h/t Twitter users _AshleyPriest, Prronto, and LyndsayFarlow (click to enlarge):

Goose’s $2Bn Shock ‘N Awe Intervention

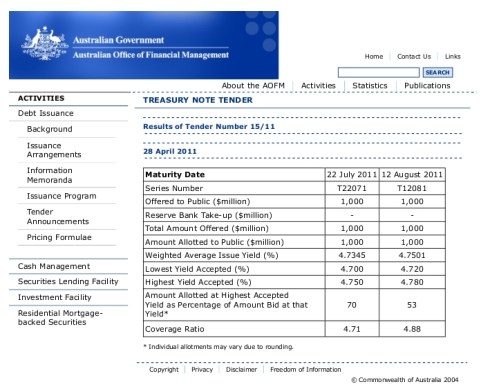

28 AprJust checking the AOFM website to confirm any changes to tomorrow’s scheduled $700M Treasury bond auction, and found this bombshell announcement:

So, another $2 billion (that’s $2,000,000,000) in short-dated Treasury debt was auctioned off today.

Did anyone see that coming? And why the shock ‘n awe of a previously-unannounced auction, to the tune of $2 billion?

Could it be that the rapidly rising Aussie dollar, combined with fast-growing inflationary pressures, has forced this incompetent government into a “necessary” money markets intervention – (ie) selling extra AUD-denominated government debt, in an attempt to keep a lid on the AUD?

If so, then when (if ever) will Goose and his fellow incompetents be held to account for driving those inflationary pressures in the first place, with their hundreds-of-billions in reckless and wasteful spending on overpriced school halls, ceiling insulation, the NBN, etc etc?

UPDATE:

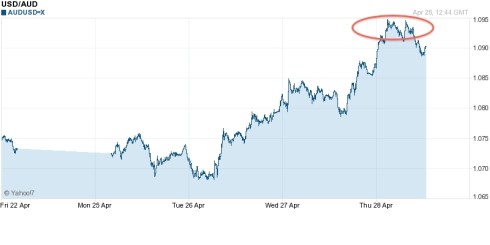

If this was an intervention in money markets to cap the rapidly rising AUD, it seems to have worked. For now –

For interest, here’s how the AOFM describes its Cash Management program:

Short-term funding needs can be met by increasing the volume of Treasury Notes on issue…

And here’s how they describe the Issuance Program for auctions of Treasury notes (as distinct from Treasury bonds):

Treasury Notes are short-term debt securities used primarily to meet within-year funding flows. Issuance decisions are made weekly and depend on the Government’s projected daily cash position for the weeks ahead. Treasury Notes are not expected to make a major contribution to overall funding for the 2010-11 financial year as a whole…

Tenders for the issue of Treasury Notes will be held on Thursdays, with details of the tenors (sic) and amounts to be offered announced at noon on the Friday of the preceding week.

Unless I missed something, the AOFM did not pre-announce today’s $2bn T-note auction at noon last Friday. Granted, it was Good Friday. But I did not spot an announcement at any time during this week either.

Given the obvious immediate effect on the AUD this afternoon (see charts), and particularly in consideration of the media storm in recent days that followed the shock inflation figures, I smell a money market intervention – for pure political expediency.

With the public already concerned about rising cost of living, a growing revolt against the carbon tax, and plummeting polls for Labor, the last thing this government needs right now is the public spooked even further by the spectre of further rises in interest rates to hold back inflation.

So could it be that this government is going from bad, to worse, to calamitous, on fiscal management? Could it be true that they are now compounding their first error of creating inflationary pressures by wanton borrowing-and-spending, by engaging in an ad hoc currency intervention – one that throws us into yet another $2bn of debt – solely in order to cap the rising AUD and calm inflation fears, a few days before the RBA meets to decide on interest rates, and, less than a fortnight out from the Budget?

UPDATE 2:

April 29, 9.14am –

From FXStreet:

AUD/USD Closing In On Yesterday’s High

Well now, that went well, didn’t it Wayne? $2bn more debt just to save face before the Budget .. and the effect lasts less than 12 hours.

Comments