The gummint has passed its Minerals Resource Rent Tax (MRRT) through the Lower house.

But only after “negotiating” deals with the Greens and Independents that … incredibly … actually render this great big new tax a net loss-maker for the government bottomline.

More on that in a moment.

But first, we bring you the brilliance of Barnaby Joyce’s well-justified mockery:

SABRA LANE: This was supposed to be the so-called “sunshine parliament” but a deal done last night to secure the Green’s support in the Lower House to pass the mining tax has the Opposition claiming dirty deals and the Green’s leader Bob Brown sounding sorry.

BOB BROWN: I apologise to people in the media and in the public who want to know about this but that’s the nature of the arrangement we have with the Government. And it will be, the details will be forthcoming and the Government’s got good reasons for not wanting to reveal it.

SABRA LANE: The Greens are still reserving their rights in the Senate, prompting the leader of the Nationals in the Senate, Barnaby Joyce, to go on the attack this morning.

BARNABY JOYCE: Every time we see the Labor Party do a deal, this tune starts going through my head and goes something like this: Da da dada da da dada… because we’ve got – it’s Monty Python.

It’s Monty Python. It’s Monty Python, it’s The Life of Brian.

We’ve got Bob Brown, Bob Brown who is like leader of the Judean front. “What have the Romans done for us?” What has the mining industry done for us? What have the – oh aqueducts, kept us out of recession, supported our standard of living.

You know, “What have the Romans done for us?” We’ve got Terry Jones, you know, Terry Jones is obviously Tony Windsor. “It’s not the Messiah, it’s just a naughty boy.” You know, he’s out the front there.

They’re not the Messiah, they’re just naughty boys.

SPEAKER OF THE HOUSE: Senator Joyce. Senator Joyce, could I just remind you to refer to senators and members by their correct titles.

BARNABY JOYCE: Okay and of course, you know, we’ve got Mr Rob Oakeshott, the Member for Lyne, who reminds me of Eric Idle. He’s always looking on the bright side of life, no matter what’s happening.

Graham Chapman, well that’s obviously Andrew Wilkie. And Michael Palin is Mr Adam Bandt.

But see the problem is it’s just a fiasco. We have no idea who’s running the show. It’s a complete and utter fiasco. In fact as we speak I look at a quote from Senator Bob Brown: “We’re very disappointed when the Government reached an agreement with Andrew Wilkie.”

Well we can’t have someone usurping his position as being the nuttiest person in the palace. No, that’s all his position.

Barnaby is right.

It’s a complete and utter fiasco.

Here’s what Alan Kohler (ABCTV News Finance) had to say about the MRRT, in Business Spectator (reproduced in full, emphasis added … and h/t Twitter follower @John_Poelwyk):

Mourning Gillard’s mining disaster

Australia’s effort to levy extra taxes on mining companies has been an unmitigated debacle, capped by the passage early this morning of the Minerals Resource Rent Tax with a further last-minute compromise.

It is one of the great lose-lose outcomes. We can only hope the Senate knocks it back.

To get the vote of Andrew Wilkie, the Member for Denison, a seat about as far from mining as it’s possible to get, the government increased the profit threshold at which the tax kicks in, from $50 million to $75 million.

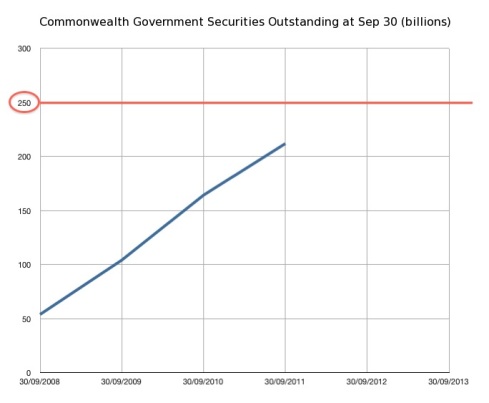

This is now a deficit tax – it will cost more in concessions to get it passed than it will raise in new revenue. That gap widened by about $100 million last night with the Wilkie amendment.

There are two big problems with the MRRT: state mining royalties can be offset against it and an increase in superannuation has been shackled to it.

A resources rent tax was proposed in the Henry Tax Review of 2009 as part of a package of measures designed to deal with the pressure the resources boom was putting on non-mining industries.

The idea was to replace ad valorem mineral royalties on mine production volumes with a rent tax on profits because governments weren’t sharing in the big increase in commodity prices that increased the terms of trade and therefore the currency.

There was, and is, a fundamental disconnect between the terms of trade boom that was killing manufacturing and tourism and the tax revenue governments were getting from it because royalties are levied on volume not price.

The Henry proposal involved a 40 per cent extra resources rent tax and a reduction in company tax to 25 per cent, plus a series of depreciation and capital allowance benefits for manufacturers and other small businesses.

The last time there was a sustained terms of trade boom in Australia, in the late 19th and early 20th centuries as a result of gold, wheat and wool exports, the policy response involved regulating wages through the Harvester Judgement and then imposing a tariff on imports to protect manufacturing. This so-called Australian Settlement had the effect of insulating manufacturing from the terms of trade and its effect on the currency but led to a gradual, disastrous decline in competitiveness.

It’s worth pointing out that the United States had the same terms of trade problem 100 years ago but chose not to protect manufacturing, with the result that it became the great manufacturing powerhouse, only eventually destroyed in the 21st century by China’s currency manipulation.

In the 1970s and 1980s Australia removed tariff protection and centralised wage fixing, so that the new terms of trade boom – ironically resulting from China’s defeat of America’s manufacturing supremacy – leaves Australian manufacturing entirely exposed to its effects.

Former Treasury Secretary Ken Henry had been banging on about the two-speed economy problem for years, and the Future Tax System review that he chaired contained his solution: a resources rent tax to be spent on reducing company tax. Without wage regulation and tariffs there is no other way to protect manufacturing from the effects of the mining boom.

But the Labor government has managed to completely mess it up.

First the Resources Super Profits Tax was plucked out of the Tax Review by Wayne Swan and Kevin Rudd and dumped on the miners by surprise. They revolted and won.

Then Julia Gillard negotiated a lower tax on iron ore and coal with BHP, Rio Tinto and Xstrata so that only the smaller companies with smaller advertising budgets would complain. As part of that, she was forced to allow existing mineral royalties to be deducted from the tax, which totally negated the idea of replacing ad valorem royalties from a tax on profits.

And then, to make the whole exercise completely pointless, she tied it to an increase in the superannuation guarantee levy from 9 per cent to 12 per cent.

That increases manufacturing costs instead of reducing them, and vastly increases the cost of the exercise to the federal budget.

According to Brian Toohey in this morning’s Financial Review, the cost to the budget of the extra superannuation tax deductions will be $4.2 billion in 2019-20. The total cost of the concessions connected to the MRRT will be $9.4 billion in that year – less than a third of which is paid for by the revenue to be collected from the MRRT.

In the 2012-13 financial year, in which the budget is supposed to return to surplus, the net cost of the MRRT package – revenue minus giveaways – is $1.7 billion.

It is, in short, a joke. Everybody loses. It was an idea designed to help Australia deal with the terms of trade boom that has been bastardised by politics into a complicated impost on mining that achieves nothing at all and in fact worsens the position of everyone involved.

Business as usual then, for the Green-Labor-Independent comedy show.

Comedy?

Why not.

This show really has gotten so bad that if you don’t laugh you’ll …. ?

Tags: alan kohler, andrew wilkie, barnaby joyce, mining tax, MRRT

Comments