With all the recent turmoil in Europe, and grave questions being asked over the solvency of the European banking system, perhaps it’s time to again ask the question – How safe are our Aussie banks?

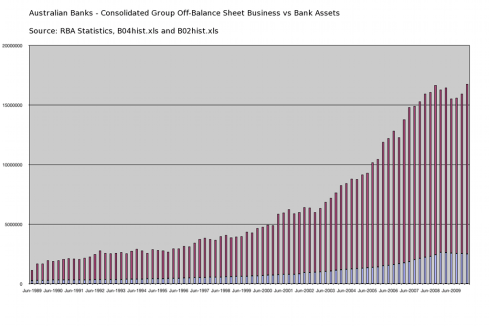

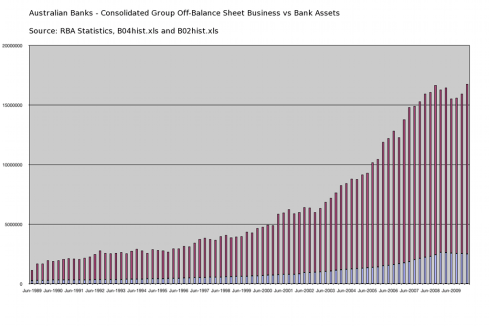

Back on March 4th (“Aussie Banks Not So Safe“), we saw that Aussie banks were holding $13 Trillion .. yes, TRILLION .. in Off-Balance Sheet “business”. By comparison, they were holding only $2.59 Trillion in on-balance sheet assets.

The latest RBA statistics show an interesting change.

Our banks’ Off-Balance Sheet “business” has blown out by a whopping $1.2 Trillion. It now stands at $14.2 Trillion (RBA spreadsheet here). That growth alone – in just months – is equivalent to the entire Australian economy.

By comparison, their on-balance sheet assets have only grown by $26.6 Billion, to $2.62 Trillion (RBA spreadsheet here).

The chart below shows our banks’ assets in blue, with Off-Balance sheet business added on top in burgundy (click to enlarge):

$14.2T in derivatives vs $2.6T in assets = MEGA-RISK

The vast bulk ($13.1 Trillion) of that $14.2 Trillion in “Off-Balance Sheet” business, is in the form of OTC derivatives. Specifically, it is in the form of Interest Rate and Foreign Exchange “swaps” and “forwards”.

What are derivatives?

Derivatives are the exotic financial instruments at the very heart of the GFC.

Back in 2003, the world’s most famous investor, Warren Buffet, famously called derivatives “a mega-catastrophic risk”, “financial weapons of mass destruction“, and a “time bomb”.

Our “safe as houses” Aussie banks are buried up to their eyeballs in the things.

UPDATE:

Alarmingly, it seems Australians are increasingly inclined to trust their savings with the banks.

From today’s The Australian:

Banks sit on record holdings as wary consumers save

The war for deposits has prompted Australians to save more than ever, driving the money on call at banks to record levels.

Australian households have lodged $461.8 billion with banks in June, up 8.4 per cent on the same time last year. It’s a trend underscoring the risk aversion that still exists among investors.

The major banks are the biggest beneficiaries of consumers’ flight to cash.

June data published yesterday by the Australian Prudential Regulatory Authority shows there is $1.266 trillion in deposits at all of the banks in Australia.

The amount is almost the size of the Australian economy, and a 3 per cent increase compared with June last year.

Most of the savings come from households…

Few Australians know that we had the beginnings of a bank run in late 2008. At the height of fear in the GFC, Australians quietly withdrew $5.5 Billion in savings to stash away under the mattress. A year later, only $1.5 Billion had been redeposited.

From The Australian:

The private banks keep reserves of cash distributed in 60 storerooms across the country with an average of about $35 million in each. They get topped up by the Reserve Bank before Christmas, when demand for cash typically rises by about 6 per cent, and at Easter, when there is a smaller increase.

But in early October, the Reserve Bank started getting calls from the cash centres for more, especially in denominations of $50 and $100.

The Reserve Bank has its own cash stash. It is coy about exactly how much it holds, but it is understood to be in the region of $4 billion to $5bn.

As the Armaguard vans worked overtime ferrying bundles of $10,000 out to the cash centres, the Reserve Bank’s strategic reserve holdings of $50 and $100 notes started to run low and the call went out to the printer for more. The Reserve Bank ordered another $4.6bn in $100s and another $6bn in $50s. It was the first time it was forced to do this since the Y2K computer bug scare in 1999.

Households pulled about $5.5bn out of their banks in the 10 weeks between US financial house Lehman Brothers going broke – the onset of the global financial crisis – and the beginning of December. That is roughly 80 tonnes of cash salted away in people’s homes. Mattress Bank is doing well, was the view at the Reserve. A year later, only $1.5bn had been put back.

Could it be that Aussies are now feeling a little safer about the GFC, and are starting to put their money back in our banks … at the very time the banks are loading up even more rapidly than ever on derivatives – those “financial weapons of mass destruction”?

UPDATE 2:

16 August 2010

Greg Hoffman of The Intelligent Investor explains the significance of Aussie banks’ derivatives exposure.

From the The Age:

Bank headlines you won’t want to see

‘Australian banks in half trillion dollar derivatives scare” is a headline no-one wants to read. And while it’s unlikely to ever appear, it is possible. So forewarned might be forearmed.

In Monday’s column I showed how Australia’s banks have far more in loans outstanding than they have in deposits.

Now it’s time to explore how that situation came to be and how the banks deal with the risks it presents.

…

The RBA’s figures show that as at March 2009 ”around 20 per cent of banks’ total liabilities were denominated in foreign currencies.”

This percentage has remained relatively stable over time, but the raw numbers involved ballooned through the credit boom, to the point where the banks’ net foreign currency exposure is more than $300 billion.

If the banks simply borrowed these foreign funds without doing anything else, then they’d have direct exposure to the notoriously fickle Australian dollar exchange rate. Their profits would be violently thrown around (soaring when the currency rises and plunging when the Australian dollar dives).

Yet the banks have produced a string of comparatively smooth profits, at least until the past couple of years. The RBA explains; ”Despite this apparent on-balance sheet currency mismatch, the long-standing practice of swapping the associated foreign currency risk back into local currency terms ensures that fluctuations in the Australian dollar have little effect on domestic banks’ balance sheets.”

Derivative trick

The trick involves the banks entering into hundreds of billions* of dollars worth of derivative contracts known as ”swaps”. These contracts represent an agreement to exchange interest rate and/or currency exposures for a set period of time.

* [Ed: Mr Hoffman badly underestimates here. The latest RBA spreadsheet B04hist.xls shows not mere “hundreds of billions”, but rather $6.7 Trillion in Interest Rate swaps, and $1.57 Trillion in Foreign Exchange swaps. So that’s $8.3 Trillion of the total $14.2 Trillion in off-balance sheet business]

Using such contracts, Australia’s banks can arrange a schedule of payments with another party that match off against their foreign currency-denominated debt. In this way, the banks know their exposure from day one.

Any gains or losses that arise on the loan due to currency movements are offset by an opposite result on the swap contract. That’s how a financial hedge is supposed to function and these contracts have worked nicely for our banks over the years.

Yet one of the expensive lessons taught so savagely by the crisis to financial institutions around the world is that arrangements that have worked smoothly in the past may not always do so in the future.

That lesson brought the business models of lenders dependent on securitisation to a screaming halt in 2007, when previously deep and liquid markets simply seized up. And at some point in the future, it might just pay Australian bank shareholders to have spent a few minutes today considering the risks they’re exposed to as a result of our banks’ reliance on offshore borrowings.

What’s the risk?

I suspect that few people fully understand how dependent our banks are on foreign debt and the mechanism by which they mitigate their exposure (through a series of swap contracts designed to insulate against currency and interest rate movements). And that brings us to the key issue.

Should future convulsions in the global financial markets send any of the institutions on the other side of these contracts to the wall, our banks would become more exposed to the harsh winds of the international financial markets.

This is the nature of ”counterparty risk”, a concept former customers of HIH Insurance came face to face with when that institution couldn’t make good on its financial contracts.

And if the past few years are any indication, the Australian dollar tends to fall in times of uncertainty. So the very conditions which might bring about the failure of the banks’ counterparties would be highly likely to coincide with a plunging Australian dollar: thus blowing out the repayments of foreign currency-denominated debts in local terms.

This is the nightmare scenario…

Indeed.

At the height of the GFC, the Aussie Dollar plummeted from a high of 98c (vs the USD) to just 60c. In fact, the RBA had to step in on multiple occasions and buy the Aussie Dollar on the open markets, just to defend its exchange rate value at the 60c level.

Given Mr Hoffman has so woefully underestimated our banks’ massive exposure to Interest Rate and Foreign Exchange derivatives, perhaps he should have opened his article as follows:

“Australian banks in 8 trillion dollar derivatives scare” is a headline no-one wants to read.

Tags: bank bailouts, banking crisis, derivatives, financial weapons of mass destruction, GFC, Lehman Brothers, off-balance sheet, OTC, too big to fail, warren buffet

Comments