Barnaby writes for The Drum, on Their ABC (h/t @margotdate):

What to do with all this water

Why is it that every time the Labor party involve themselves with anything that relates to competency it turns into an unmitigated disaster?

Why is it that every time you look to the details behind their doorstop interview they are just never there? There is a pattern of behaviour that is quite evident in this Green-Labor Party administration. When they announced the NBN, the largest infrastructure program in the nation’s history – larger than the Snowy Mountain Scheme – there was no cost benefit analysis, and of course we are now suffering the affliction of a monster that is starting to commercially wander around the yard in a very similar fashion to a big white elephant.

Our desire to cool the planet via a carbon tax works on the rather peculiar premise that there will be a global climate change agreement by 2015. There is not even a sign of that, but we handed away one of our greatest strategic advantages, cheap power. Australia’s plan is nothing more than a mad gesture which no-one else is following and no-one cares about. On top of this, the only climatic effect it will have is inside buildings rather than outside, as people find they can’t afford to keep themselves warm in winter and cool in summer.

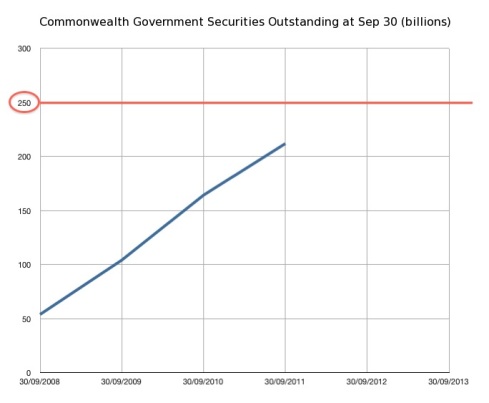

Our debt, which as I stated years ago would get a life of its own and go out of control, now has a life of its own and is increasingly out of control. We are heading towards our third debt ceiling. We have increased the ceiling from $75 billion to $200 billion to $250 billion and it is not stopping. Lately we have been borrowing $2 billion a week and our Gross Debt is now $221 billion. If we don’t depressingly extend the nation’s credit limit again, then soon the presentation of our nation’s credit card at the checkout will result in the attendant telling us that “transaction declined, see bank for details.”

Now this pathological ineptness in management has arrived in water policy. Your government is now the biggest irrigator in the country through the Environmental Water Holder, Ian Robinson, but instead of watering spuds and onions, they water 2,400 venues for frogs and swamps.

In the very last sentence of the Commonwealth Environmental Water Holder’s 2010-11 annual report, Mr Robinson states that “the Commonwealth environmental water is required to be managed in accordance with the Environmental Water Plan, which will be set out in the Basin Plan.”

Mr Robinson only wrote this in July this year but it is already out of date. The draft Basin Plan released last month does not include an environmental watering plan. Instead, that task will now be flicked to state governments, who won’t need to come up with one for another three years.

A farmer will tell you exactly how they get their water, exactly how much water is stored in dams, how much water is lost when it is moved to a field to water a crop and how much water it takes to water a crop through the season. They will also be able to tell you how much is left to start next year’s crop.

Every farmer has their watering plan. If a farmer didn’t have a watering plan, they wouldn’t be much of a farmer. The Commonwealth Environmental Water Holder currently has 1,075 GL – 1,075 billion litres – of water. Quite a bit; in fact more than what would fill Sydney Harbour twice and they are buying much more. This is to water 2,442 environmental assets, 2,442 environmental crops so to speak.

But when the very valid question is asked, “where is your watering plan?” the predictable answer comes back – they don’t have one. It’s obviously in the draw with the cost benefit analysis of the NBN, the global modelling of the carbon tax, the plan to control our debt, and a myriad of other incredible statements that come without a clue of how to deliver them.

Australia is merrily spending billions of dollars buying an asset but there is really no plan of where exactly it will come from, how it is to be used or where it will be stored. There is a rough idea, but that’s as good as it gets. When there is no plan, the environmental water is dropped arbitrarily in the river from public dams to flood out farms and close public bridges like it did on the Murrumbidgee earlier in the year, at a time when there was not a cloud in the sky. The environmental benefit of these actions is at best vague most likely unknown.

If I was back with my accountancy hat on, I would make sure I got my money off this Green-Labor client prior to starting their work; from what I have seen they are not going to be with us as a business for long.

Comments