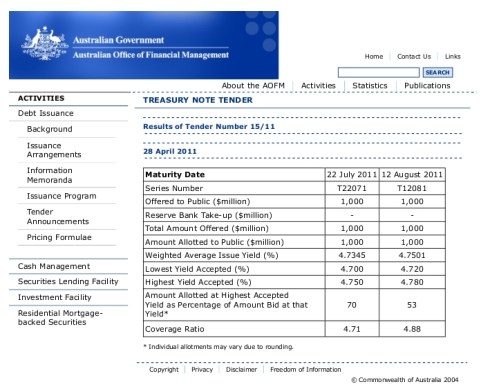

The following chart is an updated and extended version of the one used in the previous article. This shows Treasury Note auctions from 2000 through to end April 2011 (the previous chart began at March 2009).

The other difference, is that the previous chart listed each individual auction separately. It escaped my notice that there has been as many as 3 auctions p.w. in recent times. So this new chart sums the total of all auctions of Treasury Notes in a given week into a single bar on the chart (click to enlarge):

Source: Australian Office of Financial Management (AOFM)

Some key points to note.

Firstly, there’s clearly quite a difference between how much the Howard Government relied on short-term debt (Treasury Notes), compared with the subsequent Labor Government. The period when the largest block of Howard-era short term debt auctions occurred was through the year 2002 – coinciding with the 2002-03 global recession, which Australia largely avoided.

Secondly, for four (4) full years between October 2003 and the Rudd election win in November 2007, the Howard Government raised no short-term debt. Not one cent.

Neither did Kevin07. For 16 months. Until the GFC.

Thirdly, you can see clearly the period from March 2009 through around September 2009, during which the Rudd Government was regularly raising around $800m to $1,500m a week from short-term debt auctions. I assume that this reflects (at least in part) the government’s urgent need for cash to fund their “stimulus” response to the GFC. Stimulus 1 – $10.4 billion in cash handouts in late 2008 (goodbye 50% of Howard surplus). Stimulus 2 – another $42 billion in cash handouts and “nation-building”, beginning in … February/March 2009.

You remember. “Swift and decisive”. Rushed and bungled. $900 cheques to dead people. Electrifying foil insulation. Blazing pink batts. Rorted “green” schemes. Overpriced school halls. Literally billions more, to investigate and repair these Rudd-made disasters.

Finally, note the significant jump in both the frequency and the totals of short-term debt auctions, coinciding exactly with Ms Gillard’s rise to power. The fact is, she has presided over a $10.1bn (31.5%) increase in issuances of short-term debt in just 10 months, compared to the previous 12 months of the Rudd Government.

The big unanswered question that I have is this: WHY would a Gillard-led government suddenly need to bash the nation’s short-term credit card 31.5% harder than even the profligate Kevin Rudd did? After all, he had a GFC “stimulus” package or two to finance.

What is Ms Gillard’s excuse?

According to the government’s own budget records, we-the-taxpayers are already wearing an Interest-on-debt bill of more than $10 Billion per year:

MYEFO 2010-11, Appendix B, Note 10: Interest Expense

According to the AOFM, short-term Treasury debt is supposed to be used for financing “within-year”, daily cashflow requirements of the Government. And then there’s this official prediction:

Treasury Notes are not expected to make a major contribution to overall funding for the 2010-11 financial year as a whole.

Why has the Gillard-led government apparently been so incapable of planning their week-to-week expenses, that since that statement was published they have resorted to bashing the national credit card more than 31.5% harder than Kevin Rudd “needed” to?

The data supports the increasingly widespread view that the Gillard minority government is a shambles. They have no financial plan – even over the short-term. And so, from Day 1, have had to pull out the national credit card 31.5% more than Kevin Rudd, just to manage the week-to-week cashflow requirements of government.

One can only wonder just how much Interest-on-debt we will end up paying in total over the coming years.

While Gillard and Co comfortably retire. On mega-buck, index-linked, taxpayer-funded pensions.

Tags: AOFM, barnaby joyce, budget, Commonwealth securities, debt and deficit, debt bubble, GFC, julia gillard, sovereign debt, stimulus spending, wayne swan

Comments