Picture this.

You are a new government, following nearly 12 long years in opposition.

You campaigned with the catchcry, “This reckless spending must stop”.

A global financial crisis has struck within 12 months of your taking office.

Your party’s last term in office presided over a “recession we had to have”, so your economic credentials are poor.

You desperately wish to avoid being seen to preside over a “technical recession”, especially in your first term.

You have embarked on a massive “stimulus” spending spree, drawing criticism from many.

You have blown the $20-odd billion surplus left to you by the previous government, and plunged the nation’s finances deep into the red.

Your government’s financial numbers are terrible.

You are obsessed with “managing” the media cycle, public perceptions, and the popularity polls.

What do you do?

In his post-career book Sideshow: Dumbing Down Democracy, key member of the “kitchen cabinet” or “Gang of Four”, former Finance Minister Lindsay Tanner, informed us that what he did was to become adept in the “dark arts”. He employed the “standard tricks” – such as “switching between different methods of accounting“ – in order to “maximise political appearances”.

But how do you cook the books to disguise your massive spendathon – and bury the truth of a technical recession – without the media catching you out?

And how do you cover your tracks, so that noone can ever say you lied?

Easy.

What you do is tell everyone about your change in accounting methods.

But you do it in such a way that no one hears you.

What you do is bury the notice of your change in accounting methods in the fine print of the Mid-Year Economic and Fiscal Outlook (MYEFO) budget update, released 2 November 2009. You do not mention any numbers that might reveal the actual impact of the change. And you include a reference to an obscure Appendix of “revised” historical data*, that you know journalists don’t ever bother to read, much less take the time to cross-reference against previously published budget figures.

In your Treasurer’s press release announcing the MYEFO, you do not mention the changed accounting method at all. Nor do you mention it in Parliament, or in interviews with the media.

Instead, you issue another Treasurer’s press release that, while still opaque and misleading, does admit (in one sentence) to just how much your changed accounting method has impacted on the critical budget number – the GDP figure.

But … you delay issuing that press release until 8 December 2009. Over a month after the MYEFO. Two weeks after Parliament has closed for the year. And, the same day (UTC) as the opening of the 2009 UN Climate Change Conference in Copenhagen, where the eyes of the world are focussed, where your party’s Prime Minister is playing a headline role … and where you have brought a massive Australian media delegation.

Voila!

You did not lie.

No one heard you publicly admit that you cooked the books to hide a recession. And you spend the rest of your days in office loudly and incessantly referring to your brilliant economic management … using figures always expressed in terms of “per cent of GDP”.

A GDP number that you made a “substantial increase” to, just by changing the method of accounting.

Hard to believe that our government is that crooked?

It is true.

They have admitted it.

You just have to follow the carefully hidden trail of evidence, to discover that admission. And the deceit used to hide it.

Two years ago on 3 March 2010, your humble blogger revealed that Labor’s much-heralded low debt-to-GDP ratio figure was a fraud (emphasis in original):

In the 2009-10 Mid-Year Economic and Fiscal Outlook (MYEFO), the government refers to a change in the methodology used to calculate GDP for the previous 2008-09 year, and for the historical data series. This change results in a “substantial increase” in the published level of GDP.

The flow-on result from this change is obvious. The government’s spending, as a percentage of that artificially increased GDP figure, will appear lower than if the change had not been made.

And because all of its spending is being done using borrowed money, the debt-to-GDP figure will also appear lower too. Perfect cover for a government that needs to defend itself from Opposition attacks, and smooth over public fears, about rising government debt.

Two weeks later, I calculated the actual amount by which Labor had artificially increased the reported level of GDP (see Labor Fakes GDP By 4.5%):

In the fine print on the Rudd Government’s Budget 2009-10 MYEFO website, we learned that Rudd Labor made a change in the accounting method that was previously used to calculate Gross Domestic Product (GDP). This change resulted in a “substantial increase” to the official GDP figures:

* The 2008-09 Annual National Accounts show a substantial increase in the level of GDP over history due to the ABS adopting the new System of National Accounts 2008. Given the degree of increase in the level of nominal GDP, the Government has released updated tables of fiscal aggregates contained within Appendix D of the 2009-10 MYEFO.

So just how much is that “substantial increase”?

4.5%. Or $47bn. In just one year.

…

Of course, we can easily perceive just why Rudd Labor would wish to do this.

By making “revisions” to the historical data – revisions that all very conveniently result in a “substantial increase” in reported GDP – their spending (as a percentage of GDP) looks lower.

Their annual spending growth (as a percentage of GDP) looks lower.

Their debt as a percentage of GDP looks lower.

And their Interest-on-debt as a percentage of GDP looks lower too.

Fast forward another two years, to this week.

In response to my mentioning the fudged GDP figure, fellow Macro Business reader Steven Shaw kindly drew my attention to Treasurer Wayne Swan’s press release No. 122.

While it is gratifying to see confirmation that my March 2010 reverse calculation of the “substantial increase” to the GDP figures was accurate, it is far more interesting to observe the date of the press release – 8 December 2009.

A press release date (in Australia) that happily coincided with the opening day of the Copenhagen Climate Change Conference:

The Annual National Accounts also show a substantial increase in the level of GDP over history due to the ABS adopting the new System of National Accounts 2008 standards.

The ABS has taken the decision to adopt these new standards to better capture new economic developments and to reflect revised international standards issued by the UN Statistical Commission.

The level of nominal GDP is now 4.4 per cent higher in 2007‑08 than published in the 2007-08 Annual National Accounts, bringing the size of the Australian economy to $1.25 trillion in 2008-09.

Given the degree of increase in the level of nominal GDP, the Government has released updated tables of fiscal aggregates contained within Appendix D of the 2009-10 MYEFO. These tables include receipts, revenue, net debt, payments and expenses as a proportion of nominal GDP and are available at: www.budget.gov.au. The adoption of the new standards only affects those Budget aggregates which are expressed as proportion of GDP.

Quelle surprise!

Have you ever noticed, dear reader, that this government always … always … boasts of its economic record by quoting figures expressed as a proportion of GDP?

How very, very convenient that “substantial increase” in nominal GDP has turned out to be.

No need to worry about two consecutive quarters of negative GDP (a “technical recession”) making your new government look like it has blown tens of billions of borrowed dollars on “rushed and bungled” “stimulus” for nothing.

Simply change accounting methods. Tack on an extra 4.4% of GDP “growth” out of thin air to the year’s “official” figures. And revise all the historical data as well.

And make sure you tell everyone … in such a way that no one hears you.

Mind you, dear reader, the reason for the change in accounting method was solely to “improve the accuracy and comparability of the data through time” (MYEFO excuse). And/or “to better capture new economic developments and to reflect revised international standards” (Treasurer’s belated-and-buried press release excuse).

Of course it was.

Nothing to see here. Move along now.

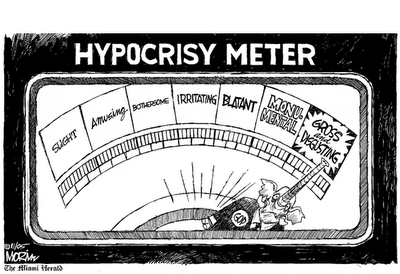

If a corporate executive engaged in these kinds of “dark arts”, these “standard tricks”, they would be prosecuted and jailed for fraud.

Our government is a pack of crooks.

If you accept any claimed government statistic at face value, you are a fool.

It is that simple.

* On Labor’s revising of historical budget data, reader “vk” summed it up best two years ago: “Any similarity with the book 1984 – where the Ministry of Truth kept revising old encyclopedias and newspapers in the libraries – is purely coincidental.”

Tags: copenhagen climate change conference, GDP, lindsay tanner, MYEFO, sideshow, wayne swan

Comments