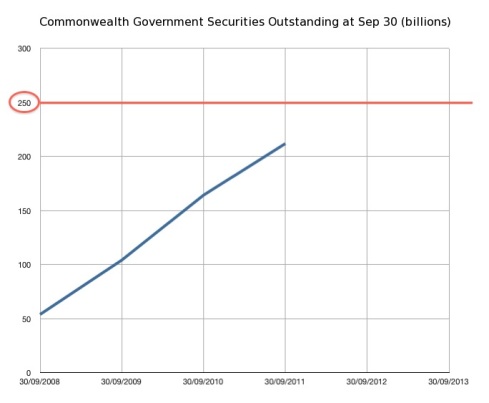

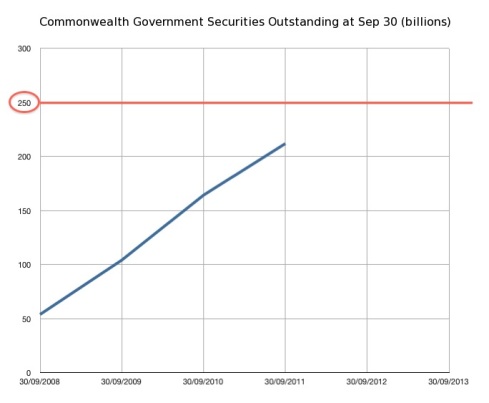

Click to enlarge | Source: Australian Office of Financial Management (AOFM)

Your humble blogger met Senator Joyce for the first time on 1 July this year.

On introducing myself and mentioning this blog, Barnaby’s very first words to me … were words of humility.

He immediately referred self-deprecatingly to his now-famous warning in late 2009 about the risks of rising US Government debt leading to “possible” default.

You remember. His was the warning that no one wanted to hear; that drew the wrath and mockery of Rudd, Swan, Tanner, Chris Bowen, then Treasury Secretary Ken Henry, and of course, all of our lamestream media economic “experts”. Ignorant, arrogant, foolish ridicule, that prompted the launch of this blog.

Barnaby was quick to volunteer that his warning about US debt was nothing special; rather, in his opinion it was simply obvious that the rising trajectory of US Government debt must eventually run smack into their debt ceiling.

As we all know from the early August kerfuffle over raising the US debt ceiling, a political crisis that threatened to blow up the world economy … Barnaby was right.

Since this blog began in early 2010, we have seen time and time again, that when it comes to matters financial, Barnaby is the only one on the ball.

Doubtless a big contributing factor is that he is an experienced Chartered Accountant, and not a lawyer cum union hack, or a career political hack with an Arts degree.

In May, for example, Barnaby was the first to rail against the Green-Labor minority government quietly sneaking in a budget provision to raise Australia’s debt ceiling by 25%, to a quarter of a Trillion dollars ($250 Billion). Even though no one is supposed to dare question Wayne’s authority:

As Treasurer Wayne Swan was congratulated by colleagues after Tuesday’s budget speech, Assistant Treasurer Bill Shorten introduced draft laws allowing the government to increase the amount it can borrow from $200 billion to $250 billion.

The proposed legislation would also remove a requirement that the Treasurer explain why the extra money is needed.

In recent weeks, Barnaby has upped the ante in continuing to make good on his pledge to never rest in pointing to the dangers of rising government debt. And fair enough too, when they’re continuing to borrow on the national “credit card” at a staggering rate.

Indeed, Wayne and Co have blown out our total Gross Debt Outstanding by over $7 billion a month in September and October, to a new record $215.6 Billion.

Which begs the question, “When will we run into our new debt ceiling of $250 Billion?”

That is, the new one Wayne set only 5 months ago, in May this year.

The chart above tells the story.

Our debt trajectory suggests that our Green-Labor government will bang into our new debt ceiling around mid-2012.

Unless something goes pear-shaped first, of course.

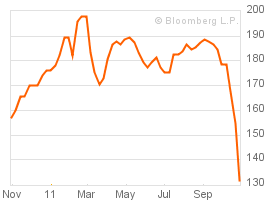

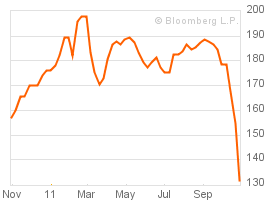

Like, say, a big fall in our Terms of Trade? Due to a big fall in the price of our biggest export, the iron ore sold to Chinese steel mills, perhaps?

Steel China Iron Ore Fines cfr main China port USD/dry metric tonne (MBFOFO01:IND)

Oops.

Like, say, a 32 month low in the latest measure of Chinese manufacturing? (h/t ZeroHedge)

China Manufacturing PMI prints at 50.4, down from 51.2, when consensus was expecting an increase to 51.8. This is the lowest print in 32 months, and the lowest since February 2009. But wait, before concluding that this is very bad news, uh, ahem… well, sorry, we haven’t taken the CNBC spin school yet. It’s bad news and the hard landing is coming. We leave the spin to the professionals.

Click to enlarge

Oops.

And there’s a lot more “oopses” where they came from. Including internal “oopses” … like Australian house prices and sales both falling … and the Reserve Bank starting to cut interest rates again; which means trouble’s afoot, and they are hoping their action will prompt you to be a complete idiot and start borrowing and spending like a drunken sailor Green-Labor politician.

Dear reader, the signs are all there that a real SHTF moment draws near once again, a la 2008.

Only worse.

Much worse.

Can you say “stimulus”?

Wayne can.

Do you think our government will stop spending more than they bring in from taxing us when they smack into our new debt ceiling?

Not if new Treasury Secretary and former student of US Federal Reserve chairman “Helicopter” Ben Bernanke has anything to do with it.

We already know his views on endless debt.

Here’s what happened back in June, when Barnaby kicked up a stink over our government jacking up Australia’s debt ceiling on the sly:

On Wednesday in Senate Estimates, our [new Treasury Secretary] Martin Parkinson was challenged by Senator Barnaby Joyce over this utterly incompetent and reckless Labor/Green government’s decision, just before the Budget, to sneak in new legislation to raise our debt ceiling too. By $50 Billion – a 25% increase. To a new all-time record debt level of $250 Billion.

Just like America. The only difference is the scale.

And what did Mini-me Parkinson have to say?

Nationals senator Barnaby Joyce wanted to know what would happen if the government was prevented from lifting its gross debt ceiling by a further $50 billion to $250 billion, as proposed in the budget.

“I couldn’t imagine that parliament would be so foolish,” Parkinson replied.

It would have “serious ramifications” for the operation of government.

So, dear reader, you already know what is going to happen in this country.

Green-Labor are firmly on course to bang up hard against our new debt ceiling, in 2012.

Even without another round or two of “stimulus” borrow-and-spending, to prop up the economy.

The all-knowing genius of Treasury Secretary Mini-me Parkinson will (of course) support the government in raising the debt ceiling even higher.

Our interest-on-debt bill of $1.59 million per hour will rise even higher.

And at some point … sooner rather than later, your humble blogger would suggest … the great external debt-driven forces of the USA, Europe, and/or China, will send the wave that collapses our own financial house of cards.

You can bet your falling house price on it.

“If you do not manage debt, debt manages you”

~ Barnaby Joyce, February 2010

Barnaby is right.

UPDATE: 12:41am

Ummmm, what was that I was saying? … “the signs are all there that a real SHTF moment draws near once again, a la 2008. Only worse. Much worse” …

Greek Prime Minister George Papandreou plunged the euro and stock markets back into crisis on Monday [evening, northern hemisphere time] with a shock announcement that he would put a hard-fought rescue deal to a referendum…

All of Europe’s main stock markets registered sharp falls at the new risk of Greek default and contagion, with the German blue-chip DAX 30 stocks index slumping by more than five percent, French shares were down over four percent and London’s stocks fell more than three percent.

Athens witnessed a meltdown as stocks plunged 6.31 percent amid warnings that a rejection of a deal that is deeply unpopular in Greece would force it to leave the 17-nation bloc which uses the euro single currency.

“This is a referendum, in which they’re effectively voting on Greece’s euro membership,” Alexander Stubb, the Europe minister for Greece’s fellow single currency member Finland, told the commercial MTV3 network.

In a sign of the deep unease in European capitals, French President Nicolas Sarkozy and German Chancellor Angela Merkel were to hold talks by phone.

Italian Prime Minister Silvio Berlusconi, another leader under pressure as a result of the eurozone crisis, registered his sense of shock and annoyance.

“There is no doubt the Greek decision to hold a referendum on the European Union’s rescue plan is having a negative effect on the markets,” he said. “This is an unexpected decision that generates uncertainties after the recent European Council and on the eve of the important G20 meeting in Cannes.”

Italian stocks plunged 6.12 percent, led by big falls for banks…

In an online commentary, the Moneycorp currency broker said Papandreou had presented Greeks with “the ultimate Hobson’s Choice”.”

“They could either have their financial eyes ripped out by austerity measures or by the chaos that would follow the total bankruptcy of Greece and the wipe-out of its financial institutions,” it said.

Nicola Rossi, an opposition senator in Italy, warned the mounting cost of borrowing for the government in Rome had the potential to further scupper attempts to safeguard the euro.

Under last week’s deal, the eurozone plans to increase the stockpile of cash in a bailout fund to some one trillion euros but many observers suspect that it will be an insufficient firewall if a country of the size of Italy collapses.

“The Greek government’s decision has unleashed havoc on the markets. It wasn’t very well thought through,” Rossi, an economist, told SkyTG24.

“The problem is that Italy is the weak link in the euro chain so we are under particular scrutiny.”

“We all know that when our borrowing rate is close to seven percent our debt risks becoming unsustainable. The situation is extraordinarily serious.”

And from Bloomberg:

Greece’s referendum poses a threat to financial stability in the euro region and increases the risk of a “disorderly” default, Fitch Ratings said. Papandreou’s grip on power weakened before a confidence vote on Nov. 4 as six senior members of the ruling party called on the prime minister to step down, state- run Athens News Agency reported, without citing anyone.

“The risk of a Lehman-style disorderly default now looms a bit larger than before, including some residual risk that Greece may leave the euro zone if it rejects the offer of orderly debt relief in exchange for harsh new spending cuts and reforms,” Holger Schmieding, chief economist at Joh. Berenberg Gossler & Co. in London, wrote in a note…

The cost of insuring against default on sovereign debt surged the most in almost four months with the Markit iTraxx SovX Western Europe Index of credit swaps linked to 15 governments jumping 29 basis points to 333 basis points. Contracts on Italy soared 46 to 498 basis points, France was up 16 at 192 and Germany climbed 10 to 94 basis points.

Tags: AOFM, barnaby joyce, commonwealth government securities, debt ceiling, debt default, government bonds, sovereign debt

Comments