Do not fear, dear reader. You are not about to be subjected to a boring, #JAFA-style lecture.

101 is just my shorthand for “1-on-1”.

Today we are going to compare notes. On the topic of carbon derivatives.

Whose notes?

The SMC University in Switzerland’s recent Working Paper titled, “Carbon Derivatives and their Application within an Australian context”.

And, excerpts from my numerous articles predicting and forewarning that the Green-Labor government’s Clean Energy Future legislation is nothing more, and nothing less, than a banker-designed carbon derivatives scam.

Let’s begin, shall we?

SMC Working Paper (page 8):

Risks involved with carbon markets and carbon-based derivatives are those that are typical to standard derivatives, including price, counterparty, credit, operational, spread, currency and liquidity. Again like any derivative, the value of a carbon derivative is based upon the value of the underlying commodity.

Compare Ticking Time Bomb Hidden In The Carbon Tax (Nov 2011):

[A “security interest in” a carbon unit is, quite simply, a derivative or “security” that is based on the underlying “value” of the carbon “unit”]

And compare Our Bankers’ Casino Royale – “Carbon Permits” Really Means “A Licence To Print” (July 2011):

The “creation of equitable interests”, and “taking security over them”, simply means this. The carbon permits can be used as the basis for bankers to create other, new financial “securities”.

Carbon derivatives, in other words.

Derivatives (or “securities”) are the toxic, wholly-artificial financial “products” that were at the heart of the GFC. The same bankster-designed “widgets” that the world’s most famous investor, Warren Buffet, spoke of as “a mega-catastrophic risk”, “financial weapons of mass destruction”, and a “time bomb”.

SMC University Working Paper (page 9):

Questions therefore arise as to how an odourless and colourless emission can be considered a commodity. For example, “…the commodity traded as ‘carbon’ does not actually exist outside of the numbers flashed up on trading screens or the registries held by administrators (Gilbertson & Reyes, 2009, pg. 12).”

Compare Our Bankers’ Casino Royale – “Carbon Permits” Really Means “A Licence To Print” (July 2011):

They are an artificial construct – “an electronic entry” – that is deemed by government decree to be a new “financial product”.

And compare Carbon Permits Do Not Even Exist (Aug 2011):

As I have said all along, the carbon permits will not even be printed on physical paper.

They will be electronic bookkeeping entries.

Electronic digits. In a computer.

It is yet another similarity with the completely farcical EU system, where over 3 million of these “permits” – which only exist as numbers in a “Registry” computer – were stolen between November 2010 and January 2011…

From our government’s exposure draft Clean Energy Bill 2011, Part 4, Division 2 (emphasis added):

98 How carbon units are to be issued

(1) The Regulator is to issue a carbon unit to a person by making an entry for the unit in a Registry account kept by the person.

(2) An entry for a carbon unit in a Registry account is to consist of the identification number of the unit.

SMC Working Paper (page 9):

With stark disparities in existence, how can countries come to accept as true fact the admissions made by another? Further, if countries have such different approaches, how can companies across nations be asked to trade an underlying commodity that has different measuring techniques!!! As highlighted by one paper, “…this makes putting a price on carbon largely an arbitrary exercise and uncertain as predicting a price of even the most mundane commodity is at best guesswork… (Gilbertson & Reyes, 2009, pg. 13).

Therefore, due to a lack of transparency and lack of a generally accepted approach on quantification and pricing, the primary concern with carbon trading is the ability of carbon derivatives markets to be manipulated.”

Compare Government’s RIS Admits Carbon Emissions “Audits” A Propaganda Exercise (Aug 2011):

… the question still remains – how are they going to measure the “emissions”?

Answer: They are not going to measure them.

They are not even going to audit any but a very few of the very largest “emitters” either.

It is all a hoax.

Just as under the present National Greenhouse and Energy Reporting (NGER) department “system” – one that only came up with 299 companies reporting emissions in their latest Report – the companies “caught” in the system will be asked to “estimate” their own emissions…

Let us take a look at the Government’s Clean Energy Future Regulatory Impact Statement.

It is yet another telling indictment of the total fraud that this carbon pricing scheme scam actually is (emphasis added):

“Under the proposed reporting requirements liable entities will report on their own emissions. As they will also have to acquire (buy) permits to cover these emissions, they will have an incentive to underreport their emissions… It is to be expected that most (intentional) misreporting would result in an underestimation of emissions and less permits being surrendered to Government. This would have implications for the accuracy of national emissions estimates…”

SMC Working Paper (page 9-10):

…one might argue that due to carbon-based derivatives being founded upon carbon emissions and ownership is via computerised notations, it would be difficult to manipulate such a market. In other words, like more typical commodity markets, influence the price of the deliverable up the supply curve.

Whilst that is a feasible argument, it needs to be also remembered that financial-based derivatives, such as treasury notes and bonds, are also based upon computerised systems where such price manipulation still occurs. This was recently noted in 2006, where the U.S. Treasury “…observed instances in which firms appeared to gain a significant degree of control over highly sought after Treasury issues and seemed to use that market power to their advantage (Forbes, 2006).” Hence, if markets can come undone so traumatically after pricing investments which contain apparently measurable levels of risk, difficulties will easily arise in how markets can price a commodity that can hardly be seen!!!

Compare Flash Crash “Had Something To Do With Some Derivatives”, Says Goldman Trader (Aug 2011):

… it is all about preparing the way for international banking’s latest casino – carbon dioxide futures and derivatives trading. A mega-casino with trading via the bankers favourite new toy, HFT (High-Frequency Trading) – advanced computerised platforms directly linked into the stock exchanges and able to execute fully-automated trades in under 10 milliseconds…

The government’s scheme is all about putting in place the necessary laws to allow banksters the legal right to create trillions of new carbon “securities” – that is, new carbon derivatives, and futures “products”.

The kind of “products” that lead to “flash crashes” which can wipe out 98% of the sharemarket value of one of the world’s biggest mining companies in less than 4 minutes.

SMC Working Paper (page 10-11):

It has been claimed that derivatives were a major contributing factor in the most recent Global Financial Crisis in 2008-2009, whilst also a causative in distorting energy and food market prices during 2007-2008…

Of course there has been much debate about the introduction of the Waxman-Markey Bill, much to the enormous potential it has in creating the next global financial crisis. For instance, according to Friends of the Earth, an independent organisation that aims for the establishment of environmentally sustainable solutions, “…the development of secondary markets involving financial speculators and complex financial products based on the financial derivatives model brings with it a risk that carbon trading will develop into a speculative commodity bubble. This in turn would risk another global financial failure similar to that brought on by the subprime crisis (Clifton, 2009, pg. 32).”

Compare Our “Squeeze Pop” Carbon Bank (May 2011):

And derivatives, well, they’re safe-as-houses too.

After all, the mortgage-backed derivatives market that blew up America is only a tiddling little market.

So there’s clearly no cause for concern about yet another bankster-driven scheme, to blow up a global, air-backed derivatives bubble…

And compare Doing God’s Work – Turnbull An Angel of Death Derivatives (May 2011):

To banksters, insurance companies, and superannuation fund managers, the possibility of your living “longer than expected” is considered a “risk“.

Nice.

And now, thanks to the sick, evil genius of global banksters like Goldman Sachs, this “risk” factor of you and your loved ones living longer than expected can be packaged up into a tradeable commodity.

A ‘death derivative’.

A new artificial “commodity” – exactly like “carbon permits” – that can be used to attract “investors” who want to place bets with despicable scumbag banksters like Goldman Sachs, on how long each securitised “pool” of human beings will live for…

…

Can you imagine just how many elderly (and not so elderly) people will suffer physically in the future, when current record-high electricity prices double?

From The Age, May 22 2011:

One of Australia’s largest home and business electricity suppliers, TRUenergy, has warned that household power bills will double in six years after a carbon price is introduced and uncertainty over its implementation might lead to power shortages.

That would be bad enough for older Australians. People just like your mum and dad. Your nanna and grandpa.

Imagine the impact on elderly folk in the much-colder Northern Hemisphere, where far more of the world’s total population lives. And where, right now, 44 million (about 1 in 7) Americans already depend on food stamps for survival. All thanks to the banksters’ GFC.

The effect of our allowing CO2 taxes / emissions trading to be enacted, is now very clear…

Thanks to carbon dioxide derivatives trading, more and more human beings will die earlier and earlier than “investors” in death derivatives have estimated.

Superannuation fund managers, insurance companies, “investors” and speculators will find that they have made the wrong bet on average life expectancies.

Meaning – the banksters will first make a killing on the trade in carbon dioxide derivatives.

And then make another killing on the trade in their new ‘death derivatives’ too.

Compare also, Bankers’ Chief – Carbon Price Is “Essentially Creating A New Market” (July 2011):

The carbon permits can be used as the basis for bankers to create other, new financial “securities”.

Carbon derivatives, in other words. Derivatives (or “securities”) are the toxic financial “products” that were at the heart of the GFC.

And compare most recently, Ticking Time Bomb Hidden In The Carbon Tax (Nov 2011):

Derivatives are a toxic, wholly artificial and unregulated financial product, created and traded en masse by the banks; they are held Off Balance Sheet so that noone really knows anything about their real activities. It was toxic derivatives over mortgages that nearly blew up the world in 2008.

SMC Working Paper (page 11-12):

Today, via the European Climate Exchange (ECX) and cleared through the Intercontinental Exchange (ICE), futures and options contracts are based upon three types of carbon-related units being European Union Allowances (EUAs), Certified Emission Reductions (CERs) and Emission Reduction Units (ERUs).6 Another derivative referred to as the European Carbon Futures (ECFs) contract, again based upon the EUA is traded via the European Energy Exchange (EEX)…

All contracts are standardised in respect to contract terms. Across either exchange, the futures contracts allow the holder the right and obligation to buy or sell 1,000 EUAs at a certain date in the future at a pre-determined price.

Compare what I said in Our Bankers’ Casino Royale -“Carbon Permits” Really Means ” A Licence To Print”, the day after the release of the draft legislation (July 2011):

Now, why have I bold underlined “borrowing“?

And why have I bold underlined “advance auctions of flexible price permits…”?

Because these are the key words from the “banking and borrowing” section. The words that tell you all you need to know.

That this SCAM is nothing whatsoever to do with the global climate.

And that it is 100% about creating a new, global, CO2 derivatives-trading market for the banksters.

The world’s biggest-ever financial cesspool.

Of toxic, intrinsically-worthless, humanity-raping financial “instruments” called derivatives.

Non-existent, digital “widgets”.

That can be borrowed from the future – ie, before these artificial carbon “widgets” are even issued – and leveraged by scum-of-the-earth banksters.

And then, traded by these parasites at multiples of hundreds and thousands of times more than the underlying, artificially-created “value” of the carbon permit.

Furthermore, the “advance auctions of flexible price permits in the fixed price period” proves beyond all shadow of doubt, that I was right.

That this “carbon pricing mechanism” is the bankers’ CPRS by another name. From Day 1.

Why does it prove it?

The advance auctions of flexible price permits “in the fixed price period” means this.

From Day 1, the government is effectively allowing the setting up of a futures trading market, for Australian CO2 permits.

Futures trading of nothing. Before the nothing is even created.

The banksters’ wet dream.

And compare Bankers’ Chief – Carbon Price Is “Essentially Creating A New Market” (July 2011):

The news gets even better for the bankers.

Because the Government’s scheme scam will also set up an “advance auction” system, during the so-called “fixed price period”, where carbon permits valid for the later “flexible price” system can be purchased in advance.

Which is essentially nothing less than a Futures trading system for the bankers and speculators to exploit…

It’s easy to see why the banksters’ are pleased right now.

The Government’s scheme allows them to:

1. Begin creating and trading in carbon “securities” (ie, derivatives of carbon permits) from Day 1.

2. Earn fees and commissions from trade in “freely allocated” permits during the “fixed price” period.

3. Earn fees and commissions from Futures trading in the “advance auctions” of “flexible price” permits during the “fixed price” period.

4. Create other derivatives products on top of the Futures trade in advance auctions of permits.

SMC Working Paper (page 14):

A number of submissions were made to the Australian Competition and Consumer Commission (ACCC), requesting that the permits within the current scheme be included as financial products. Yet counter submissions took a different route, with requests made by the Australian Bankers Association and Australian Financial Markets Association recommending that permits be regarded as commodities. Such arguments were made on the basis “…that traders are relatively uninterested in permits…”

Compare Ticking Time Bomb Hidden In The Carbon Tax (Nov 2011):

The fees and commissions on the straight trading in carbon permits … is peanuts.

The real monster action is in the unlimited, unregulated derivatives market, that sits on top of the basic carbon trading market. Just imagine an inverted pyramid, with the trade in carbon permits at the bottom, pointy end.

What the banks really want – and what this blogger predicted and forewarned of time and again leading up to the release of the draft legislation – is a mechanism that allows them to create and trade carbon derivatives.

In unlimited, unregulated quantities.

And compare I Was Right – Banks Begin Preparing Carbon Derivatives Market (July 2011):

ANZ’s head of energy trading said the value of the derivatives carbon market would dwarf the $10 billion initially raised by the government, according to the AFR.

SMC Working Paper (page 15):

It is therefore interesting to note that the scheme eventually allows freely allocated permits to be traded within the compliance year of issue. Such a statement seems to indicate a profit making opportunity not to dissimilar to the situation within the EU ETS, where power companies generated large profits. In a submission to the House of Commons by Ofgem, the energy and gas regulator in Great Britain stated that between 2008 – 2012, UK power companies could receive windfall profits approximately amounting to £9bn (House of Commons, 2008). Concerns are still being voiced about such astonishing revenues, with the European Commission further indicating that via the accumulation of excess free credits (i.e. freely allocated permits), “…the surplus is estimated to amount to 500 – 800 million allowances with an economic value of around €7bn – €12bn (European Commission, 2011, pg. 2).”

Compare A Disturbance In The Farce (July 2011):

… even the Green-Left Weekly is aware of the disturbance in the farce:

Europe’s biggest polluters have made billions out of the European Emissions Trading System (ETS). But a new briefing by Carbon Trade Watch (CTW) says the scheme will ensure industry will not have to cut its emissions until at least 2017.

The first phase of the ETS ran from 2005 to 2007. It made no dent in emissions. But power companies made about 19 billion euros by charging customers for the “cost” of permits they were given for free.

Manufacturers made about 14 billion euros in windfall profits with the same trick.

The European Commission said the scheme’s problems would be ironed out in the second phase, from 2008 to 2012. It claimed the ETS was working when emissions from the 11,000 polluters covered by the scheme fell by 5% in 2008 and 11.6% in 2009.

But CTW points out the emissions fall was due to the impact of the global recession, which caused a fall of 13.85% in industrial and electricity production in 2009.

In 2010, as the economic crisis eased, emissions shot up again by 3.5%.

The polluters stand to make more money for doing nothing in the ETS’s second phase. By 2012, power companies will make between 23 billion and 71 billion euros from passing on the cost of their free permits.

The third phase of the ETS, which will run from 2013 to 2020, won’t solve the problems. Companies will still be able to use the excess permits given out in the second phase. The World Bank has estimated about 970 million permits will be available.

This means polluters won’t have to cut their own emissions until 2017 — they can just cash in their free permits instead.

SMC Working Paper (page 15-16):

The Way Forward

Within the Australian context, what does this treatment of permits mean for carbon-based derivatives? With permits freely allocated to emitters and with the ability of permits to be price squeezed because they are allocated rather than auctioned, the possibility of carbon-based derivatives to be manipulated increases substantially. Such instances have been witnessed within the EU ETS and are one of the major criticisms levelled against derivatives as a whole (Clifton, 2009; Pirrong, 2009; Wood & Jotzo, 2010; Holly, 2011).

…

The maturity of the carbon market within Australia is still in its infancy and debate will continue about how the country should undertake its approach to CO2 emissions. At this early stage, it would seem that carbon-based derivatives will mainly be used once the fixed-price period begins…

[Compare what I have said countless times – that “our” system enables banksters to begin creating and trading carbon derivatives from Day 1. Our government has successfully conned the Australian public (and all mainstream commentators) into believing that their scheme is a fixed price “tax” for the first 3 years, and only after three years will trading commence. That is pure deception. While “purchased” permits cannot be traded, “freely allocated” permits can; and far more importantly, banksters are enabled to begin creating derivatives based on the underlying “value” of permits, from Day 1. The SMC Working Paper confirms my warning/prediction, as does the Clean Energy Future legislation itself.]

Globally, even though a mixture of regional policies are currently in existence or are looking to come online, inconsistent methodologies across countries make it difficult for a truly global acceptance of carbon derivatives to take off.

As such, the acceptance and establishment of any true global exchange or global central bank of carbon is some time away. Simply, this retains the odour of trouble, with increased opportunities for manipulation and failure. Whilst volatility and manipulation is in no means isolated to only carbon-based derivatives, “…due to the lack of policy towards the development of an efficient carbon derivatives market and the absence of a standard pricing tool (Leconte & Pagano, 2010, pg. 3),” greater opportunities for manipulation and fraud are present.

Exactly.

Which, as I have long said and demonstrated, is precisely what the true architects of both the Great Global Warming Hoax, and its popularly advocated “solution” (carbon trading), have always wanted.

A new, bigger, rigged, derivatives casino. One that they control. With no regulation, or government oversight.

A galactically-huge speculative financial bubble.

Based on thin air.

Hot, thin air.

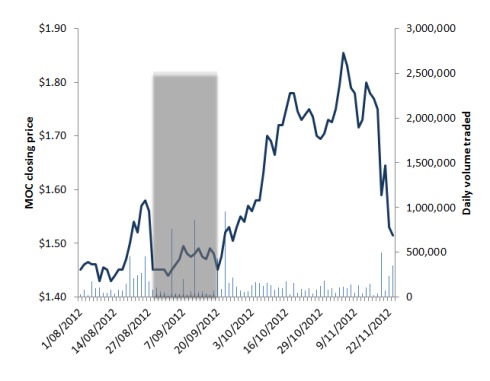

Guaranteed to end like this –

Next week, we will take a look at a webinar by the President of the Institute For Agriculture and Trade Policy on Carbon Derivatives: The Next Toxic Asset, where we will see how derivatives have been used by banksters to manipulate markets and drive up the price of other commodities. Especially food … wheat, corn, sugar, soybeans, and more.

And we will again consider the implications of allowing our politicians to allow greed-obsessed banksters to create wholly unregulated derivatives, thus enabling them to manipulate the prices of food (and now, power/energy) worldwide … and ultimately, as a direct result, to make yet another killing on those new ‘Death Derivatives’ they are selling, that we mentioned earlier.

Here’s a teaser –

Click to enlarge | Source: IATP

Click to enlarge | Source: IATP

Click to enlarge | Source: IATP

Click to enlarge |Source: IATP

Tags: banksters, carbon derivatives, CFTC, clean energy future, commodity speculators, fraud, Goldman Sachs, manipulation, OTC derivatives, speculation

Comments