Treasurer Wayne Swan is busily preparing hearts and minds for his fourth consecutive Budget … deficit. A deficit that’s going to be epic.

Oops.

Time to wave a big red herring:

We created 750,000 jobs since we came to office when other nations shed millions of jobs…

Let’s take a bite out of his red herring. Is the jobs claim true?

Wayne’s former colleague Lindsay Tanner – recently confessed expert in the “dark arts” of lying with numbers– has given us this timely warning:

“… whenever a politician cites… figures to show what a fine job he or she is doing, examine the fine print very carefully.”

Ok. Let’s do that.

If it’s true that Labor has created 750,000 jobs since coming to power, one would think this “fact” might be reflected in some official statistics. Say, in the official government Final Budget Outcome reports.

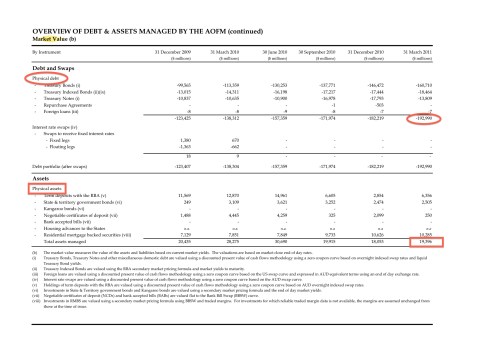

According to the 2007-08 Final Budget Outcome, the last year of the Howard Government brought in $126.135 Billion in Total individuals and other withholding taxation:

Source: Final Budget Outcome 2007-08 | Part One, Table 2: Australian Government general government sector revenue

Now, if Labor really has created 750,000 jobs since they came to office, then you’d expect the Total individuals and other withholding taxation for last year (2009-10) to be a lot higher than in 2007-08, right?

After all, even if these “750,000 jobs” were all only modestly paid jobs – say, $35K p.a. – then you would expect the government should have received around 750,000 x $4,350 = $3.26 Billion more individual income tax revenue than in 2007-08 … right?

Wrong.

According to the 2009-10 Final Budget Outcome, the Labor Government brought in $3.31 Billion less from individual income taxes last year than in 2007-08:

There you have it.

In Wayne’s World, 750,000 jobs created means $3.31 Billion less income tax revenue.

Who knew?

Rather than adding to Government revenue, “job creation” actually loses money.

On the eve of Budget 2011 … and a fourth consecutive mega-deficit … this is Wayne’s headline argument for Labor’s record in economic management.

“750,000 jobs created”.

But wait … there’s more!

“Half a million more”. “In the next two years”.

Be-holed, Wayne’s Große Lüge.

If you are going to lie, make it a Big Lie. And repeat it often.

Everyone will believe you because –

“They’re government statis…. they’re facts” (2.27min)

Comments