Reader “Phil” had the following to say, in response to Thursday’s post, Real Estate Marketers Now Out To Get Your Kids.

His words are an object lesson for real estate industry professionals everywhere (my bold added):

As a licensed real estate agent myself, I would like to suggest a difference between single office agencies and franchise groups. The typical stereotype of a real estate agent is derived from the high flying top 3%. There is no doubt there are some wankers in the industry. The rest that I know are hard working good people who support families and employ staff of 10 to 15 on average. That goes for many of the offices within franchise groups.

Since 2008, I have stood back and looked at the industry a bit differently. I have recognised that most real estate agents have no idea that it is bank credit expansion that causes house prices to rise. Or as Steve Keen explains, actually “growth” in credit expansion.

This is only possible due to legislation allowing private banks to use housing equity as security to create credit. We just continue to do this as that appears to be the way it always was. (IMO housing should be a consumable not an asset).

BTW, hat tip on your recent article exposing those who foster the continuation of the “housing industry” as a financial derivative.

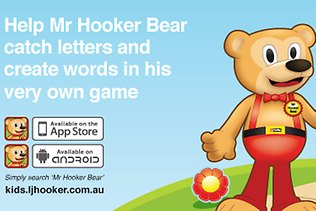

Back to the franchise groups and franchises in general (Parasites!!!). This is not unlike usury or rent seeking. They take franchise fees from hard working small businesses and promote corporate ideals. The LJ Hooker promotion is revolting IMO.

I keep returning to your story of the used car salesman. Most people just keep doing what they know to do to get by or maybe get ahead. We are all preyed on by those who control and promote the FIRE structure.

As one who is now seeing the reality of this I feel a responsibility to speak. Much as you do. I tend to do this even as it makes me an outsider. Strange that huh?

Comments