It has been well-documented by others that the Cyprus-style bank “bail-in” scheme that is presently being prepared right across the G20, is really all about derivatives — those “financial weapons of mass destruction” that were at the heart of the GFC in 2008 (see Derivatives Managed By Mega-Banks Threaten Your Bank Account).

To briefly summarise, a critical aspect of what the bail-in scheme is intended to do, is to prioritise the payment of banks’ derivatives obligations to each other, ahead of depositors. In other words, it is about stealing the public’s bank deposits, to pay out at least some of the big banks’ Death Star-massive — and toxic — derivatives positions.

Yves Smith of Naked Capitalism explains:

In the US, depositors have actually been put in a worse position than Cyprus deposit-holders, at least if they are at the big banks that play in the derivatives casino. The regulators have turned a blind eye as banks use their depositories to fund derivatives exposures. And as bad as that is, the depositors, unlike their Cypriot confreres, aren’t even senior creditors. Remember Lehman? When the investment bank failed, unsecured creditors (and remember, depositors are unsecured creditors) got eight cents on the dollar. One big reason was that derivatives counterparties require collateral for any exposures, meaning they are secured creditors. The 2005 bankruptcy reforms made derivatives counterparties senior to unsecured lenders.

Note carefully that last point about the “collateral” for derivatives exposures, which means that derivatives counterparties are deemed “secured” creditors, making them “senior” to unsecured “lenders”.

In layman’s terms, what all that means is that when banks take out a derivatives bet, the bank on the other side of that bet (the “counterparty”) requires some collateral to be put up. Thanks to deregulation of the financial system over the past couple of decades, banks have — unbeknown to the public — been putting up their customers deposits as collateral for their derivatives bets.

Now, because collateral (or “security”) has been put up for those derivatives bets (or “positions”), this means that those bets are considered “secured”. And in a bank “resolution” (ie, a “bail-in”), the secured creditor has seniority (ie, priority) over “unsecured” creditors (ie, depositors).

Got that?

The big banks are all counterparties to each other on their derivatives bets. They have pledged “collateral” — often, your deposits — as “security” on those derivatives bets. When a bank fails, and is “resolved” under the new, FSB-directed bail-in regime, payouts on those “secured” derivatives bets get priority over paying you back your deposit.

Here at barnabyisright.com, we have recently been looking at the documents going back and forth between the Australian Treasury and the Australian banks. And it is here that we find confirmation of what has been reported by Yves Smith and others.

In the Australian Financial Markets Association (AFMA) 11 January 2013 letter in reply to the Australian Treasury’s September 2012 consultation paper, “Strengthening APRA’s Crisis Management Powers,” we see clearly that our banks consider the issue of how derivatives would be handled in a bank bail-in to be “critical”:

Legal certainty around the enforceability of the netting and collateral arrangements in connection with OTC derivatives is critical to the stability of the market.

In particular, what the banks are concerned with — so much so, they call it a “guiding principle” in their response to Treasury — is ensuring that the implementation of bail-ins in Australia will “include appropriate respect for…collateral rights”, with safeguards to protect their derivatives positions against “destruction of value”:

Governing our response to the Consultation Paper are three guiding principles:

…

Ensuring consistent treatment of transactional claims relating to derivatives and other financial instrument, including appropriate respect for netting and collateral rights, subject to safeguards to avoid destruction of value.

The international bankers (the Financial Stability Board) who are behind the G20-wide bank bail-in scheme, have sought to portray it as being designed to “resolve” failing banks, while at the same time, “protecting” bank depositors.

However, the truth is that the FSB bail-in scheme is really designed to ensure that the mega-banks — “systemically important financial institutions (SIFI)” — will receive priority for payout on their derivatives positions, in any “resolution” of a failing bank.

Because for the bankers, propping themselves and their compadres up is all that matters. What we call “theft”, they call “ensuring financial system stability”.

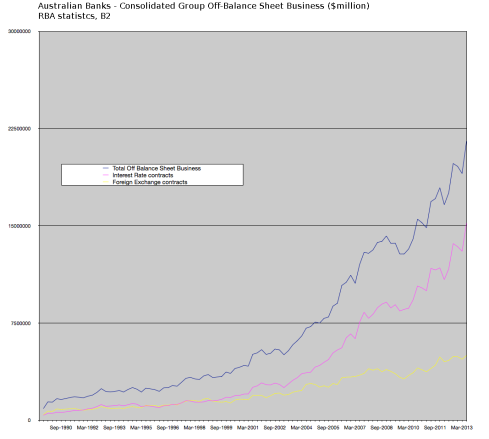

According to the RBA, our banking system holds $21.5 Trillion in “Off-Balance Sheet” derivatives exposures:

Over $15 Trillion of that is the “value” of derivatives betting on interest rates.

In the “bail-in” of an Australian bank, do you really think there would be anything left to pay you back your deposit, after the banks get “seniority” for payout on their “secured” derivative positions?

See also:

Australian Banks “Welcome” Cyprus-Style Bail-In Plan

Australia Plans Cyprus-Style “Bail-In” Of Banks In 2013-14 Budget

Thanks for the analysis, BI.

Not much more to be said, is there.

Anyone visit the blog “HangtheBankers”?

We have been warned.

Good that there are still some citizens who are not owned by big business and who tell it like it is. This is explosive stuff and you need to try and get it into the wider media. Having said that personal experience tells me that this may well be unsuccessful as this sort of information is routinely hushed up.

Of course all of this ignores the fact that any government trying to steal everything investors have would find itself faced with civil disobedience and potentially civil war so not sure what any legal framework designed to steal would be worth if push came to shove.

Do you have a handle on which financial institutions in Australia are ‘safe’ should the worst come to pass?

Unfortunately no, I don’t. Credit unions may be worth a look. Key to remember is Due Diligence — finding out exactly how the institution operates; what it does with your money; how it “invests”.

Also key is remembering the basics — when you give your “money” to any financial institution, you are lending it to them (ie, you are a creditor of the bank). They are not safeguarding it for you; they are borrowing it from you, and will “invest” it how they please.

The Credit Unions have got together to form Abacus Banking, which is a mutual society that has no shareholders. I’ve questioned them on facebook about their derivative exposure and got no reply. Hence I don’t trust them.

We need a movement now to establish a new Govt bank now, since our banking derivative gamblers are going down fast.

We can do this quickly with Australia Post being service centres. This has to be a people initiated change,since as our pollies are gutless and clueless.

It seems these bets are bigger than any counter party can pay out the other party even with all our depositors funds. A depositors haircut in the order of 90%+ seems likely. It would be prudent to move the money you don’t want to lose outside of the the banksters reach, how you do that is up to you, but the time to do it is before the derivative system collapses which is sooner than later.

“It seems these bets are bigger than any counter party can pay out the other party even with all our depositors funds.”

That’s my view too.

As the Big 4 hold less than 10 cents in the dollar ON Balance Sheets, depositors are screwed regardless. The only solution I can see is to let the banks liquidate, suffer the property price crash and currency devaluation, rebuild as our parents did after the war. Another 60 years prosperity might ensue ?!?!? Could be hard to sell to the electorate …

Judiciary Act sect 80. Common Law is the prevailing law. If the bank does not have your consent then it can’t use your deposits to use as collateral or in the fractional reserve system. It’s about time we all let the banks know that they can’t use our deposits at their discretion but only by our permission. Charge them for breach of contract and enforce section 80 of our Constitution and trial by jury. What jury would side with the banks?

The Confessions of an Economic Hit Man

.

A confessional by a former global banker, John Perkins, on the use of usury to enslave independent nations by the IMF, World Bank and other agencies. As part of their plan, the bankers use assassination, slander, and coups to maintain their positions of power and to prevent the truth about their corruption from reaching the public. Most of the imperialism of the 20th and 21st century by Western countries is really the result of globalist bankers aid to third world countries money that the bankers then force to be spent on development projects led by multinational corporations.

.

Thanks for the above video Kevin. Now it occurs to me that we don’t need an Economic Hitman in Australia. We have a government that has gone from having money in the bank to one with $300,000++ in debt in only a few short years. Let us hope that the government is not having to require a loan from overseas and corporate development! anything to do with the SIC Standard Industrial Classification on the US register?

This is relevant

.

Gillard acquiesces to US demands

.

http://cleaves.zapto.org/news/story-3185.html

http://hat4uk.wordpress.com/2013/08/09/global-looting-the-new-eu-bailin-law-was-passed-8-days-ago-did-you-notice/

also this is for those in Europe

This is what someone says happened to NZ Christchurch. Pretty scary times.

Notice too that no buildings collapsed during the nine magnitude “earthquake” in Japan.

Too big to fail. Too big to jail. Too cancerous to care.

.

http://andrewgavinmarshall.com/2013/08/09/global-power-project-part-9-banking-on-influence-with-morgan-stanley/

Would the Australia Post “Load and Go” Visa Prepaid card be safe for say up to $10,000 to store? I am going to check on Monday?

I thought this article would be of interest to you –

http://wakeup-world.com/2013/02/18/all-corporations-banks-and-governments-lawfully-foreclosed-by-oppt/

This UK financial blogger worries that Euro bank derivatives can be held off-balance sheet and that a bank bail-in can go ahead even if not voted in as such by the euro parliament.http://hat4uk.wordpress.com/