Have you ever questioned how exactly the government can actually monitor the “emissions” of carbon dioxide of each of the 1,000 … 500 … “more like in the order of like 400” so-called “biggest polluters”?

Are they really going to have an army of “carbon cops”, as Tony Abbott would have you believe, roaming the country investigating people like a 21st century Green Gestapo?

Even if so, the question still remains – how are they going to measure the “emissions”?

Answer: They are not going to measure them.

They are not even going to audit any but a very few of the very largest “emitters” either.

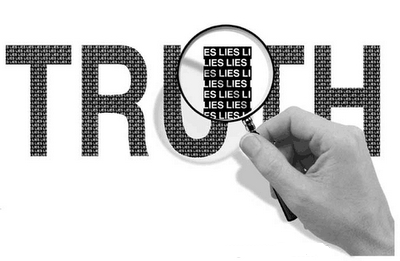

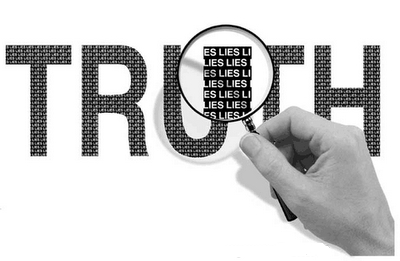

It is all a hoax.

Just as under the present National Greenhouse and Energy Reporting (NGER) department “system” – one that only came up with 299 companies reporting emissions in their latest Report – the companies “caught” in the system will be asked to “estimate” their own emissions.

Other than that, maintaining public “confidence” in the “credibility” of the scheme scam will be a matter of “additional assurance activities undertaken by the regulator”.

Proof?

Let us take a look at the Government’s Clean Energy Future Regulatory Impact Statement.

It is yet another telling indictment of the total fraud that this carbon pricing scheme scam actually is (emphasis added):

7.4 Ensuring compliance with reporting requirements

Under the proposed reporting requirements liable entities will report on their own emissions. As they will also have to acquire (buy) permits to cover these emissions, they will have an incentive to underreport their emissions. There is also the risk that errors would be made in reporting either through negligence or through other ‘good faith’ mistakes. Errors in the reporting of emissions would have a number of negative consequences.

It is to be expected that most (intentional) misreporting would result in an underestimation of emissions and less permits being surrendered to Government. This would have implications for the accuracy of national emissions estimates and would represent an effective loosening of the cap.

Errors in reporting would also have significant implications for the credibility of the scheme. If there was a perception of widespread non-compliance, community support for the scheme would be much harder to maintain (in the absence of community acceptance and support, the long term future of the scheme could be called into question). At an international level, confidence in the legitimacy of the emissions reductions driven by the scheme is a key consideration in whether other countries will be willing to ‘link’ with the Australian scheme. International linking is an important element in reducing the overall costs of the scheme and the ability to establish future links with international schemes is an important consideration in the design of the Australian scheme.15 Finally, business perceptions of compliance by other businesses with the scheme could have implications for their own compliance. That is, if one emitter believes that other emitters are non-compliant with the scheme, this may influence their compliance decisions. In closing, it is important to note that, in considering impacts on the credibility of the scheme, perceptions of non-compliance can be more important than the actual level of non-compliance.16

Translation: It is “more important” for the public to believe that “polluters” are complying, than for them to actually be complying!

Misreporting of emissions would also have a number of implications at a firm or industry level. The emitter that underreported emissions would be placed at a competitive advantage vis a vis other market participants (as they would need to surrender fewer permits). This advantageous position would be a result of non-compliance with the law rather than legitimate business practices and could entail significant costs for competing entities.

For these reasons, assurance arrangements to certify the accuracy of emissions reporting are required. Three options exist:

* ex-post audits undertaken the Government

* ex-ante audits undertaken by third party auditors

* a hybrid option involving third party audits for very large emitters (those emitting over 125 kt CO2-e/year) and Government assurance for liable emitters below this threshold.

Before continuing to examine what the Government thinks about those 3 options, let’s first take a look at footnote 16 annotated in the above paragraphs. It sheds further light on the fact that the reporting/auditing of so-called “polluters”, is really all about perception management.

Propaganda, in other words:

16 While perceptions of non compliance should be linked to actual levels of non-compliance, this need not be the case. Importantly Government actions to ensure compliance can improve perceptions of compliance with the mechanism even in the absence of widespread non-compliance. For instance, even if there were widespread compliance with the carbon pricing mechanism, the absence of an auditing mechanism could lead some stakeholders to question the accuracy of reported emissions. This would have impacts on confidence with the carbon pricing mechanism even in the absence of widespread non-compliance.

The RIS document goes on to waffle on, about the 3 different potential options for “audits” and the estimated costs associated with each. You can download and read it all for yourself here (pages 58-61). Just for background, following are a few key excerpts regarding costs etc for each option – we wish to move past this to the punchline of the scam:

Under the second and third options it is expected that (at least initially) many audits would be undertaken by large accounting and consulting firms. The extent to which specific training and qualifications will be required before a person can undertake these audits is currently the subject of an auditing regime established under the NGER Act. Over 170 persons are currently registered from a diverse range of organisations.

…

For those businesses that are required to obtain third party audits, the cost is estimated to be $150 000 per year. It is also likely that companies would incur some costs associated with liaising with the auditors. On average these are estimated to be around $11 500 per business per year. Obviously the overall compliance costs would be largest under option 2 — all business would be required to obtain audits. With around 500 liable entities, this would entail total aggregate compliance costs of around $80 million per year.17 The third option would require less than 200 businesses to seek third party audits. The total compliance costs of this option are estimated to be around $32 million per year. The compliance costs associated with the first option are minimal.

In terms of administrative costs, it is estimated that the cost to Government of the third (hybrid) option would be around $5 to $9 million per year. This represents the costs to Government of undertaking audits of a selection of emissions reports submitted by liable entities both to double check the reports of vary large emitters and assure the accuracy of reports by smaller liable entities. The administrative costs of the first two options have not been separately estimated …

Overall, it is expected that the first option (no third party audits) would be the least costly option while the second option (third party audits for all liable entities) would be the most expensive.

Ok.

Let’s just check that footnote 17:

17 This is likely to be an over estimate of the compliance costs for this option. The per business costs were estimated in the context of assurance for very large emitters (over 125 kt CO2-e/year). The costs of obtaining a third party audit for smaller emitters (the bulk of the 500 liable entities) are likely to be lower than this amount.

Hang on?

Hasn’t the Government been labelling the “polluters” as “1,000 … 500 … more like in the order of like 400 of the BIGGEST“?

But in the RIS, “the bulk of the ___ liable entities” are here called “smaller emitters“!?!

There’s an old saying – If you’re going to lie, then you’d better have a perfect memory.

Let’s move on to that punchline, shall we? (emphasis added):

The benefits associated with the third (hybrid) option are lower than under the full third party assurance option as only a subset of emissions reports are assured. However, the benefits are not likely to be significantly lower. The majority of emissions are accounted for by very large emitters (over the 125 kt CO2-e/year threshold). As a result, assuring the accuracy of these emissions will ensure that overall emissions data are largely correct. Moreover, the very large emitters are likely to be the most ‘visible’ and ensuring the accuracy of these reports should provide confidence in the accuracy of emissions data for the majority of stakeholders. Any concerns with the accuracy of reports by smaller emitters can be alleviated (to a degree) by additional assurance activities undertaken by the regulator.

…

On balance, it is considered that the hybrid option represents the best balance of risks to scheme credibility and compliance costs for reporting entities and is the preferred option.

Translation: So long as we can assure accuracy of the tiny number of “very large emitters”, who are “the most visible” to the public, then the public will have “con-fidence” in our scheme scam. And if any concerns are raised about accuracy of (self)reporting by “the bulk of” emitters (who are “smaller”), the regulator can deal with that by “additional assurance activities”.

Otherwise known as “propaganda”.

Or … “cooking the books”.

Something that this Government have a history of being very good at. Just ask former Finance Minister Lindsay Tanner.

Ladies and gentlemen …

IT.

IS.

A.

SCAM.

Comments