From The Australian today:

China’s Premier, Wen Jiabao, has warned that the world risks sliding back into recession and says his country faces a difficult year trying to maintain economic growth and spur development.

“The unemployment rate of the world’s main economy is still high, some countries’ debt crises are still deepening, and the world’s commodity prices and exchange rates are not stable, which are most likely to become the cause of any setback in the economic recovery,” Mr Wen said yesterday in Beijing’s Great Hall of the People.

China’s and Australia’s economies have become more intertwined in recent years: the country is now our largest trading partner with two-way trade surging to $83 billion in the year ending last June 30, and in December it passed Japan as our largest export market.

Any trouble in China’s economy would quickly resonate in Australia.

Perhaps Treasury Secretary Ken Henry might care to revise his recent declaration that the GFC is ‘over’?

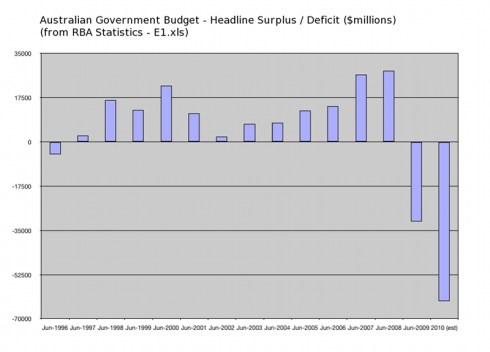

Perhaps Henry, along with RBA Governor Glenn Stevens, and all their many mindless cheerleaders in the media, might pause to reconsider their claims that ‘the risk of serious contraction‘ has passed, and that Australia is now set to enjoy a multi-decade China-fueled mining boom? One that will fix the massive Rudd hole in the Budget, and provide a “period of unprecedented prosperity” for Australia?

Please… inform yourself. Understand what is really going on in the financial world. Unlike the lazy, short-sighted economic illiterates who are running this country.

Please browse through the posts on this blog, and follow the links that catch your eye.

You will find references and links to literally dozens of articles from around the world. You will see that international economists, investors, financiers, world leaders, and many others, have been increasingly warning of the many threats to the global economy. And thus, to Australia’s economy too.

Our Australian economic “authorities” are living in La la land.

Only Barnaby is on the ball.

Comments