Serendipitously discovered this during my cyber surfing this morning; a presentation “outlining massive fraud in the Australian listed investment company (LIC) sector”:

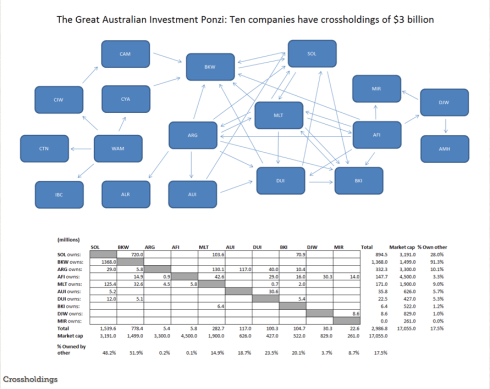

The Great Australian Investment Ponzi

The A$16 billion Australian listed investment company (LIC) sector has become one of the largest Ponzi schemes in history, surpassed only by Bernie Madoff and MMM.

For years, the dividends from the LICs have been financed by the LICs issuing shares, with the LICs thus paying their returns by seeking new investor funds.

The LIC’s manipulate their share prices by buying each other and themselves, in the process creating inflated reported net tangible assets (NTA).

The companies named include:

Washington H Soul Pattinson & Company Limited (SOL)

Brickworks Limited (BKW)

Argo Investments Limited (ARG)

Australian Foundation Investment Company Limited (AFI)

Milton Corporation Limited (MLT)

Australian United Investment Company Limited (AUI)

Diversified United Investment Limited (DUI)

BKI Investment Company Limited (BKI)

Djerriwarrh Investments Limited (DJW)

Mirrabooka Investments Limited (MIR)

Your humble blogger is not a shares guy, and so cannot comment on the veracity of this impressively comprehensive (85 page) presentation.

Perhaps readers with more knowledge of the subject would care to analyse and comment?

UPDATE:

Some excerpted highlights, for those unwilling to wade through such comprehensive details –

“LIC share manipulation is not performed for vanity alone, it allows the managers to perpetuate premium fraud. Premium fraud is committed by inflating the LIC share price beyond NTA and then issuing shares… Over the years premium fraud has netted the LICs hundreds of millions of dollars, at the expense of small investors, and ASIC has done nothing. Of the $1.6 billion in LIC shares issued between 2006 and 2012 a significant proportion has been lost due to this form of securities fraud. All the major LICs currently engage in flagrant securities fraud of this kind.”

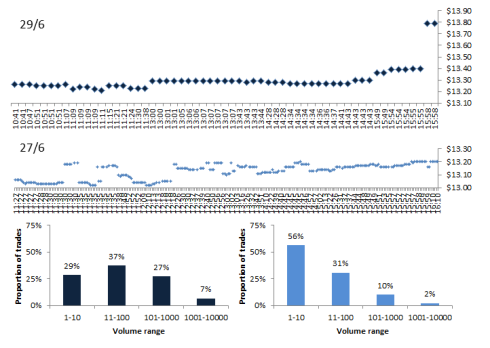

“SOL (Washington H Soul Pattinson & Co Limited) is one of the most manipulated shares on the ASX, and has been for years. SOL and its accomplice bankers have set up a fake share price, with the most common trade size being one single share. The manipulators can then ramp the price as they see fit…

This is a multibillion dollar company. On the 29/6 at 15:58, SOL was ramped 3% by HFT algos trading 5 shares.

Regulators, bankers, research analysts and financial journalists do not ask any questions, even after years of blatant fraud. In most cases they are incompetent, in many cases they are corrupt, and in some cases they have been silenced. The LICs can either buy off editors or sool lawyers on them.”

“The LIC managers have a cartel of crossbuying, with three beneficial effects for the criminals:

* The crossbuying ramps LIC share prices from true market values

* The crossbuying distorts reported NTAs from real asset values

* The crossbuying increases manager fee income and distorts reported fee incomeThe crossholdings allow the managers to charge multiple fees and hide it.”

“A cartel owns most BKW (Brickworks Limited) shares and controls the share price. The cartel openly ramps the share price after employee share plan issues, so insiders can cash out at a higher price. This is of course the very definition of insider trading. On the 3rd October, BKW issued a quarter of a million shares to employees at a consideration of $10.07. The cartel then ramped the share price 12%, to close at $11.25 on 5th October. It is clear they have given up any pretense and are now not even bothering to cover their tracks.

The bankers and analysts associated with these criminals are fully aware of what is going on, with the BKW scheme alluded to in internal communications, thus leaving proof of collusion in share manipulation and insider trading. These criminals are 100% confident in ASIC’s complete incompetence and impotence.

Granny investors buying BKW shares at the inflated price, perhaps under the misapprehension that ASIC does its job, can consider themselves screwed. If you think ASIC is doing nothing, you are wrong. Much worse, ASIC is endorsing BKW as non-manipulated to granny investors and is abetting criminals.”

“Some of the richest and most well-connected people in Australia are directly involved in the scam. The LIC managers openly refer to their industry as ‘The Gentlemen’s Club’, where goodfellas back each other up rather than honouring their fiduciary duty to investors. This cooperation is crucial for coordinating ramps, as defectors taking profits would crash a ramp before it even started. But the protozoan parasites have evolved an entire ecosystem:

1) Managers form cartels to buy each other and chosen manipulable shares

2) Lawyers cover up any mention of fraud using legal threats

3) Auditors sign off that inflated asset valuations are fair

4) bankers provide leverage for share price ramps

5) Brokers churn shares to create the illusion of liquidity

6) Stock exchange personnel advertise the scam and provide misleading statistics

7) Analysts are directly and explicitly bribed to shill the LICs

8) Journalists tout individual ramped stocks and the entire fraudulent industry

9) Regulators legitimize the scam and rubberstamp its abusesIn every single link of the chain, the LIC managers have close friends and accomplices, and these receive their rewards in the form of cash, insider tips and future appointments. The entire knot could be unwound with an Alexandrian solution: Ban LICs from ever again issuing a single share to granny investors. The goodfellas would of course apoplectically protest, as this would starve the ponzi of new cash inflows, and thus sound its death knell. But if they are such great managers and all outperform the market, why do they need to constantly beg for more cash?”

“The Australian government Future Fund recently revealed it had underreported fees, with investment fees actually totalling $1bn instead of $500m last year. The reason for this slight miscalculation of 100% was ‘non-consolidated investment vehicles’. If two investment vehicles own part of each other, and the Future Fund invests in them, part of the holdings will be charged fees twice. Sound familiar?

The geniuses at the Future Fund have discovered fee distortion from crossholdings… Of course this.. applies to the entire Australian superannuation and managed funds industry. Of $1.9 trillion unconsolidated assets in managed funds, crossholdings constitute $382bn or 20%.”

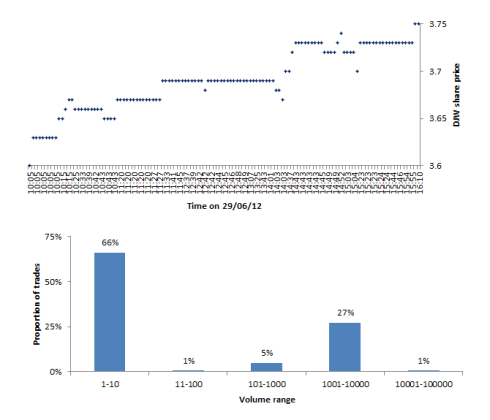

“Most of the LICs are now manipulating their share price with algo share trading. The reason for this is simple; the cost is low, the risk of apprehension zero, and the rewards considerable. The top chart shows DJW share trades on the 29/6/12, when the price was ramped from $3.60 to $3.75. The bottom chart shows the volume distribution of trades, illustrating how two thirds of the trades were for ten shares or less.

The share prices of the LICs are fraudulent, mere empty quotes put up by the managers themselves. In reality the LIC sector is insolvent and has nowhere near enough money to cash out investors.

The LIC sector has devolved into fraud along the lines of Stratton Oakmont. The only difference is that Jordan Belfort required hundreds of boiler room traders, whereas today with HFT trading the costs are much lower.”

“EQT (Equity Trustees Limited) has ramped LIC shares with its superannuation and managed funds, including EquitySuper products and the EQT Flagship Fund. The LIC crossholdings allow the same assets to be counted on several balance sheets, in a form of rehypothecation, and fraudulently inflates NTAs…

ASIC is well aware the the EquitySuper and EQT Flagship products are fraudulent with overstated NTAs and unit prices, yet helps cover up the fact the millions in super money has been stolen by a criminal crossramping cartel.”

“Managers of several Australian fund management companies have started using pension funds entrusted to them by granny investors to ramp their own share prices. This can either be done directly, by using funds under management to buy shares in the fund management company, or indirectly by using FUM to crossbuy with one or more other fund management companies. The managers then reap the direct benefit from own shareholdings and performance metrics related to their fund management company share price.”

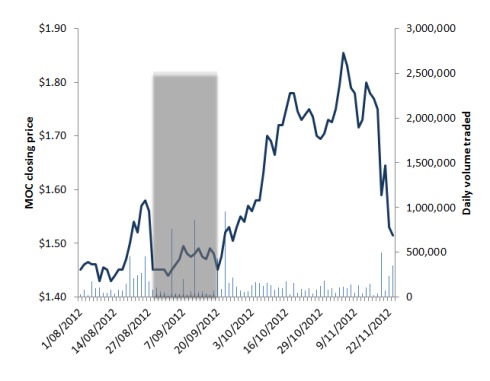

“Executive share plans can be used for ramping, as ESPs are allowed to buy the shares to be awarded to executives on-market. For thinly-traded shares or for shares with concentrated ownership, this allows the executives to ramp their own shares before they are awarded. The net effect is that insiders can off-load their shares to granny investors at a temporarily inflated price.

Between 28/08 and 20/09, the Mortgage Choice executive plan issued 2,500,000 shares to executives using options with a $0.76 exercise price. MOC was then ramped 30%.”

And much, much more.

Comments