Earlier this month, Treasury Secretary Ken Henry declared that the Global Financial Crisis is “over”:

“What people have called the global financial crisis, that has passed, I think it’s safe to say,” Dr Henry said. “But that isn’t to say that there will not be further adverse shocks for financial markets down the track and some of those shocks … could be of some significance for individual countries, but I don’t imagine (they would be) shocks of the sort that would be globally significant.”

Remember that claim.

Ken Henry did not see the GFC coming in the first place. He later claimed that “only extraordinarily good forecasters” would have predicted the GFC.

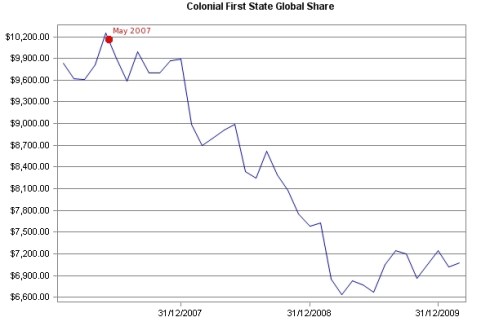

Well, that would be lots of extra-ordinary folk like me then, Ken. Even I could see it coming, from late 2005. And despite the ridicule (familiar story?) of “trained” “expert” financial advisers, I chose to pull all my superannuation out of the sharemarket into cash in May 2007, completely avoiding the global crash that has wiped out the investments and retirement savings of countless millions –

Historical performance chart assumptions: Performance is calculated on an initial investment of $10,000, using entry to exit prices, with distributions reinvested. A 4% contribution fee has also been applied. This information is general information only

And what about those international economists who publicly warned of a looming GFC, Ken? Men such as professors Ken Rogoff and Nouriel Roubini, and our very own “Dr Doom”, Professor Steve Keen?

You’d think Henry might have learned a few lessons about wide-ranging research… and caution… given his utter failure to foresee what many others did. So has he learned anything?

Clearly not.

Henry presently remains ignorant of, oblivious to, or (worse) rejects the numerous dire warnings coming daily from all around the world. Not just from Barnaby Joyce, but from many leading international economists – several of whom did predict the GFC – who are now genuinely concerned with multiple threats to the global economy. Everything from the European debt crisis, to the China property bubble.

Scarily, it has become increasingly obvious that Ken Henry is the man who really holds the reins of Australia’s economy, since PM Rudd, Treasurer Swan, and Finance Minister Tanner, are all totally unqualified economic imbeciles. Never forget, all of them were frantically talking up “the inflation genie” danger in 2008, even as the GFC tsunami was breaking over the world economy.

If (when) it all goes pear-shaped… again… Ken Henry must be sacked.

Tags: AOFM, Asia Crisis, barnaby joyce, debt and deficit, GFC, housing bubble, ken henry, sovereign debt, stimulus spending, treasury

Comments