You see my problem is this:

I’m dreaming away;

Wishing that heroes, they truly exist.

I cry watching the days.

Can’t you see I’m a fool

In so many ways?

But to lose all my senses…

That is just so typically me.

Baby, oh.

Hands up all those who think yesterday’s bloodbath in global sharemarkets should inspire us with confidence that all is well here in the land of Oz?

Let’s see now … that’ll be Wayne … and his friend Glenn … oh yes, and their new mate Martin … noone else?

Interesting, is it not, how all the same clowns persist in repeating their same tired old lines.

Overwhelming weight of evidence to the contrary be damned.

Here’s our Treasurer Wayne Swan as quoted by AAP (via the Australian):

The Australian share market slumped around 4 per cent this morning following a similar drop on Wall Street over rising fears of another economic downturn and worries Europe’s debt problems will widen.

“Australians should never forget that our economic credentials are among the strongest in the developed world,” the treasurer said.

“Australia has a proven track record of dealing with global economic uncertainty.

Indeed we do.

But “a proven track record of dealing with global economic uncertainty”, and “a proven track record of dealing wisely with global economic uncertainty”, are two very different animals.

What is your track record, Wayne?

“The fact is the share market in Australia is not back to levels prior to the global financial crisis and now we’re being hit by another bout of uncertainty.”

Hold the phone!

I thought you’ve been tirelessly telling us just how well you brought Australia through the GFC? Now you’re telling us the share market “is not back to levels prior to the GFC”? And it’s getting its a*** kicked again?

But but but … you had me believing that you were our Saviour, Wayne!

Please… say it ‘aint so!?

I think I did it again. I made you believe

We’re more than just friends.

Oh, baby;

It might seem like a crush,

But it doesn’t mean

That I’m serious.

‘Cause to lose all my senses…

That is just so typically me.

Oh, baby; baby.

I’m devastated!

Oh Wayne, I feel so used!!

What … what was that you said again?

Mr Swan insists Australia is in the right part of the world at the right time, as the Asia-Pacific economy remained strong.

Really?

Funny. That’s not what the latest RBA Chart Pack graphs suggest.

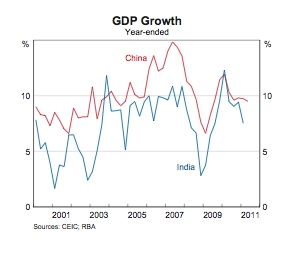

Here’s China and India:

Looks to me like Chindia’s GDP growth has been on a downward slide since late 2009 / early 2010, Wayne. Ever since their GFC Mk1 “stimulus” money began to dry up. Seems they didn’t get any sustainable bang-for-their-stimulus-bucks either. Both of their economies are now running at lower rates of growth than 6 years ago Wayne … that’s 2005.

Looks to me like Chindia’s GDP growth has been on a downward slide since late 2009 / early 2010, Wayne. Ever since their GFC Mk1 “stimulus” money began to dry up. Seems they didn’t get any sustainable bang-for-their-stimulus-bucks either. Both of their economies are now running at lower rates of growth than 6 years ago Wayne … that’s 2005.

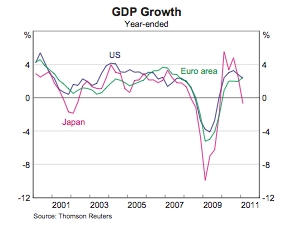

Oh look … here’s our second biggest trading partner, Japan:

Looks like Japan’s GFC “stimulus” can-kicking exercise has stopped rolling up the road too, Wayne. They’re back to 2001-02 levels of growth.

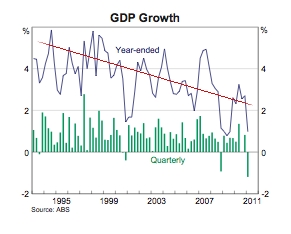

And our GDP growth chart looks even worse:

Ummmm … Wayne, ol’ son.

That approximate trendline I’ve added to the RBA’s GDP growth chart for the land of Oz looks suspiciously like a long term downward trend to me. And looking pretty ugly at the pointy end.

What was it your mate Glenn was saying just yesterday, about his RBA’s forecast tea-leaf prognostication for GDP growth?

The Reserve Bank has slashed its growth forecasts for the Australian economy while predicting inflation would remain high for longer than expected.

The August statement of monetary policy released today shows the central bank believes the economy will grow by just 2 per cent in 2011, on a yearly average, compared to its earlier call of 3.25 per cent.

The reduced forecasts are greater than economists had expected. It predicts this financial year growth will be 4 per cent down from 4. 5 per cent.

Ummmm.

Not bad. If your revised prognostication turns out to be right this time – questionable, since you only made the first one a couple of months ago – then you’ll only have screwed up your first guesstimate by a measly 38.5%.

By the way.

A little tip Glenn.

Your own Chart Pack says our GDP is already sitting well below 2%. About half that, actually.

Expecting a surging “recovery” out of the blue red yonder, are we?

Got any other sage comments?

In the statement, the RBA said economic growth would be lower because of a range of domestic and overseas factors.

“Growth over 2011 has been revised downwards due to a slower than expected recovery in coal production and to a lesser extent a downward revision to consumer spending as domestic and international concerns have weighed on sentiment,” the RBA said.

Ruh roh!

The Greens want to shut down the coal industry. Preferably within 10 years, they say.

And you’re saying, Glenn, that the main reason why your original economic growth forecast has been revised within a couple of months by a whopping 38.5%, is due to a “slower than expected recovery in coal production”?!?

Anything else to add Glenn?

“The medium-term outlook continues to be characterised by the significant pipeline of resource sector investment with a number of large projects already underway and by strong growth in resource exports.”

Oh yes. That tired old line.

Sorry Glenn.

Macquarie Research tore that particular ass-umption underpinning all of your “forecasts” into lots of little shreds some time ago.

Back over to you Wayne:

[Swan] said Australia’s fundamentals – low unemployment, robust financial institutions and low public debt – would help protect the economy.

“Robust financial institutions”?!?!

Surely you jest.

“Low public debt”?!?!

Ahhhh … Wayne.

Something isn’t “low”, just because it may be less than others that are huge.

Your total tax revenues are only around $300 billion.

You’ve got us in debt to the tune of nearly $200 billion.

And don’t give me any of that “Net” debt crap.

“Net” debt might sound better (for you) when you’re spruiking, because it’s a lower number than the Gross figure that you really owe.

But presuming others will pay you back what they owe you, is counting your chickens before they’ve hatched.

We owe $200 billion in public debt. End of story. Versus … at best … $300 billion in taxes this year.

By your own “estimates”, we’re paying $11+ billion per annum in Interest-only.

And you’ve got to run the country with the rest.

And another thing Wayne.

You’re always banging on trying to make out that our “public debt” is “low” compared to basket case “developed” economies abroad.

You remember. Europe, the UK, the USA. Those “developed” economies. Hardly a big claim to fame to say our public debt is lower than these paragons of fiscal prudence (/sarc).

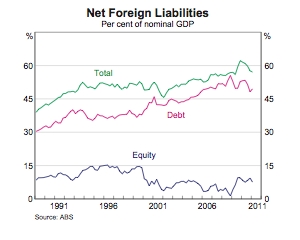

But what about our Net Foreign Liabilities, Wayne?

Ummmm.

Wayne.

Net Foreign Liabilities at nearly 60% of GDP?

I had a little look in the RBA’s data, Wayne. Takes about 20 seconds.

Our Net Foreign Liabilities of nearly 60% of GDP?

In real numbers (not this “% of GDP” nonsense) … that’s $780.57 Billion at March 2011 (RBA Statistics, H5.xls).

Oops!

Wayne … you’ve done it again.

You’ve confirmed your official title, and your legacy for the history books.

World’s Stupidest Treasurer.

Comments