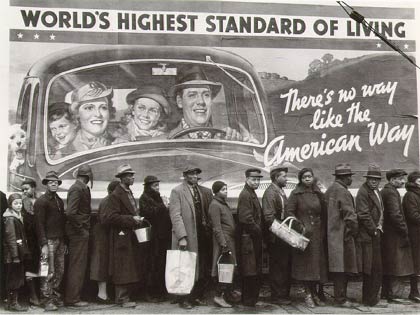

Caricature by Zeg | click to enlarge

My sincere apologies, dear reader.

I understand that you are probably a little concerned about the future for the economy right now.

If you own shares, then you are probably worried about last week’s bloodbath in global sharemarkets.

But I have a very important question to ask you.

It’s a bit of a reality check, I’m afraid.

Do you think your Superannuation “nest egg” is safe from the greedy hand of government?

If you answered “yes”, then …

I dare you.

I dare you to ignore the rest of this blog.

I dare you to ignore the fact that Senator Barnaby Joyce – the only Australian politician who foresaw and forewarned about America’s present debt nightmare – gave this warning on 5th May 2011:

In response to a question I put in Senate estimates, Treasury revealed that $64 billion of the difference between our gross debt and our net debt is made up of the cash and non-equity investments of the Future Fund. The Future Fund is there to cover the otherwise unfunded costs of public servants’ superannuation.

That is a little fact that the people of Canberra might be interested in. When Wayne mentions net debt translate that to, I am going to pay his debt off with my retirement savings.

I dare you to ignore the fact that Barnaby repeated his warning on May 13th, straight after the Budget:

Of course, the public servants will not be happy when we use their retirement savings, put aside in the Future Fund, to pay off some of Labor’s massive debt.

I dare you to ignore the fact that the US Government has been stealing federal workers pensions since May this year:

Treasury to tap pensions to help fund government

The Obama administration will begin to tap federal retiree programs to help fund operations after the government lost its ability Monday to borrow more money from the public, adding urgency to efforts in Washington to fashion a compromise over the debt…

Geithner, who has already suspended a program that helps state and local government manage their finances, will begin to borrow from retirement funds for federal workers.

I dare you to ignore the fact that the US Government has been planning to steal their private citizens’ super too, since at least February 2010:

The plan, as sketched in the 43-page document, calls for the creation of something called “Guaranteed Retirement Accounts” (GRAs). Biden slyly shifts the onus for the idea through weasel words typical of the federal government: “Some have suggested the creation of Guaranteed Retirement Accounts (GRAs), which would give workers a simple way to invest a portion of their retirement savings in an account that was free of inflation and market risk, and in some versions under discussion, would guarantee a specified real return above the rate of inflation.”

These accounts would be “free of inflation and market risk” because they would be under the direct and absolute control of the federal bureaucracy.

I dare you to ignore the fact that Argentina’s government stole their citizens’ super in October 2008:

Argentina’s center-left President Cristina Fernandez on Tuesday signed a bill for a government takeover of the $30 billion private pension system in a daring and unexpected move that rocked domestic markets.

I dare you to ignore the fact that Hungary’s government nationalised stole their citizens’ super in November last year:

Hungary is giving its citizens an ultimatum: move your private-pension fund assets to the state or lose your state pension.

Economy Minister Gyorgy Matolcsy announced the policy yesterday, escalating a government drive to bring 3 trillion forint ($14.6 billion) of privately managed pension assets under state control to reduce the budget deficit and public debt. Workers who opt against returning to the state system stand to lose 70 percent of their pension claim.

I dare you to ignore the fact that France began stealing their citizens’ super in late 2010 as well:

France seizes €36bn of pension assets

Asset managers will have the chance to get billions of euros in mandates in the next few months for the €36bn Fonds de Réserve pour les Retraites (FRR), the French reserve pension fund, after the French parliament last week passed a law to use its assets to pay off the debts of France’s welfare system.

I dare you to ignore the fact that “Europe’s economic superstar”, the one EU nation that (like Australia) came through GFC1 with positive economic growth, began stealing their citizens’ super in May this year:

It appears moving backwards on pension reforms has become the thing to do on both sides of the Atlantic.

Hungary last year moved much of its private pension assets to the state. Last month, new rules came into effect in Poland diverting 5% of the 7.3% of salary going to private pension funds to the state.

I dare you to ignore the fact that Ireland too, began stealing their citizens’ super in May this year:

Irish Bombshell: Government Raids PRIVATE Pensions To Pay For Spending

“The various tax reduction and additional expenditure measures which I am announcing today will be funded by way of a temporary levy on funded pension schemes and personal pension plans.”

I dare you to ignore the fact that the UK Government announced plans to steal public sector workers’ pension entitlements in June this year:

Thousands of teachers, lecturers and civil servants joined a UK wide strike yesterday in a mass protest over pension reforms.

…

The government … wants to impose a 3%-of-pay levy on public sector workers’ contributions to help reduce the budget deficit. This amounts to a pay cut to follow on the heels of the current pay freeze.

I dare you to ignore the fact that the Liberal Party of Australia quietly announced a new policy on June 3 this year – sneakily disguised as a helpful “reform” – that should make your hair stand on end:

Further relief for small business

The Coalition will relieve the red tape burden from Australia’s small businesses by giving them the option to remit the compulsory superannuation payments made on behalf of workers, directly to the ATO.

Small business will be given the option to remit superannuation payments to the ATO at the same time as they remit their PAYG payments.

This will require only one payment to one agency – rather than multiple cheques to multiple superannuation funds. The ATO will be responsible for sending the money to superannuation funds directly.

I dare you to ignore the fact that an “option”, can very easily become a “non-option”.

I dare you to ignore the fact that our Green-Labor Government announced plans in the May Budget that should also make your hair stand on end:

The Gillard government’s 2011-12 budget has proposed a raft of initiatives aimed at encouraging superannuation fund and private investment in infrastructure projects.

I dare you to ignore the fact that “encouraging”, can very easily become “enforcing”.

I dare you to ignore the botched “school halls” program, and the white elephant NBN, as you ponder whether or not you really trust this government to wisely and prudently invest your super in Government infrastructure projects, and achieve a reasonable return on your money, when even so-called “experts” have doubts:

The government’s plan to use tax incentives to encourage superannuation funds to invest in new infrastructure could be thwarted by inadequate returns on projects and a reluctance by the states to take on project risk, experts say.

I dare you to ignore the fact that the government’s white elephant NBN is a(nother) Green-Labor thought bubble, drawn up on the back of Kevin Rudd’s in-flight napkin, with no cost/benefit analysis:

Trust us with the NBN; we’re politicians

I dare you to ignore the fact that Bill Shorten, the Minister for Financial Services and Superannuation, already thinks of your super as a “significant national asset” … a kind of “sovereign wealth fund”:

Superannuation is our sovereign wealth fund

This week marks 12 months exactly since the government announced plans to take compulsory superannuation from 9 per cent to 12 per cent.

… our superannuation savings place Australia fourth in the world. Its $1.3 trillion in funds under management through superannuation significantly boosts national savings and provides greater retirement security for millions of Australians. Superannuation is also a significant national asset because it strengthens our financial sector.

I dare you to ignore the fact that our government has guaranteed our banking sector using the promise of your future earnings as collateral, and that Moody’s ratings agency has put our government on notice that our banks are Too Big To Fail – just like in the USA, UK, and Europe:

Heavens to Betsy. It’s finally out in the open. The big four are too big to fail and Moody’s rates the Australian government’s implicit guarantee of the banks’ wholesale debt (as well as the explicit deposit guarantee) as worth two ratings notches. Moreover, by phrasing it this way, Moody’s has essentially put the Australian government on notice that if it dares back away from that guarantee then it can count on the result. The further implication is that the Budget had better remain shipshape to provide the guarantee.

I dare you to ignore the fact that the government’s carbon pricing scheme scam includes a new “independent” Clean Energy Finance Corporation (carbon bank) that will be permitted to borrow against future government revenue – your future tax dollars – in order to invest in “green” energy projects:

The Clean Energy Council will today release a discussion paper proposing the carbon bank, which it says could be allowed to borrow money to invest in renewable energy projects against the future revenue of Labor’s proposed carbon tax and emissions trading scheme.

…

The Gillard government is examining the creation of a multi-billion-dollar carbon bank to drive renewable energy technologies as the Greens demand “complementary measures” to cut emissions in return for accepting a lower starting price for the carbon tax.

…

6.2.1 The Clean Energy Finance Corporation

The $10 billion Clean Energy Finance Corporation will invest in businesses seeking funds to get innovative clean energy proposals and technologies off the ground. These Government-backed investments will deliver the financial capital needed to transform our economy.

…

A variety of funding tools will be used to support projects, including loans on commercial or concessional terms and equity investments.

…

The Corporation will be independent from the Government. The Government will appoint an independent Chair who will have appropriate banking or investment management experience.

I dare you to ignore international banking’s core philosophy, now rendered infamous by GFC1: “Privatise the profits … socialise the losses”.

I dare you to ignore the fact that another sharemarket collapse – like in 2008 – would be a perfect pretext for nanny-state, “Big Brother knows best” governments everywhere to step in and “safeguard your retirement”, by taking and “investing” your super in Government-approved “safe investments” … just like the US Government’s planned, doublespeak-titled “Guaranteed Retirement Accounts”.

I dare you to ignore the fact that this blog has documented in detail the wave of super confiscations that is already rolling around the Western world, and the clear evidence that both sides of Australian politics already have their own quiet, sneaky plans to do the same.

I dare you to not bother reading any of my many articles on this topic –

No Super For You!!

US Treasury “Borrowing” Of Federal Pensions Brings Theft Of Private Pensions One Step Closer

Now The UK Government Is Stealing Super Too

Fresh Evidence Our Banks In “Race To The Bottom” Means You Can Kiss Your Super Goodbye

Fitch Ratings: Australian Banks Most Vulnerable To Europe’s Debt Crisis

Our Banks Racing Towards A “Bigger Armageddon”

Money Morning Agrees – Your Retirement Savings Under Threat

The Pricing Carbon Choir – Why Should *Any* Sane Person Trust Economists After The GFC?

Why Would Any Sane Person Believe Treasury’s Carbon Tax Modelling When Its Budget Forecasting Record Is This Bad?

How Wayne ‘Franked’ Another $20 Billion

Wayne: OOPS! I Did It Again

Liberal Party’s Sneaky Plan To Steal Your Super To Pay Labor’s Debt

Dear reader …

I dare you to ignore, mock, and ridicule Barnaby Joyce’s warnings … again.

I dare you to bend over … grab your ankles … bury your head in the sand … and keep telling yourself that “She’ll be right mate”.

I dare you to ignore the fact that …

Barnaby is right.

* A hearty “Thank You” to the inimitable Zeg for his brilliant cartoon drawn especially for this post, and at very short notice.

Please follow him on Twitter – @Zegcartoonist and subscribe to his blog – http://zegsyd.blogspot.com/

Better still … hire him!

Tags: barnaby joyce, future fund, GFC, julia gillard, public servants, SGC, stealing pension funds, superannuation, TBTF, tony abbott, too big to fail

Comments