Media Release – Senator Barnaby Joyce, 12 March 2010

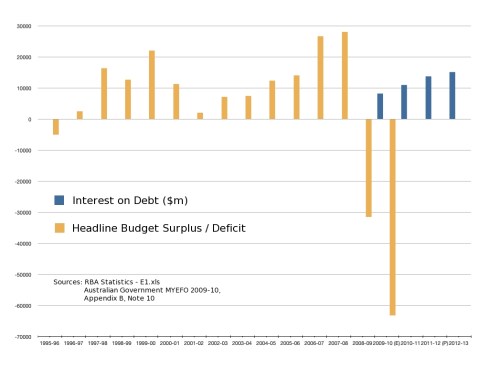

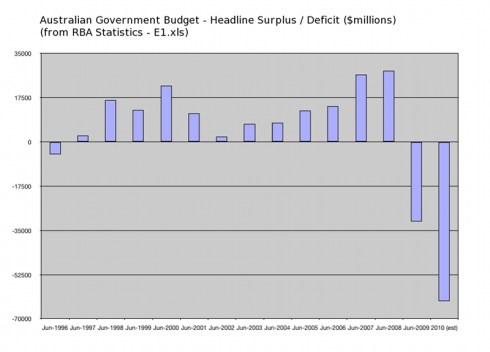

Senator Barnaby Joyce says that reports in The Australian today confirm what the Coalition has been saying for months on debt and interest rates. Simply put, the Rudd Government’s excessive and profligate spending is putting upward pressure on interest rates.

It is clear that the RBA have resorted to the fastest increases in interest rates among advanced economies in response to the effects of this spending. So while other countries enjoy modest rises, hard working Australians will be paying the price for Labor’s bad management.

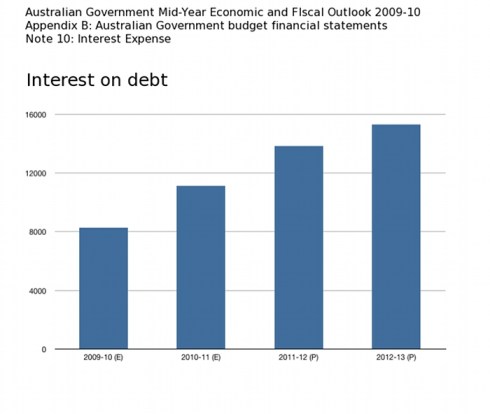

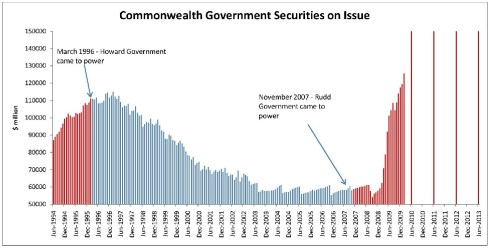

There is still a major portion of the $42 billion Nation Building and Jobs Plan to spend and while the Government has almost $128 billion of debt on issue (almost $16,000 per household), this is less than half its projected peak of $270 billion in 2014-15.

Gross debt has risen from $126.183 billion two weeks ago to $127.982 billion today. In two weeks the debt has risen by $1.8 billion. Easy to throw these figures about, but remember, just this increase is enough to seal 9000 kilometres of 6 metre wide road in country Queensland. This would take us from Sydney to Perth and back again and still have money left over.

It is highly unlikely there will be many left of the current Labor members by the time this debt is repaid. In fact quite a few will have passed away, but the debt will still be with us.

More Information- Jenny Swan 0746 251500

Comments